Not long ago, a sweet potato pie became famous. The reason it became famous? A singer named James Wright posted a video review on Facebook (Nasdaq: FB). The video went viral and Patti LaBelle’s sweet potato pies flew off the shelves at Wal-Mart (NYSE: WMT).

The brand was launched in September, but Patti’s pies generated little attention or sales. No one knew what they were or that they even existed. That all changed in just a few short hours. The weekend Wright’s glowing endorsement swept across the social networks, sweet potato fanatics gobbled up more than $1 million worth of the dessert.

[ad#Google Adsense 336×280-IA]Wright’s video is a prime example of the power of viral marketing combined with social media.

Financial criminals have noticed.

Penny stock promoters are the pioneers of viral marketing.

Long before the invention of YouTube or Facebook, they were using it to pump (then dump) stocks.

But back then, they used the good old-fashioned telephone.

One time I got a voicemail that went like this:

“Hey Tracy, it’s Debbie! I couldn’t find your old number and Tammy said this was your new one… Anyway, remember Evan, that hot stock exchange guy I’m dating? The stock symbol is [stock symbol]… It’s $0.50 now and it’s going up to, like, 5 or 6 bucks this week, so get as much as you can…”

Scammer on Social Media

These days, instead of the telephone, these criminals are fishing in the social media pond to lure investors into low-priced stocks. The venue may have changed, but the scam is still the same. And it has a name.

Affinity fraud.

It’s the new viral marketing scheme sweeping social networks. It’s not much different than the “smile and dial” boiler rooms of the past. Here’s how it works.

In order to establish a bond with their victims, dishonest stock promoters or pumpers will join social media interest, alumni or even interest groups. Often, they will create several fake profiles to target members of several groups at the same time.

The key to successfully pumping a stock is gaining the victim’s trust. Facebook, LinkedIn and Twitter make it easy.

Many people accept new online “friends” into their networks without question. Especially if they are connected to something or someone we know. This is what makes social media such an attractive platform for pumpers.

Then, out of the blue, your new “friend” will strike up a conversation. They may claim to be an old college or high school friend. Of course, you won’t recognize them. I graduated high school with more than 500 students; there is no way I could be expected to remember all of my childhood classmates.

However, with the information available on social media, your long-lost chum will know a lot about you. It won’t take long for him or her to gain your trust. Then comes the hard sales pitch for the “too good to be true” investment – usually a penny stock.

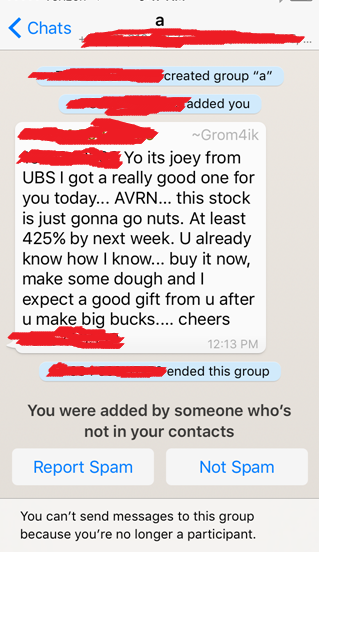

Here’s the thing: You don’t even need to accept someone’s friend to be targeted. Here’s a stock pump that was sent around the messaging application WhatsApp:

Once the target has invested or gotten suspicious, the social media profile of the person who recommended the stock disappears. In traditional pump-and-dump style, so does the share price.

Once the target has invested or gotten suspicious, the social media profile of the person who recommended the stock disappears. In traditional pump-and-dump style, so does the share price.

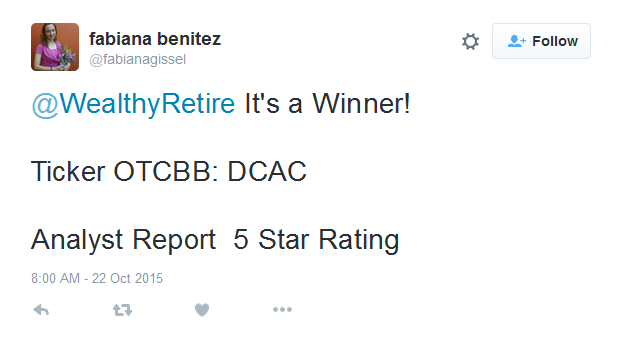

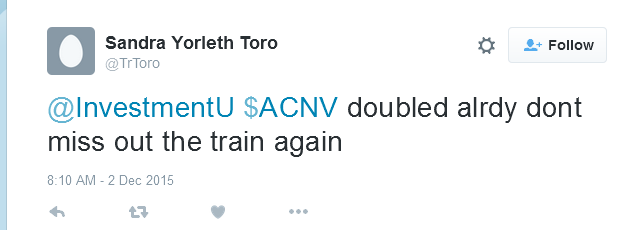

Here are a couple examples of what a stock pump might look like on Twitter:

Avoiding social media is not an option for most of us. We use it to keep up with friends and family. Plus, social media gives us access to many outlets that provide a surplus of accurate information for investors. So how do you recognize social media investment fraud?

Avoiding social media is not an option for most of us. We use it to keep up with friends and family. Plus, social media gives us access to many outlets that provide a surplus of accurate information for investors. So how do you recognize social media investment fraud?

How to Combat Social Media Investment Fraud:

- Verify the source.

Find out if any of your connections actually know this person. Also, be skeptical of information from a profile with a limited history of posts and messages. - Perform your own due diligence on the investment.

Make your own determination of the financial health of a company before you invest – no matter where the recommendation came from. Also, don’t trust unsolicited advice. - Find out where it trades.

Remember, over the counter and Bulletin Board stocks are the most risky stocks and are easily manipulated. - Beware of “inside” information.

Sometimes promoters will claim to have inside information regarding a catalyst that will push the stock price higher. Trading on inside information is illegal and the promise is a typical stock scheme designed to trick gullible investors.

Stick with these four simple rules and you’ll never get suckered into a bad investment.

Has anyone ever tried to send you a penny stock tip on social media? Or have you tried Patti Labelle’s sweet potato pie yet? Sound off below.

Good investing,

Kristin

[ad#sa-income]

Source: Wealthy Retirement