This is the first back-to-school season where I’m not out there digging through every clothing aisle with my daughter or wrestling someone over a backpack for my youngest, who graduated from high school earlier this year.

I’m lucky to sit this one out as both of my kids head off to their respective colleges. And that means they’re now old enough to buy their own clothes, supplies, and gear.

[ad#Google Adsense 336×280-IA]But I certainly remember what it’s like preparing for the new school year, and my hat goes off to you for getting through it.

It’s also the time of year when retailers really start pushing their back-to-school sales even harder, according to the National Retail Federation. Retailers typically start their promotions in July, with some starting as early as June.

Now, it still takes between three and four shopping trips over the span of a few weeks before kids are fully prepared for the first day of school…

And that’s exactly what these four back-to-school stocks are banking on…

These Four Stores Could Pay You Back for Your Back-to-School Shopping Bill

1. Staples Inc. (Nasdaq: SPLS)

SPLS is one of the most well-known office supply chain stores in the United States and also has over 2,000 stores worldwide.

Now, its second-quarter earnings met expectations, with a reported earnings per share of $0.12 and a reported $4.75 billion in revenue.

But this week it announced a newer and easier way for customers to shop… the Staples Easy System. This voice-recognition and text technology enables customers to place their orders easily and interact with customer service without ever needing to log in to the website or even use a desktop computer.

What makes this service even more appealing to parents is that they can now take pictures of their own back-to-school lists and send directly to a Staples associate to then provide the best product options for their needs. And to make things even easier, customers can pick their orders up at the store or have them shipped.

Below are just some of the many of the options trading opportunities my proprietary tools are showing for this stock over the next 30 days…

2. Target Corp. (NYSE: TGT)

TGT is a company I’m pretty sure you know very well. It’s the second-largest discount retail store in the country behind Wal-Mart Stores Inc. (NYSE: WMT).

And its popularity and success showed in its second-quarter earnings, with earnings coming in at $1.23 per share compared to the consensus estimate of $1.14. Now, its reported revenue of $16.17 billion fell a little shy of the $16.21 consensus estimate. But the fact that it’s among the top (arguably the top) shopping place for students of all ages year-round makes it even more promising.

Here’s what I see in the way of profit opportunities for options traders over the next 30 days:

3. Phillips-Van Heusen Corp. (NYSE: PVH)

PVH is considered to be more of an upscale retail apparel company. As the parent company of big-brand names like Calvin Klein, Tommy Hilfiger, and Heritage Brands, it’s no surprise that PVH stands to profit handsomely from the back-to-school shopping craze.

It’s already one of the highest-priced stocks in the retail apparel sector and has shown a solid uptrend this year since the lows back in January.

And PVH had strong earnings in the second quarter, with a reported $1.47 earnings per share (11.4% higher than the consensus estimates) and $1.93 billion in revenue.

Take a look at all of the options trading opportunities you can use to make money off of this stock…

4.Sodastream International Ltd. (Nasdaq: SODA)

SODA manufactures home beverage carbonation systems that turn tap water into soda and sparkling water.

Now it may seem weird to include a soda manufacturing company on this list, but these are just a couple reasons why we can expect a pop higher in price as students head back to school…

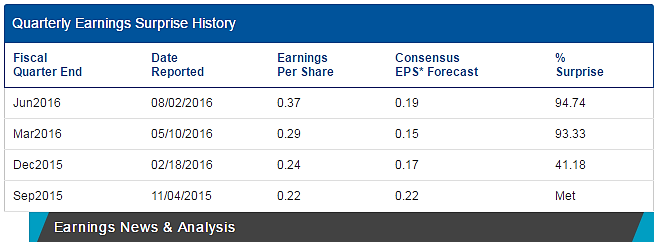

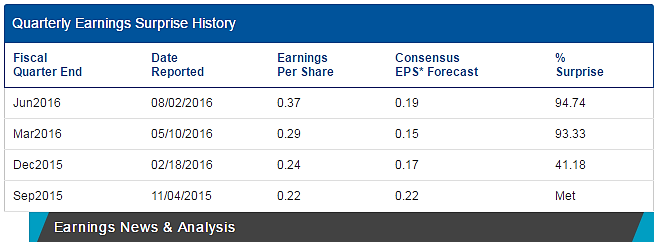

Its earnings came out on Aug. 2, and the results were better than expected. SODA reported earnings per share of $0.37, beating the consensus estimates by over 94%. And on the revenue side, the company saw 17.2% growth, reporting $119.2 million in revenue for the second quarter.

After giving away free beverage makers to angry owners of the discontinued Kuerig Kold back in June, SODA is also featured in Target’s back-to-school section.

Mark Your Calendar for Sept. 15…

On Sept. 15, the monthly retail sales report for August comes out. So keep in mind that the results could affect your trades for better or for worse.

Now as you get closer to this date, you might consider taking any gains you’ve made instead of giving them back because of the retail sales numbers. Whether the report is good or bad, there’s still that chance of the markets doing the old “buy the rumor, sell the news,” which means any retracement in share price will come out of the option’s premium.

So get back that money you spent on clothes and school supplies…

— Tom Gentile

[ad#mmpress]

Source: Money Morning