The recent market correction has all of us questioning our stock picks.

The REIT sector has been hit especially hard, and since values peaked in January of this year many of us are sitting underwater on REIT holdings that were purchased in the second half of 2014 or first half of this year.

With continued volatility expected in what may turn out to be a mostly sideways market for quite a while, you can improve your portfolio results by weeding out those REITs that do not bring any extra growth potential to the table.

[ad#Google Adsense 336×280-IA]A primary criteria for a REIT that I will recommend is a history of dividend growth.

I then analyze the company to make sure that the payout growth rate can continue at a similar pace or even accelerate.

In all market conditions, but especially in times like these, a growing dividend provides two important benefits. First, there is the obvious result of a growing cash flow stream.

I like to view my REITs as investments that give me a raise at least once a year.

A second benefit is that a growing dividend should eventually drag the share price higher. It’s a basic math if a REIT that yields 6% increases the dividend by 10%, the share price must go up by the same 10% to keep the yield at the same level.

The result is a 10% share price gain plus the 6% yield for a 16% total return. In the short to intermediate term the market ignores this basic, math based fact, but in the longer term a rising dividend will propel a share price higher.

So the REITs to sell or avoid in the current market are the ones that are not increasing dividends or have slowing cash flow growth rates. These are the companies that are most likely to be forced into dividend reductions if the economy gets worse or higher interest rates actually happen. Here are three that you will want to re-evaluate if they reside in your portfolio.

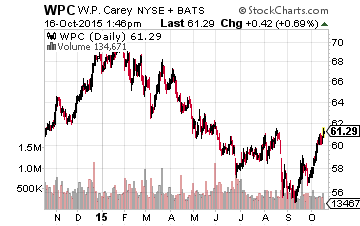

W.P. Carey Inc (NYSE:WPC) has been a great long-term yield plus dividend growth story. Historically, the dividend has been meaningfully increased every quarter.

W.P. Carey Inc (NYSE:WPC) has been a great long-term yield plus dividend growth story. Historically, the dividend has been meaningfully increased every quarter.

However, something has changed. The last three dividends came with tiny and shrinking increases of $0.0025, $0.0015, and $0.0010.

Yes, that is a one-tenth of a penny increase on a $0.95 quarterly dividend.

Yet management has been silent on the fact that cash flow per growth has stalled and the current string of micro dividend increases are more to keep a record of growth intact rather than provide a real value for shareholders.

The company has provided no guidance on either the reasons for the cash flow stagnation or when/if growth is again expected to resume.

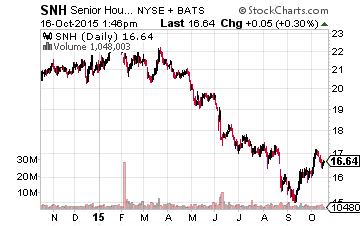

Don’t be tempted by the over 9% yield of Senior Housing Properties Trust (NYSE:SNH). The primary strike against SNH is that it has not increased its dividend since October 2012.

Don’t be tempted by the over 9% yield of Senior Housing Properties Trust (NYSE:SNH). The primary strike against SNH is that it has not increased its dividend since October 2012.

Even though the company reported 4% FFO per share growth for the second quarter, the current dividend is still 88% of FFO, leaving no room for an increase.

The REIT healthcare sector is filled with well-managed companies that have produced nicely growing dividends for investors.

A better alternative to SNH is Omega Healthcare Investors Inc (NYSE:OHI), which just announced its 13th consecutive quarterly dividend increase.

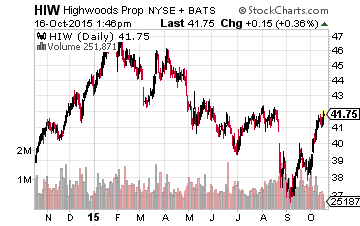

Highwoods Properties Inc (NYSE:HIW) holds the dubious honor of being the REIT in my database that has gone the longest without a dividend increase.

Highwoods Properties Inc (NYSE:HIW) holds the dubious honor of being the REIT in my database that has gone the longest without a dividend increase.

The company has paid the same $0.425 quarterly dividend since it went public in 1994.

The current 4% dividend yield is safe and well covered by FFO per share. But if a company can’t or won’t figure out a way to increase the rewards paid to shareholders, what’s the point of owning the stock. A not yet growing dividend REIT in a similar property sector that is on my radar is Columbia Property Trust Inc (NYSE:CXP). Columbia is a company that is working hard to reposition its portfolio and eventually start to grow the dividend rate. CXP yields 4.8%.

Finding companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and consistent dividend growth in stocks is what has given me the most consistent gains out of any strategy that I have tried.

— Tim Plaehn

Sponsored Link: And, there are currently over twenty of these stocks to choose from in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields. If you join my calendar by Thursday, October 29th you will have the opportunity to claim an extra $4,675.50 in dividend payouts by Thanksgiving.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from stable, low-risk stocks paying upwards of 12%, 13%, even 15% in the case of one of them. I’ve done all the research and hard work; you just have to pick the stocks and how much you want to get paid.

The next critical date is Thursday, October 29th (it’s closer than you think!), so you’ll want to take before that date to make sure you don’t miss out. This time we’re gearing up for an extra $4,675.50 in payouts by Thanksgiving, but only if you’re on the list before the 29th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Source: Investors Alley