Today, I’ll talk about a very divisive and controversial man: Republican presidential front-runner Donald Trump.

I’m not making any value judgment about Trump, his politics, his hair or anything else. I’m not endorsing Trump – nor am I telling you not to vote for him.

Let’s just take a look at what he says, and what it could mean for dividend investors.

[ad#Google Adsense 336×280-IA]It’s important to consider what could be coming in the event of a Trump presidency.

First, the following analysis makes a lot of assumptions. It assumes that everything Donald Trump has outlined in his platform is true.

My analysis also assumes that if he does become president, he’ll be able to enact at least those policies that would affect dividends in the first days of his presidency.

I’ve read through Trump’s platform, and there are two key aspects that would definitely and significantly impact dividends.

The first is the most exciting. Initially, it appears to have nothing to do with dividends, and I think that’s why you probably haven’t heard much about it.

Trump promises to allow a “one-time deemed repatriation of corporate cash held overseas at a significantly discounted 10% tax rate, followed by an end to the deferral of taxes on corporate income earned abroad.”

This policy basically means there would first be a huge influx of cash coming back to the U.S. And on an ongoing basis, there would be no benefit for companies to hold cash overseas ever again. Companies would have no incentive to keep cash abroad, because overseas earnings would also be taxed by the IRS.

Does that seem like a far-reaching policy? It’s not.

As individual taxpayers, you and I are currently required to file an income tax return with the IRS no matter where we earn income. U.S. citizens pay taxes on income earned in Antarctica, the Marianas Trench or Timbuktu. The Feds want their piece of your income regardless of where you earn it.

This single policy would account for an immediate inflow of trillions of dollars, as overseas cash hoards flood into the balance sheets of American corporations.

Consider that just eight American companies (Microsoft, Apple, Google, IBM, Cisco, Oracle, Qualcomm and Hewlett Packard) hold over $420 billion overseas. In total, American companies have over $2.1 trillion overseas.

Under Trump’s plan, American corporations would collectively bring home $1.89 trillion, after taxes.

Considering corporations already hoard near-record levels of cash, this would increase the pressure to increase dividend payments.

But that’s just the first part of the Trump dividend plan.

The second part is much more transparently beneficial, and it would signal a huge number of new dividends.

Under the current tax regime, dividends are taxed at 15% for individuals in the four lowest income brackets. Those earning more than $400,000 pay a 20% tax on their dividend income.

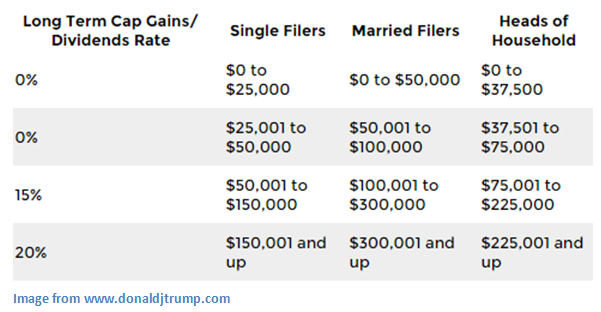

According to Trump, he would lower the capital gains and dividend tax rate for almost everyone. Only those earning more than $150,000 per year could see a dividend tax rate increase. Here’s how his plan breaks down capital gains and dividend taxes.

So what do his policies really mean?

If Trump’s policies were enacted, companies would have a strong incentive to hold off on dividend increases and one-day payouts until after he becomes president.

Despite what you hear in the mainstream media, publicly traded companies look out for their shareholders. If there’s a new tax law that impacts the amount of money they can pass on to shareholders, they will change their behavior to exploit the law.

In the event of a Trump presidency, the trend seems clear: investors would see a boon in dividend payouts after he came into power.

I don’t know if Trump will gain the Republican nomination, let alone win the 2016 presidential election.

But I do know the other presidential candidates have much different plans for taxing your dividends.

In the coming weeks, I’ll send you details about how the other candidates plan to change the tax code, and what it could mean for your investment income.

— Steve Mauzy

[ad#wyatt-income]

Source: Wyatt Investment Research