If you’re a junk-bond investor, I have a message for you.

Get out.

[ad#Google Adsense 336×280-IA]The easy money in high-yield bonds is gone. Prices have soared. And the overall high-yield bond market sits at dangerous levels today.

History says this setup could lead to double-digit losses. And that’s why the smart move is to get out – now.

Let me explain…

High-yield bonds have soared over the past 14 months.

The iShares iBoxx High Yield Corporate Bond Fund (HYG) is up 16% from its February 2016 bottom.

HYG is still near its recent highs. It hasn’t begun to break down yet. But buying today is incredibly dangerous. That’s because right now, you’re getting almost zero premium for the risk you’re taking in high-yield bonds.

You see, high-yield, or “junk” bonds, come from companies with questionable prospects. They’re less-than-stellar businesses… And they have to pay higher interest rates because of that extra risk.

In exchange for taking on more risk, investors are supposed to get the benefit of higher yields… But right now, that benefit hardly exists. High-yield bonds pay less than 6% today. That’s one of the lowest yields we’ve seen over the last decade.

This makes owning junk bonds a scary idea. But the overall yield isn’t even the best way to see what’s happening. You can do better by looking at the junk bond “spread.”

By “spread,” I mean the difference between the yield on high-yield bonds and the yield on similar-duration government bonds. For example, if high-yield bonds pay 6% and government bonds pay 2%, then the spread is 4%.

A high spread means high-yield bonds are a good deal. You’ll earn a lot of income to compensate for the extra risk. But a low spread means high-yield bonds are a bad value – and much riskier.

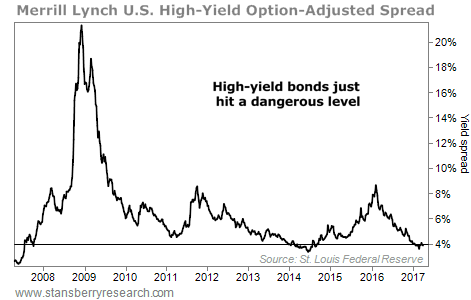

High-yield bond spreads recently hit a multiyear low. Take a look…

The current spread is at a level we’ve only seen a few other times in the past decade. And those were dangerous times to put money to work in high-yield bonds.

Spreads were below 4% in mid-2007. That was just before the “Great Recession,” which kicked off a massive 30%-plus decline in the high-yield market.

We saw spreads bottom below 4% in 2014 as well. And high-yield bonds went on to fall by roughly 20% in the next year and a half.

Today, spreads are low again… at just 4.1%, as I write. And they’ve been below 4% for most of 2017.

This is a dangerous warning sign for high-yield bond investors. There’s simply no margin for error with yields this low. And history says that major busts tend to begin when the spread hits current levels.

I can’t know the exact timing… But even if I’m early, the message is correct.

If you own high-yield bonds, get out – now.

Good investing,

Brett Eversole

[ad#stansberry-ps]

Source: Daily Wealth