Once again, the Organization of the Petroleum Exporting Countries (OPEC) is wasting everybody’s time. It grabbed all the headlines about “solving” the oil price issue. The result was embarrassing.

Last weekend, OPEC members met in Qatar to sign an agreement to reduce oil production.

But there was a problem: Iran didn’t show up.

[ad#Google Adsense 336×280-IA]As I told you back in February, any discussion of limiting oil production right now is ridiculous.

The only OPEC country whose oil production isn’t maxing out is Iran.

(Up until this year, sanctions limited its oil exports. Now that the sanctions are off, it sure as heck doesn’t want to limit its oil production.)

On the other hand, Saudi Arabia argues that with oil prices so low, every country should voluntarily freeze production.

It’s a stalemate… and neither side has shown any signs of budging.

And as I’ll explain today, that’s terrible for oil prices…

Without Iran’s agreement, OPEC can’t significantly influence oil production. All the countries in OPEC are trying their best to produce the most oil they can right now. None of them has capacity to produce more oil… and nobody is willing to produce less.

However, if these countries could get Iran to agree to the deal, it would keep about 1 million barrels of oil per day off the market. That would significantly reduce the oil supply and push oil prices higher.

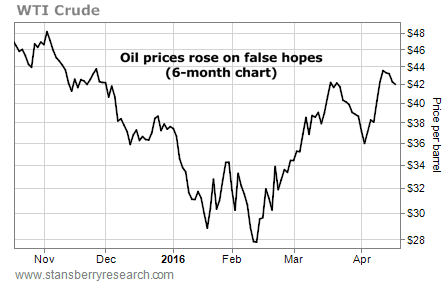

You can see in the chart below that the mere possibility of an oil-production freeze agreement helped push oil prices from around $26 per barrel in February to more than $40 per barrel prior to the OPEC meeting – a huge, 50%-plus move.

I predicted in February that the deal was going to fall apart. Sure enough, when news broke on Monday that the deal was off, oil prices slid…

There is one good thing that comes out of this OPEC comedy routine: Oil prices will have time to find a fundamental bottom based on actual supply and demand, rather than price manipulation. Because until oil production falls to a level that meets current demand, oil prices aren’t going anywhere.

There is one good thing that comes out of this OPEC comedy routine: Oil prices will have time to find a fundamental bottom based on actual supply and demand, rather than price manipulation. Because until oil production falls to a level that meets current demand, oil prices aren’t going anywhere.

Iran has no reason to change its mind anytime soon. And ultimately, that’s terrible news for oil prices… and the share prices of publicly traded oil companies. Commodity expert Dennis Gartman agrees. He told financial-news network CNBC that he believes oil prices will trade between $32 and $42 per barrel this year.

Not many oil companies can stay afloat with oil hovering around $40 a barrel. I expect to see even more bankruptcies in the oil sector.

Good investing,

Matt Badiali

[ad#stansberry-ps]

Source: Growth Stock Wire