I’ve never done the math, but if I did, I’m confident that Prospect Capital (Nasdaq: PSEC) would be the most requested stock for the Safety Net. Nearly every week, at least one person asks if I can review it.

It’s not hard to figure out why. A liquid stock with a 13% yield is very attractive to income investors.

[ad#Google Adsense 336×280-IA]The last time I looked at Prospect Capital was six months ago, and the stock got a “D” for dividend safety. Let’s see if anything has improved.

Prospect Capital’s “D” rating in May was because it had recently cut its dividend and it wasn’t making as much money as it was paying out in dividends.

Shareholders currently receive $0.083 per month.

That’s down from the $0.11 Prospect Capital paid from December 2012 through January of this year.

In February, the dividend was lowered. Management said it was because the company would focus on higher-quality loans, which have lower yields.

Prospect Capital is a business development company that makes loans and equity investments in private businesses.

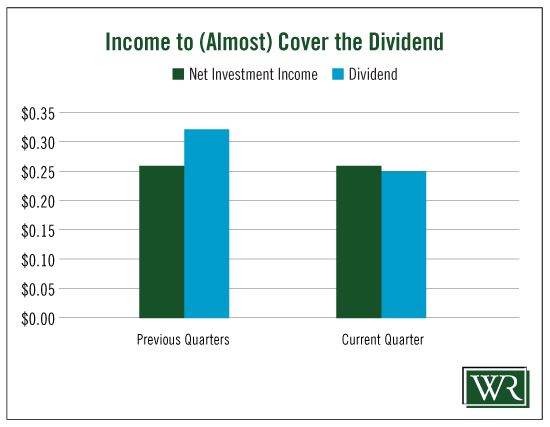

Through the first nine months of 2015, Prospect Capital has generated $0.78 per share in net investment income, earning a consistent $0.26 per share each quarter. It paid out $0.77 per share in dividends.

But that includes the $0.11 dividend in January. If you reduce the dividend to the current $0.083, the figure would be $0.75, giving the company a few cents of wiggle room in the event that net income slips. And I’d bet that’s why the company reduced the dividend in the first place, so that it wouldn’t be pressured to make sure that net investment income hit the larger dividend figure every month.

In fact, it wouldn’t have. The company was paying $0.33 per quarter, so $0.26 per share in net investment income wouldn’t have gotten the job done.

You can see from the chart below that Prospect Capital’s dividend policy is now more in line with the amount of net investment income the company generates.

I’m still concerned that a decline in net investment income will put the dividend in jeopardy, but I don’t think it’s as big of a problem as it was in May.

I’m still concerned that a decline in net investment income will put the dividend in jeopardy, but I don’t think it’s as big of a problem as it was in May.

After two quarters, the company has shown it can at least earn enough to pay the dividend.

After two quarters, the company has shown it can at least earn enough to pay the dividend.

So I’m upgrading the stock one notch.

I still wouldn’t call the dividend safe and wouldn’t be shocked if it were reduced due to falling net investment income.

But I’m not as worried about it as I was six months ago.

Dividend Safety Rating: C

Hoping your longs go up and your shorts go down,

Marc

[ad#DTA-10%]

Source: Wealthy Retirement