Trading and investing based on politics is a great way to lose money.

If you doubt that, look no further than last month’s election.

“Experts” everywhere had promised for weeks that even if Trump somehow won, the market would tank.

[ad#Google Adsense 336×280-IA]Wrong. International markets fell hard overnight, but by morning, all was calm.

The overall stock market closed within a hair of its all-time high.

Now, we’re left trying to figure out how the economy will react to a president who has been notably vague on actual policy plans.

That’s not investing, or even trading… That’s guesswork.

So what should we do now?

Well, we can look past the political circus and get back to business. Today, we’ll take a quick look at the state of the economy – and then see what that will do to the financial markets…

Oftentimes, the broadest and simplest economic stats can give you a powerful picture of the economy in just a few seconds.

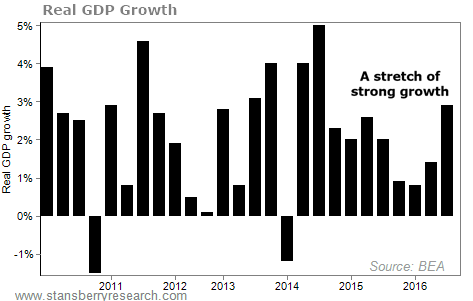

For example, gross domestic product (GDP) growth measures the economy as a whole. Its quarter-to-quarter fluctuations are cited reverentially in the financial press, but they’re mostly meaningless. What’s important is that its overall trend over the past six years has remained positive and strong.

But… in the most recent quarter, real GDP grew at an annual rate of 2.9%. That’s more than double the previous quarter. That’s significant.

But… in the most recent quarter, real GDP grew at an annual rate of 2.9%. That’s more than double the previous quarter. That’s significant.

The reasons for the surge were important. Private inventory investment rose – meaning businesses were stocking up on goods that they expect they’ll be able to sell. Exports picked up. Meanwhile, the results from the previous quarter were revised upward thanks to a big swing in nonresidential private investment.

Even if you’re not interested in digging into the details, it’s plain to see that despite any politician’s claim of a stagnant economy, we’ve seen many quarters of rising growth.

Next up, inflation statistics…

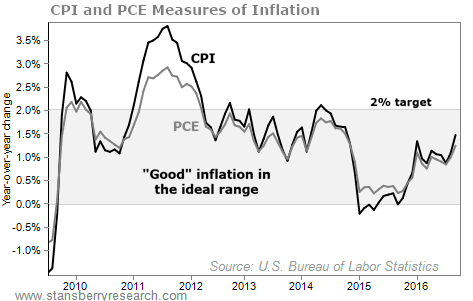

We know that inflation eats away at our purchasing power. That’s bad. At the same time, the presence of inflation signals a growing economy… If people are spending and buying things, they can drive the price up. You can call this “demand pull” inflation.

Just like Goldilocks, we’re looking for a happy middle. Ideally, an inflation rate of 2% is generally considered an indicator of economic growth. It helps us maintain reasonable purchasing power while giving us a cushion to avoid deflation.

Today, inflation is ticking up, indicating growth. But it’s still far from being something to worry about. Whether you use the Consumer Price Index (CPI) or the Federal Reserve’s preferred measure, personal consumption expenditures (PCE), inflation checks in somewhere between 1% and 2% right now.

If you’re looking for a sign of a healthy but not overheated economy, you can’t do much better.

If you’re looking for a sign of a healthy but not overheated economy, you can’t do much better.

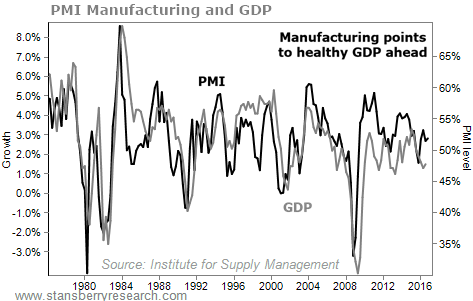

Finally, by looking at what manufacturers are doing, you can get an idea of what’s next for the economy.

The ISM Purchasing Managers Index (PMI) tracks the sentiment of manufacturers. When the reading is above 50%, manufacturers are optimistic. Below 50%, they are pessimistic.

Optimistic manufacturers are usually looking to expand their operations. They invest in their businesses to take advantage of willing customers and good business conditions. More than any presidential plan, that’s what drives the economy.

Today, the PMI is just over 53%, which is a good sign. As you can see from the following chart, the PMI does a good job of predicting where GDP will go. It leads the GDP numbers by just a little bit.

While the economy does drive the market over the long term, the two elements can move separately at times. So let’s check in on stocks…

While the economy does drive the market over the long term, the two elements can move separately at times. So let’s check in on stocks…

The market’s positive reaction to Trump’s election tells us a lot.

First, investors aren’t afraid of risk. Ever since the 2008 financial crisis, shifts in investors’ “risk tolerance” have played a big role in the market’s direction.

At times, investors flee from anything with a hint of risk – dumping stocks and high-yield bonds and moving to government bonds, gold, and cash. At other times, they load up on anything promising big returns. Taking advantage of these shifts is sometimes called the “risk on/risk off” trade.

Today, stocks are rising, even risky ones. High-yield bonds saw major inflows – the iShares iBoxx High Yield Corporate Bond Fund (HYG) set a record by collecting about $700 million in new assets just two days after the election.

Trillions of dollars of cash are still on the sidelines, sitting in safe bonds with low and negative yields. With appetite for risk rising, that money could drive the market higher.

Ultimately, the stock market will survive. Focusing on high-quality, cash-generating businesses is still a great way to make money today.

Here’s to our health, wealth, and a great retirement,

Dr. David Eifrig

[ad#stansberry-ps]

Source: Daily Wealth