We’re smack in the middle of the stock market “Melt Up” – and years into a global bull market.

That makes it darn difficult to find cheap investments.

The U.S. market hasn’t been cheap in years. Valuations have roughly doubled since 2011. But that’s not true everywhere in the world.

In fact, a certain part of the world hasn’t offered today’s value in more than 15 years. And it’s in a strong uptrend as well…

Cheap and in an uptrend? That’s the kind of investment I love to see. And it’s available right now.

Let me explain…

Asia-Pacific stocks are offering incredible value today.

Simply put, they’re one of the few cheap investments in the world right now…

This group – which includes Asian markets as well as Australia and New Zealand – is roughly half as expensive as U.S. stocks, based on one measure. That’s one of the largest discounts in history for Asia-Pacific stocks.

To see this, we only have to compare the book value of this group of stocks versus the U.S.

Based on book value, Asia-Pacific stocks are actually the cheapest they’ve been since 2002, relative to U.S. stocks.

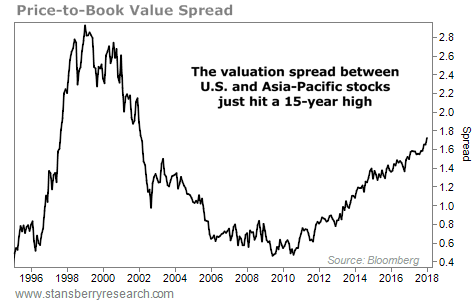

The chart below shows the price-to-book value (P/BV) ratio of the benchmark S&P 500 Index minus the MSCI AC Asia Pacific Index’s P/BV ratio. A high reading on the chart means Asia-Pacific stocks are cheap compared with U.S. stocks. Take a look…

The chart shows that this valuation gap has been increasing… And even better, it has just hit a new multiyear high.

What does this mean for investors?

It means that Asia-Pacific stocks are dirt-cheap. Again, they trade at a 50% discount to U.S. stocks based on book value. These markets haven’t been this cheap, relative to the U.S., in more than 15 years.

That’s a good thing. I love buying cheap stocks. And after a nine-year bull market in the U.S., value opportunities in this country are scarce.

But that’s not true in this corner of the globe… These markets are still cheap.

And the trend is strong, as well…

Asia-Pacific stocks rallied 32% in 2017. That’s a stellar return… a full 10 percentage points higher than the S&P 500 last year.

It makes sense, though. Asia-Pacific stocks include Japan and China – two markets that boomed last year.

As longtime readers know, we love to buy these kinds of uptrends. When prices move higher, it usually leads to more gains. And because these markets are so cheap, they have more room to run – which makes this opportunity even better.

The uptrend is in place… And today’s huge discount could be a tailwind to push these markets higher.

So if you’re looking to invest in cheap markets that are in an uptrend, Asia-Pacific stocks – places like China, Japan, Korea, and Australia – fit the bill.

Good investing,

Brett Eversole

The legendary stockpicker who built one of Wall Street's most popular buying indicators just announced the #1 stock to buy for 2026. His last recommendations shot up 100% and 160%. Now for a limited time, he's sharing this new recommendation live on-camera, completely free of charge. It's not NVDA, AMZN, TSLA, or any stock you'd likely recognize. Click here for the name and ticker.

Source: Daily Wealth