Tax reform has been signed into law, giving the market a booster shot as we kick off 2018. Republicans took a hatchet to the corporate tax rate, which should translate into more profits, which in turn should trickle down to investors in the form of earnings-driven gains, buybacks and dividends.

Generally speaking, that’s fantastic news for anyone holding blue-chip dividend stocks.

But that’s not the same thing as saying every last well-known income play is worth carrying right now.

They’re not.

Eventually, some blue-chip stocks get caught in a rut where the growth that made them a household name in the first place starts to disappear.

The reputation remains – just not the results.

This can be seen in the “Curse of the Dow,” in which new Dow Jones Industrial Average components underperform over their first few months of inclusion.

It also can be seen in the struggling shares of Dividend Aristocrats such as Emerson Electric (EMR) and Nucor (NUE) – two companies who might have nice long-term track records, but lately haven’t kept up with the payout growth of the S&P 500. These stagnant dividends have given investors little extra incentive to hang on during tough times, and ultimately helped weigh down performance over the past few years compared to the broader index.

Let’s look at four blue-chip dividend stocks that you should sell as early as you can in 2018. Then, I’ll show you which blue chip dividend growers that you should buy instead – for bigger yields, and 25%+ yearly price upside to boot!

Procter & Gamble (PG)

Dividend Yield: 3%

Procter & Gamble (PG) is a seemingly unassailable consumer staples giant. The company has weathered every major American economic calamity since 1837, its dividend has survived uninterrupted since 1891, and it sports more than six decades of annual payout growth.

It has done so on the back of a simply stunning array of billion-dollar brands including Bounty paper towels, Charmin toilet paper, Dawn dishwashing soaps, Gillette razors and Tide laundry products.

However, PG shares have been a perennial underperformer as the company’s sales have eroded by about 23% since 2013. Yes, the company has kept its bottom line padded, but it has done so through margin expansion amid job cuts and other restructuring moves. That’s not getting much better anytime soon. Analysts are looking at low-single-digit top-line growth next year, making it difficult to justify a forward price-to-earnings ratio of 21 and price-to-sales of more than 4.

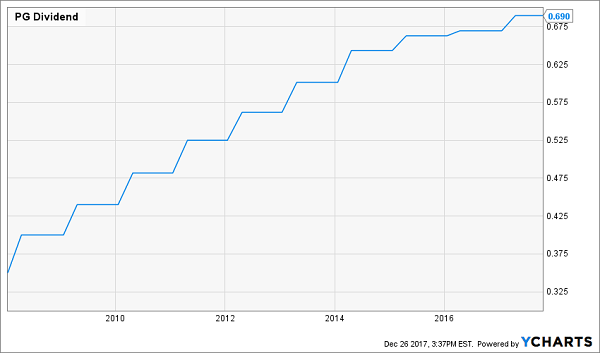

And while P&G deserves a pat on its back for its years of dividend growth, it’s doing so at a pained crawl anymore. The company raised its payout just 3% this year, to 69 cents – though that looks like a lotto jackpot compared to last year’s 1% uptick.

Yes, Procter & Gamble likely will “protect” your portfolio by not losing you any money – but it’s not going to make you any significant sum, either.

Procter & Gamble’s (PG) Dividend Is a “Safe” Sloth

Starbucks (SBUX)

Dividend Yield: 2.1%

Let’s give Starbucks (SBUX) credit where it’s due: The king of lattes has also been a dividend growth champion over the past few years, roughly tripling its quarterly dividend from 10.5 cents to a current payout of 30 cents.

If only the stock were as spry.

Shares have simply flatlined over the past two years as growth has slowed – not to a standstill, but certainly to a less dramatic pace than it had been achieving. The top line grew just 5% in 2017 – the company was putting up double-digit improvements like clockwork – and profits were just 2% better than they were a year ago.

More importantly, Starbucks slashed its 2018 earnings outlook in November, and said it expects 12% annual earnings growth in the long-term, versus previous expectations of 15% to 20%. Wall Street actually responded positively to the news; BTIG analyst Peter Saleh said at the time that “investors were increasingly skeptical of the previous mid-single digit target anyway.”

Still, Starbucks’ modest growth expectations despite its lofty international plans sets up a situation much like the past couple of years where simply “good enough” expansion isn’t … well, good enough. The more modest profit plans also could mean more modest dividend hikes going forward. All that, combined with a humble yield, make Starbucks worth watching from the sidelines.

Mondelez International (MDLZ)

Dividend Yield: 2%

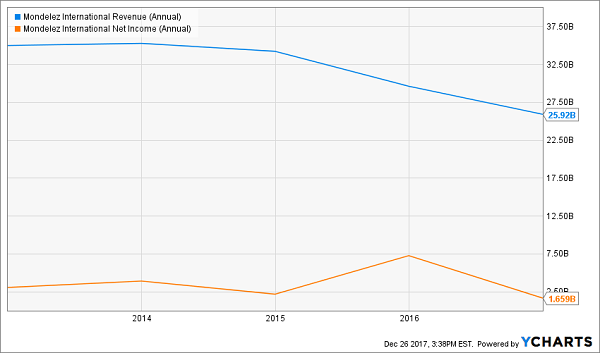

Mondelez International (MDLZ) is another underperforming consumer staples name that has run into some serious top-line headwinds. Shortly since spinning off its North American grocery business (Kraft Foods group), the company’s revenues started eroding – from $35 billion in 2012 to about $26 billion last year, and analysts expect a little more shrinkage at 2017’s conclusion.

Mondelez, as a reminder, is a global snacks giant that sells billion-dollar brands including Nabisco, Oreo, Triscuit, Cadbury, Toblerone and Trident across more than 160 countries. It’s diversified in every sense of the word. It’s also providing decent dividend growth – the payout has improved from 13 cents quarterly at the spinoff to 22 cents, including a 16% hike this year.

Thing is, Mondelez was supposed to provide actual growth, and it’s not doing that – far from it. Next year looks just as yawn-worthy, with analysts expecting less than 3% top-line growth.

Moreover, MDLZ mostly has been propped up by aggressive share buybacks, and its $18 billion-plus in debts compared to less than a billion dollars in cash and investments isn’t exactly encouraging, either. It certainly makes one wonder what exactly 18 times forward earnings would be buying.

Behold! The Mighty Mondelez (MDLZ) “Growth” Engine!

Colgate-Palmolive (CL)

Dividend Yield: 2.1%

Colgate-Palmolive (CL) – like much of the rest of the stock market – has enjoyed a revitalization over the past couple months as tax reform has taken shape. The company’s effective tax rate of about roughly 30% is about to drop down to 21%, and more consumers are about to have more coin in their pocket, which can only mean good things for its namesake dental products, Palmolive soaps, Speed Stick deodorants and Tom’s personal care brands.

But even when a rising tide lifts all boats, you can’t just go around buying every schooner in sight. Colgate may benefit from the coming tax windfall, but it’s hardly the best company to do so.

This sleepy consumer staples name, like P&G, is suffering from top-line erosion and is only bolstering the bottom line through restructuring and cost cuts. That, as well as lousy low-single-digit growth expectations going forward, make valuations such as a forward P/E of 24 and a P/S of 4 look downright unpalatable. Yes, the company is one of the most hallowed of the Aristocrats at more than five decades of dividend increases, but CL is doling out mere penny raises of late, with 2017’s hike coming to less than 3%.

Colgate is a popular “safe” play among pundits, but its mediocrity will only bog down your returns. Stay away.

— Brett Owens

These 7 Dividend Growth Stocks are Flashing “Buy” Today [sponsor]

I’ve scoured thousands of stocks out there right now, looking for the very best companies that have both rising dividends and strong buyback programs in place … the kind of stocks that could easily spin off annual total returns of 12%, 17%, even 25% or more … doubling your money in very short order.

Right now, at this very moment, there are seven in particular that I think you should consider buying.

They stand to do well no matter what the broad market does … regardless of what happens in Washington … and irrespective of interest rate trends.

I’d love to share a quick rundown on each of them with you …

Source: Contrarian Outlook