Interest rate jitters have pushed investors to rethink their holdings in income focused stock categories, such as real estate investment trusts —REITs. While REITs were one of the hot sectors in the first half of 2016, they faded in the third quarter, with the representative Vanguard REIT Index Fund (NYSE: VNQ) declining by 2.2% for the quarter and off 3.1% just in the month of September.

However, many REITs are not fixed dividend securities, and the announcements of higher dividends typically also helps boost share values.

[ad#Google Adsense 336×280-IA]Most REITs that regularly increase dividends do so once a year, and then pay the new dividend rate for the next four quarters.

The timing of dividend increases is not widely known or followed, so if you know a bump in the payout rate of a REIT is coming soon, you can buy shares before the announcement and have a good chance at a nice share price boost when the new rate becomes actual news.

One of my income stock analysis techniques is to develop and maintain a database of REITs including when during the year they have historically announced new dividend rates.

Currently I have about 130 REITs in the database, and out of those, 95 have been increasing their payouts to shareholders.

While these REITs announce new dividend rates once a year, the timing varies. For every month of the year, there are companies that will announce a new rate during that month. Now is the time to look at those REITs that should increase dividends in November. If you buy shares three to four weeks ahead of the dividend announcement you will be ahead of the crowd.

The higher rate should produce a share price increase. In the worst case, your yield will go up compared to the current percentage quoted. Here are five REITs that will probably announced dividend boosts in November.

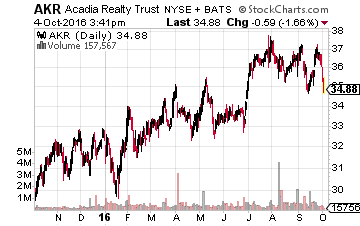

Acadia Realty Trust (NYSE: AKR) acquires, redevelops and manages retail properties in the nation’s most dynamic urban and street-retail corridors, including those in New York, San Francisco, Chicago, Washington DC, and Boston.

Acadia Realty Trust (NYSE: AKR) acquires, redevelops and manages retail properties in the nation’s most dynamic urban and street-retail corridors, including those in New York, San Francisco, Chicago, Washington DC, and Boston.

Acadia Realty will announce its third quarter earnings results at the end of October.

The new dividend rate announcement occurs during the first half of November.

For the last three years, the dividend has been bumped up by one cent, which would be a 4% increase on the current $0.25 per quarter dividend. Payment of the new rate starts in January with a December 31 record date. This REIT has also paid a special year-end dividend each of the last two years. AKR currently yields 2.8%.

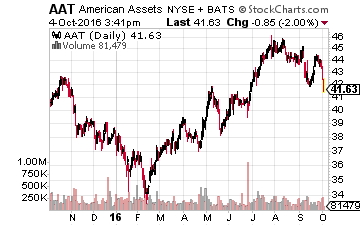

American Assets Trust, Inc. (NYSE: AAT) owns, operates, acquires and develops retail, office, multifamily and mixed-use properties in high-barrier-to-entry markets in Southern California, Northern California, Oregon, Washington, Texas and Hawaii.

American Assets Trust, Inc. (NYSE: AAT) owns, operates, acquires and develops retail, office, multifamily and mixed-use properties in high-barrier-to-entry markets in Southern California, Northern California, Oregon, Washington, Texas and Hawaii.

This REIT has announced a higher dividend in November of each of the last three years.

In 2015 the new dividend was 7.5% higher than the old payout. It looks like this year’s increase will be about 5%. The next dividend will have a record date around December 10 and the payment will be just before or just after Christmas. AAT currently yields 2.3%.

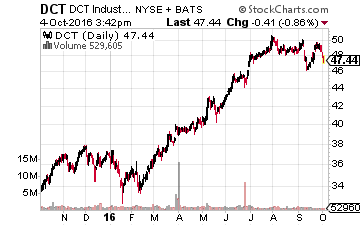

DCT Industrial Trust Inc. (NYSE: DCT) acquires, develops, leases, and manages bulk distribution and light industrial properties located in distribution markets in the United States.

DCT Industrial Trust Inc. (NYSE: DCT) acquires, develops, leases, and manages bulk distribution and light industrial properties located in distribution markets in the United States.

In 2015 DCT increased its dividend for the first time since reducing the payout in the financial crisis years of 2008 and 2009.

In 2015 the dividend was increased by 3.5%.

Through the first half of 2016, DCT reported AFFO per share that was 12.5% higher than a year earlier. A meaningful dividend increase is quite possible this year.

The last dividend boost was announced on November 10 with a December 24 record date and January 9 payment date. DCT yields 2.4%.

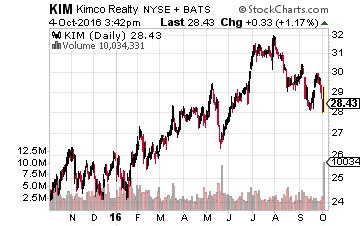

Kimco Realty Corp (NYSE: KIM) owns and manages open air shopping centers.

Kimco Realty Corp (NYSE: KIM) owns and manages open air shopping centers.

This REIT slashed its dividend in 2009, during the financial crisis, but has increased it every year since then.

Kimco has increased the dividend by 8% on average for the last five years, and in 2015 the payout was increased by 6.25%.

The company’s adjusted FFO per share was flat in the first half of 2016 compared to the same period in 2015, so this year’s increase will probably be more modest than in the past.

Kimco announces a new dividend rate in very early November with record and payment dates in January. KIM currently yields 3.6%.

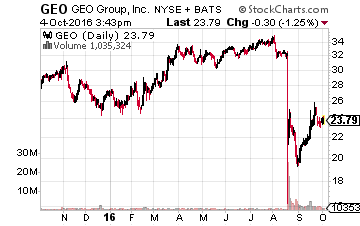

The GEO Group Inc. (NYSE: GEO) owns and manages correctional facilities –prisons and jails– in the U.S., South Africa, Australia, and the United Kingdom.

The GEO Group Inc. (NYSE: GEO) owns and manages correctional facilities –prisons and jails– in the U.S., South Africa, Australia, and the United Kingdom.

Correctional REITs have come under severe pressure due to the August announcement of the U.S. Department of Justice’s decision to phase out the use of private prisons.

Historically, GEO has increased its dividend each year since 2012.

The payout increased 9% last year. The next dividend announcement will be in early November with a mid-month record date and end of November payment date. It is unclear whether GEO will announce a higher dividend this year. If it happens, the stock’s share value should move strongly higher. GEO currently yields 10.8%.

— Tim Plaehn

[ad#ia-tim]

Source: Investors Alley