Bargains, bargains, bargains.

I’m not talking of the now seemingly arbitrary Black Friday or Cyber Monday variety.

Rather, I’m referring to the investment type.

Opportunities that most investors, particularly those of you who lean toward a contrarian point of view, should take seriously.

I plan on spending the next few weeks discussing some of the best contrarian plays I’ve seen in years.

[ad#Google Adsense 336×280-IA]I want to begin by focusing on the oil sector.

The sector has taken a beating since July 2014.

But, the precipitous decline has led to, in my opinion, a wealth of investment opportunities.

Rather than just stepping in here and hoping for the best, I want to attempt to purchase shares of the United States Oil Fund (NYSEArca: USO) – and a stock or two in the sector – for even less than where they are currently priced.

I can do so easily by employing a put selling strategy. By selling puts I can choose to lower the cost basis of the ETF or stock I wish to purchase, or use the proceeds as a form of income. In this case, I want to do the former. I want to own the asset for as cheap as possible.

Let’s start with the exchange-traded fund, USO.

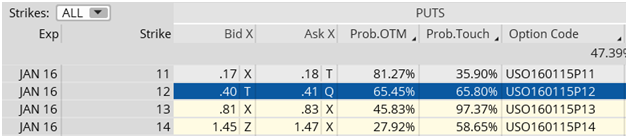

As you can see in the chart above, USO is currently trading for $12.93. I could buy it here for roughly $12.93. Or as I mentioned before, I could sell puts at a lower strike price, lower the cost basis of the stock, and potentially have the opportunity to buy the ETF for a significantly cheaper price. I almost always side with the latter.

I want to buy the ETF for $12, or 7.2% cheaper than where it is currently trading. I can sell puts at the $12 strike and collect $0.40 for doing so. I can thus lower my cost basis even further, to $11.60, or 10.3% lower than where USO is currently trading.

If in 46 days at January options expiration USO closes above $12, I will re-evaluate the current state of USO and simply sell more puts – thereby lowering my cost basis even further. My hope is that I can do this until I basically own the stock for next to nothing.

But realistically, I will be assigned the ETF at some point. Eventually USO will close below my chosen strike price. That’s OK. I want to own USO as a long-term holding in my portfolio.

Again, I know I can’t guess the bottom. But I do know that as a contrarian, when opportunities like this arrive, I am more than willing to take my chances at these levels, knowing time is on my side.

So what happens when the oil ETF closes below my strike price at expiration?

I’m simply assigned the stock at the strike price where I sold the puts, which in this case is $12. My cost basis is $11.60, or 10.3% lower than the current price of USO. Not a bad play for a contrarian investor with a long-term time horizon.

— Andy Crowder

[ad#wyatt-generic]

Source: Wyatt Investment Research