Many retirement-aged investors lean on dividends to make ends meet. The idea is to receive a stream of passive, predictable, and growing income that is independent of fickle stock prices.

Instead of worrying about where the market might head any given year or which investments to sell to generate income using the 4% rule, many dividend investors bank on the resiliency of their income rolling in and hope to leave their nest egg largely untouched.

But is this really a wise strategy during recessions? After all, if dividends are paid out of cash flow, which shrinks for most companies during economic downturns, significant dividend cuts seem like they should be expected as well.

In this article, we will examine historical evidence to see how well dividends have held up during times of distress.

Dividends Have Historically Been Much Less Volatile Than Stock Prices

A good place to start in this study is looking back throughout time to understand how volatile dividend payments have been compared to stock prices.

After all, if dividend payments are no steadier than stock prices, which often experience sharp and unpredictable swings, then it doesn’t make sense to place much faith in a dividend-focused income strategy in retirement.

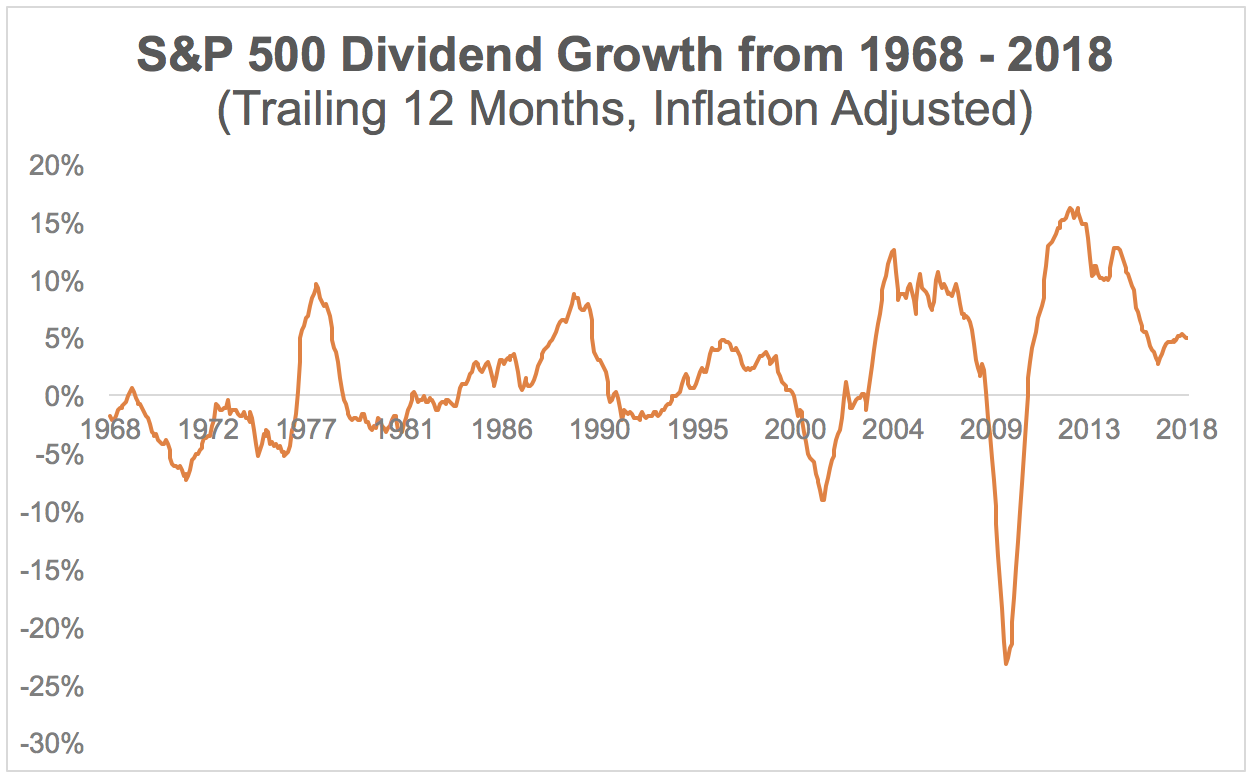

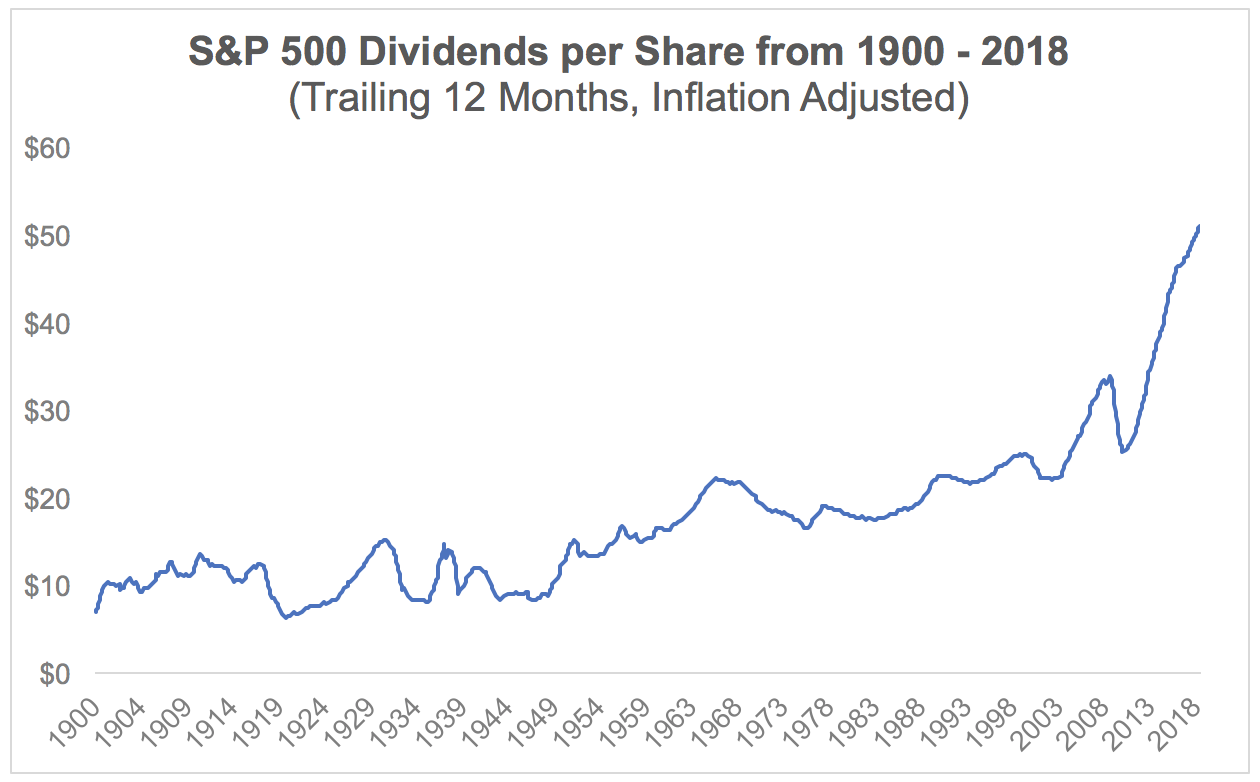

The chart below plots the S&P 500’s dividend growth, adjusted for inflation, over each rolling 12-month period from 1900 through 2018.

You can see that the first half of the 20th century had a number of significant peaks and valleys, driven largely by the Great Depression and the two World Wars.

Otherwise, the market’s dividend growth rate generally remained between -10% and 10% over most other time periods.

Source: Multpl.com, Simply Safe Dividends

Source: Multpl.com, Simply Safe Dividends

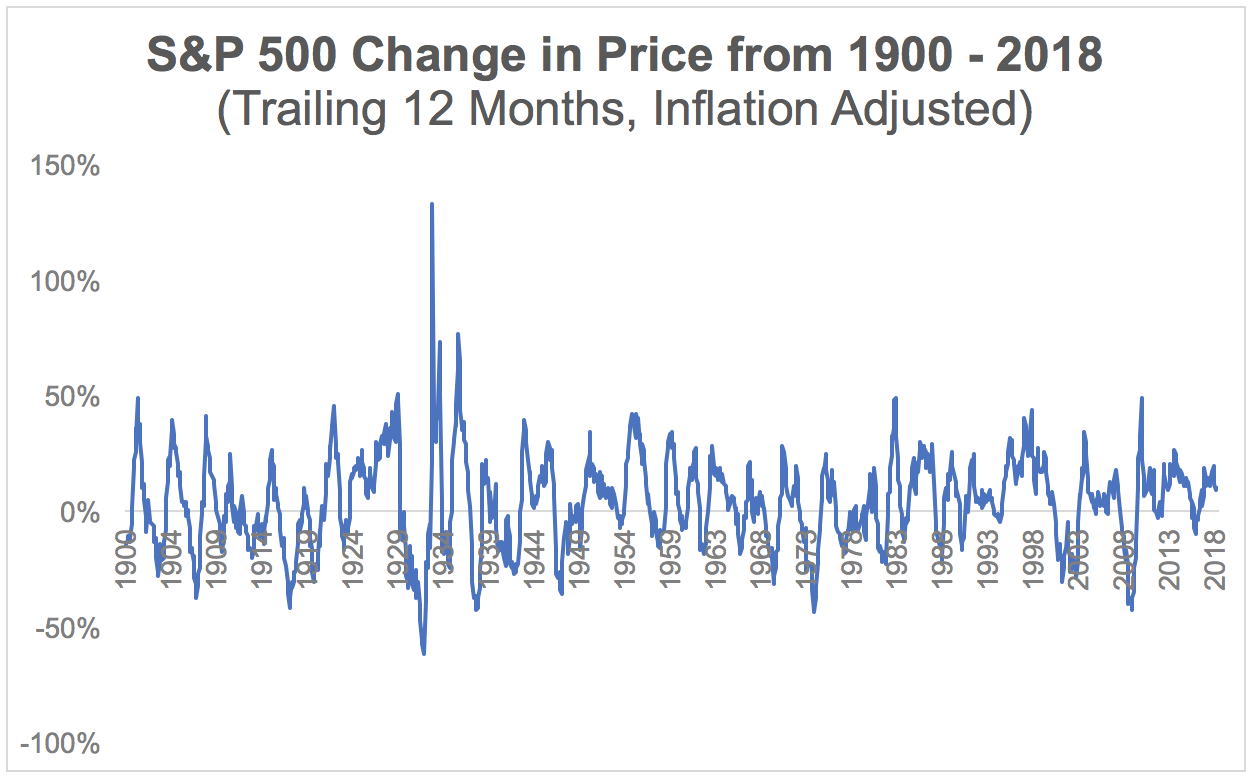

The chart below shows the percentage change in the S&P 500 over each rolling 12-month period from 1900 through 2018, adjusted for inflation. Compared to the dividend chart, you can see that stock prices experienced a greater number of swings and tended to move more significantly in either direction.

Source: Multpl.com, Simply Safe Dividends

Source: Multpl.com, Simply Safe Dividends

A lot has changed with the global economy and the stock market’s mechanisms since 1900, so it’s worth zooming in on both of these charts to review a more recent period. In this case, we looked at the last 50 years, from 1968 through 2018.

Starting with dividend growth, you can see there was a big dip during the financial crisis, but otherwise growth was fairly steady and declines were moderate.

Source: Multpl.com, Simply Safe Dividends

Source: Multpl.com, Simply Safe Dividends

However, the S&P 500’s price fluctuations were once again more severe and frequent.

Source: Multpl.com, Simply Safe Dividends

Source: Multpl.com, Simply Safe Dividends

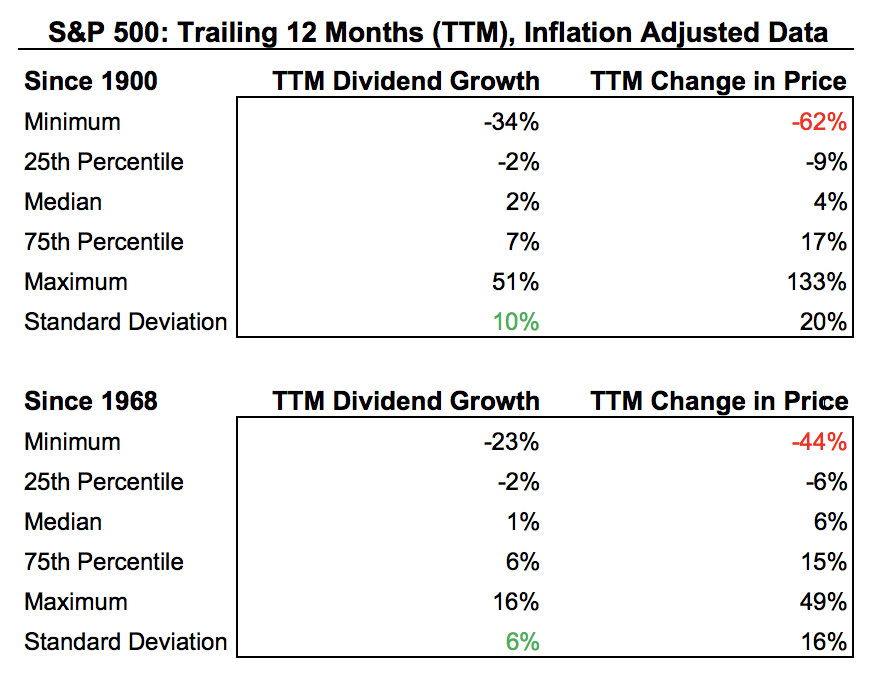

Simply put, dividend payouts have been much less volatile than stock prices throughout history. For the data junkies out there, the tables below put some numbers behind the charts we just reviewed.

Most notably, you can see that in each period we measured the S&P 500’s price returns experienced much bigger drawdowns than the decline in dividends paid. Furthermore, as measured by standard deviation, the market’s 12-month change in price was at least twice as volatile as the change in dividends.

Source: Multpl.com, Simply Safe Dividends

Source: Multpl.com, Simply Safe Dividends

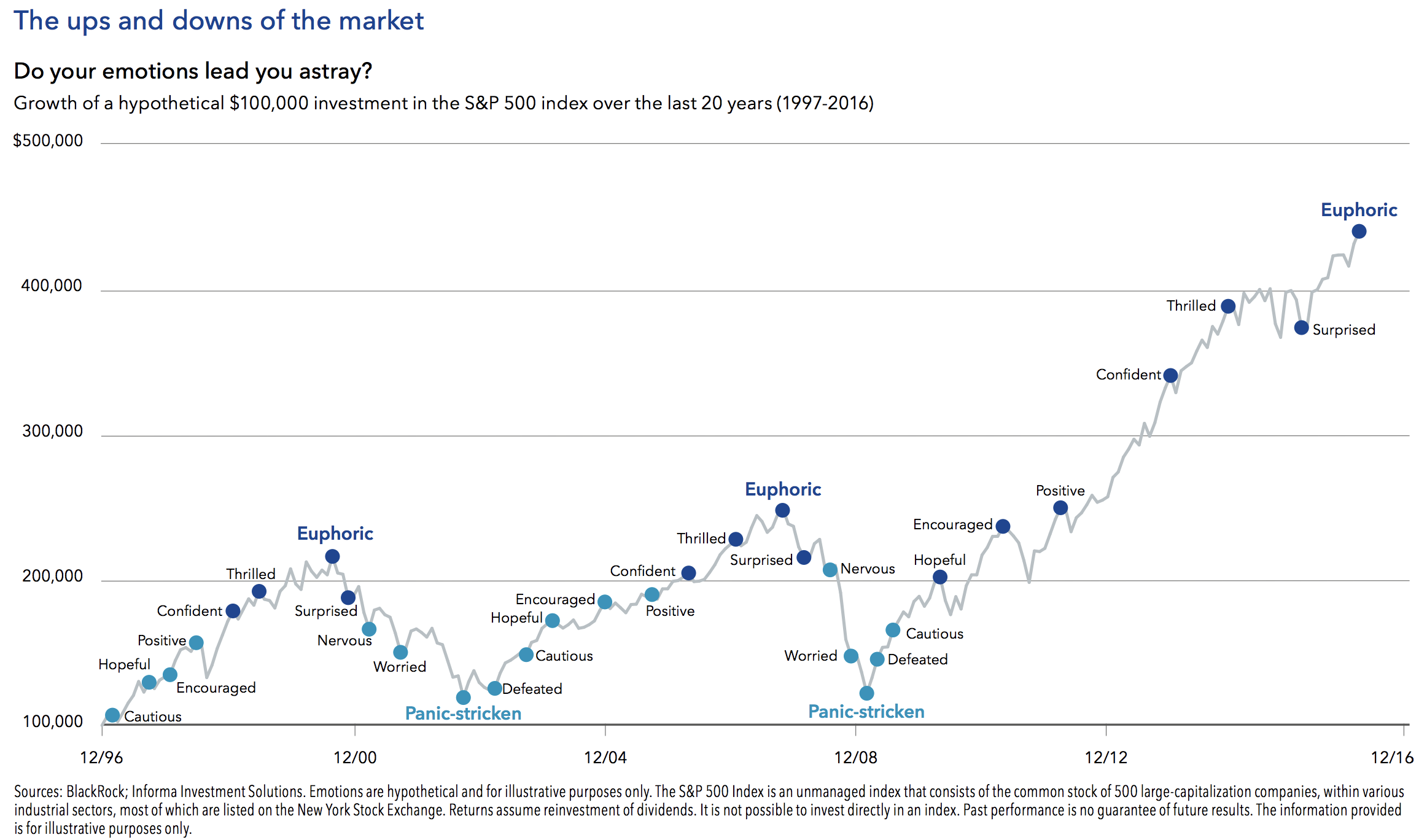

These findings aren’t too surprising. Changes in stock prices are completely unpredictable over short periods of time. As the chart below demonstrates, shifts in investor sentiment often cause the market to cycle through periods of euphoric exuberance and panic-stricken pain that detach stock prices from underlying fundamentals.

Dividends, on the other hand, are commitments made by management teams to shareholders. Cutting the dividend is one of the last things a company wants to do because it often signals financial stress and reduced confidence in the business.

Therefore, even if stock prices are falling and investors are panicking, management teams will often try to maintain the company’s dividend so long as it does not threaten their ability to meet essential obligations, such as debt payments and investments to maintain their businesses.

Companies that pay dividends also tend to be more mature, with established customer bases and relatively stable sales, earnings, and cash flow over time. Dividends are meant to be paid out of excess earnings as well, which means profits the company doesn’t need to grow the business.

As a result, many companies that pay dividends often have fairly disciplined management teams and shareholder-friendly corporate cultures which balance continued growth of the business with returning excess cash to investors.

While all of that sounds great, what about during recessions when earnings come under pressure and visibility is usually at its lowest point, raising the need to preserve cash?

What Typically Happens to Dividends During a Recession

Since World War II ended there have been 11 recessions and bear markets. Just like we previously observed, the dividends paid by companies in the S&P 500 tended to be far less volatile than their share prices during these times of severe distress as well.

In fact, in three of these recessions dividends paid to investors actually increased, including a 46% jump during the first recession following World War II. In that case, a rapid decrease in government spending following the end of the war led to an economic contraction of 13.7% over three years.

However, the end of war-time rationing and a major recovery in consumer spending on regular goods (as opposed to war-time goods companies had been forced to produce) allowed earnings and dividends to rise substantially over this time.

The other major exception to note is the financial crisis of 2008-2009. This resulted in S&P 500 dividends being cut 23% (about one in three dividend-paying companies reduced their payouts).

However, that was largely due to banks being forced to accept a bailout from the Federal Government. Even relatively healthy banks like Wells Fargo (WFC) and JPMorgan Chase (JPM), which remained profitable during the crisis, were required to accept the bailout so that financial markets wouldn’t see which banks were actually on the brink of collapse.

One of the conditions of the bailout was that nearly all strategically important financial institutions (too big to fail) were pressured to cut their dividends substantially, whether or not they were still supported by current earnings.

Even if we include both the World War II recession and the financial crisis outliers, we can see from the table above that average dividend cuts during recessions represented a pullback of just 0.5%.

If we take a smoothed out average, by excluding the outliers (events not likely to be repeated in the future), then the S&P 500’s average dividend reduction during recessions was about 2%. That compares to an average peak stock market decline of 32%.

This highlights how the U.S. dividend corporate culture has been favorable to income investors, with management teams generally wishing to avoid a dividend cut unless it becomes absolutely necessary. With dividends tending to fall significantly less than share prices, recessions can be a great opportunity for investors to buy quality companies at much higher yields and lock in superior long-term returns.

Dividend Safety Still Matters

That being said, during most recessions the market’s dividends do tend to fall. Companies that maintain or even increase their payouts during these times mask some of the drag caused by businesses that significantly cut or completely eliminate their dividends.

In other words, an income portfolio that is overweight the weakest dividend-paying stocks heading into a recession can be in for some real pain that is much worse than the aggregate dividend change figures presented above.

And since one of the biggest reasons for owning dividend growth stocks, especially for retirees, is offsetting inflation, even a modest decline can result in a loss of purchasing power than can make it harder to pay living expenses.

The chart below plots inflation adjusted dividends per share paid by S&P 500 companies. You can see a number of instances where it took years for the S&P 500’s dividends to recover back to a new high after declining. There are also several multiyear stretches of time where inflation adjusted dividends stagnated.

Source: Multpl.com, Simply Safe Dividends

Source: Multpl.com, Simply Safe Dividends

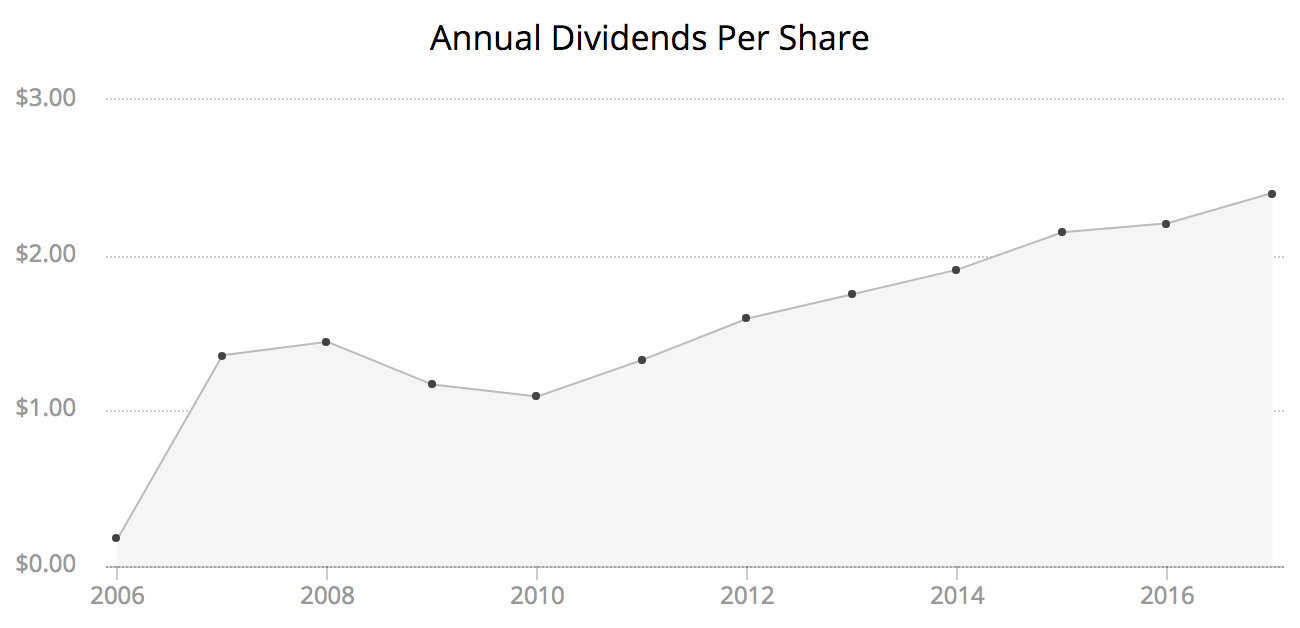

The same is true of dividend ETFs. Take the Vanguard High Dividend Yield ETF (VYM), which is invested in more than 400 companies. When a fund casts its net so wide, it is almost guaranteed to hold some quality companies and some that are much weaker (and susceptible to cutting their dividends).

Sure enough, VYM’s dividend payments were hit hard during the financial crisis. The fund’s total dividend payments peaked in 2008 at $1.44 per share before falling to $1.17 in 2009 and $1.09 in 2010, representing a peak-to-trough decline of about 25%.

Annual dividend payments didn’t recover back to their 2008 peak until 2012, but an investors’ cost of living would have almost certainly increased during this time.

In other words, if a retired investor owned 25,000 shares of VYM, he would have received $36,000 of dividend income in 2008.

By 2010, his annual dividend income had fallen to about $27,000 – a drop of more than $725 per month. Depending on his budgeting and margin of safety, life could suddenly have become much more stressful.

To help conservative dividend investors avoid companies most at risk of cutting their dividends and keep their income streams growing faster than inflation, we developed a Dividend Safety Score system.

We scrub a company’s most important financial metrics, review its dividend track record, and more to understand the risk profile of its payout. Our Dividend Safety Scores are available for thousands of stocks and can be used to evaluate your portfolio’s overall dividend safety as well.

You can learn more about how our scores are calculated and view their successful realtime track record here.

Closing Thoughts on Dividends and Recessions

Recessions and bear markets are an unavoidable part of long-term investing. Economic and market downturns can’t be predicted and more will surely happen in the coming years and decades.

But it’s important for investors to realize that while stock prices can be extremely volatile during such periods, dividends tend to be far less so.

Leaning on Dividend Safety Scores and focusing on quality dividend growth stocks, including blue chips like dividend aristocrats, dividend kings, and the companies on our list of the best recession proof dividend stocks, can be a solid way to reduce your portfolio’s risk of a dividend cut during a recession.

Understanding how to prepare your portfolio for a recession is important, too. Maintaining a well-diversified portfolio of healthy dividend stocks, including those in defensive sectors such as healthcare, staples, utilities, and telecom, can decrease share price volatility and improve your odds of maintaining a safe income stream no matter what the economy or stock prices are doing.

Brian Bollinger

Simply Safe Dividends

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends