When you start looking for stocks to generate income, it’s easy to focus on yields, and your temptation might be to believe that higher yields are always better.

I too am a fan of high yields, but only when the dividends come from a sustainable business model and the market is mispricing the quality of the company which leads to the higher yield.

However, to build an income stock portfolio that is not subject to large swings in the stock market, you need to employ some portfolio management strategies beyond just investing in a handful of high-yield stocks.

[ad#Google Adsense 336×280-IA]When I speak with investors, either at investment conferences or through my newsletter or email, I focus on how we really can’t foresee when the market will correct or go into a bear market.

These events are part of investing in stocks and happen on a regular basis, but the one thing I do know is that the market always recovers from a downturn.

This is a key fact to remember when investing.

For income-focused investors specifically investing in stocks that will keep the dividends coming through all stock market conditions is utmost necessary. As you build an income stock portfolio, take the necessary steps to make sure you earn a stable and growing income stream through any market conditions.

Before I jump into a specific stock discussion to make the point and provide an attractive stock opportunity, here are a couple of basic portfolio strategies you should always have in mind as you research for stocks to add to your portfolio.

- Diversify across a number of stocks you own and by economic sectors. I recommend that about 20 stocks will give an adequate amount of diversification. This number needs to be spread across different market sectors such as equity REITs, financial companies (REIT or otherwise), energy, telecom, and transportation.

- Plan to reinvest a portion of your dividends, even if you are investing for income to pay your living expenses. The nice thing is you can still have a relatively high take-home yield even if you reinvest a portion of the dividends you earn. For example, Starwood Property Trust, Inc. (NYSE: STWD) currently yields about 11%. Taking 7% as income still leaves you 4% to reinvest. That reinvestment will buy more shares, giving you higher dividend payments the next time around and in the future.

- Look for dividend growth. Invest a portion of your portfolio – at least a quarter and up to half – in income stocks that are more focused on dividend growth than current yield. It’s like getting a raise every time the company increases dividends.

This last point is important. Income focused investors tend to go for higher yields but do not spend a lot of time looking at dividend growth prospects.

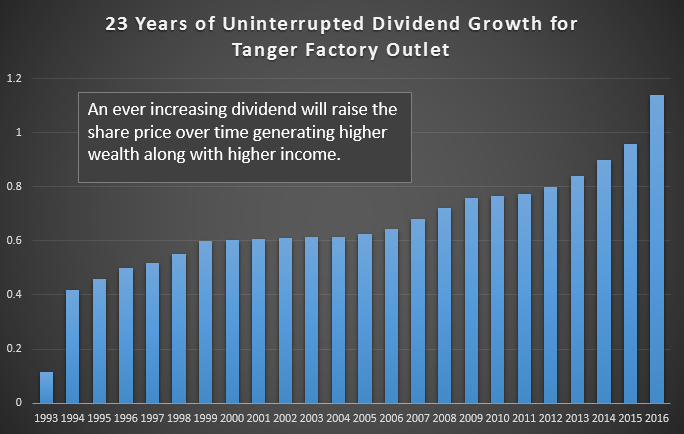

There are a couple of reasons why dividend-focused investors need some growth prospects in their portfolios. First, high yield stocks which do not have much dividend growth tend to have more volatile share prices. Over the past few months, we have all felt the pain of share prices that are down 20% or more even though the businesses behind the share prices are doing fine. You will find that by owning some stocks that generate higher dividend growth rates, you will get more price stability when the markets get volatile. Second, with some dividend growth focus, you will also see you share prices increase, generating higher wealth along with a higher income.

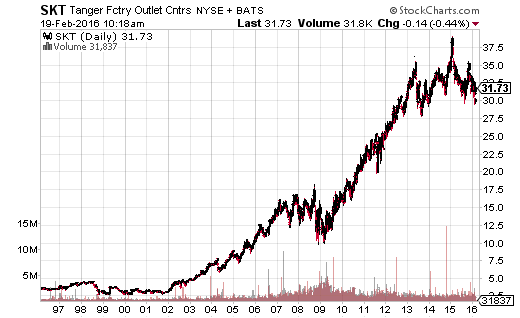

Tanger Factory Outlet Centers Inc. (NYSE: SKT) is the type of dividend growth stock you should own in your income-focused portfolio. While SKT shares currently yield just 3.8%, you need to look at the long-term potential from a company that grows its dividends like Tanger Factory Outlet Centers.

Here are some of the numbers:

- SKT has increased its dividend every year since going public in 1993.

- The company currently pays out about 60% of free cash flow, called funds from operations or FFO in the REIT world, as dividends with the rest staying in the company and used to grow future cash flow and dividends.

- The SKT dividend has grown by 7.4% per year compounded over the last 10 years and 11% annually over the last five years. This is a company that is accelerating its cash flow growth.

Let’s look at what your investment results would have been if you invested in Tanger 20 years ago. Remember, there have been two major bear markets in that period. On February 13, 1996, SKT closed at $26.25 per share. To buy 500 shares would have cost $13,125. Based on the last dividend before the purchase date, SKT was yielding 1.9%, resulting in $250 a year of dividend income.

Now we jump ahead 20 years to the present. There have been a pair of 2-for-1 share splits, so the position is now 2,000 shares. The current share price is $30.23, giving a share value of $60,460. The current annual dividend rate is $1.14 per share, giving an annual dividend amount of $2,280.

To break it down, the SKT share value has increased by 460% and the dividend cash flow has grown by 912%. The $2,280 of annual dividend also represents a 17% annual yield on the initial investment amount.

Most income-focused investors buy dividend stocks because they are building an income stream for retirement or are already there and need the income from their stock portfolio.

For most retirees, that stage of life will last for 25 years, 35 years, or even longer.

A high yield right now looks good to help pay your current expenses, but you also need to think about your income stream 20, 25, and 30 years in the future.

Mixing in some stocks with average current yields but great dividend growth prospects will make sure those later retirement years are as good as the ones just around the corner.

— Tim Plaehn

Opportunity to Claim an Extra $4,276.80 in Dividends by March [sponsored ad]

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

And, there are currently over twenty of these stocks to choose from in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields.

The next critical date is Thursday, February 25th (it’s closer than you think!), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $4,276.80 in payouts by March, but only if you’re on the list before the 25th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Source: Investors Alley