Marc is out this week, but that doesn’t mean we’re canceling the week’s dividend safety showdown. He has asked me to compose this week’s Safety Net column in his stead.

It may be hard to believe, but I love to clean. I also enjoy trying out all of the household products that show up on store shelves.

This weekend, I decided to do some deep “autumn” cleaning.

[ad#Google Adsense 336×280-IA]The household stalwarts I used provided me with the inspiration for this week’s Safety Net evaluation.

I want to show you the dividend safety of a 178-year-old manufacturer of brands consumers and investors alike have come to love and trust.

Look in your laundry room, in your shower or under your kitchen sink, and you will likely find at least half a dozen brand-name products manufactured by Procter & Gamble Company (NYSE: PG).

From Tide to Dawn to Pantene, the company’s brands are ones that most of us use daily.

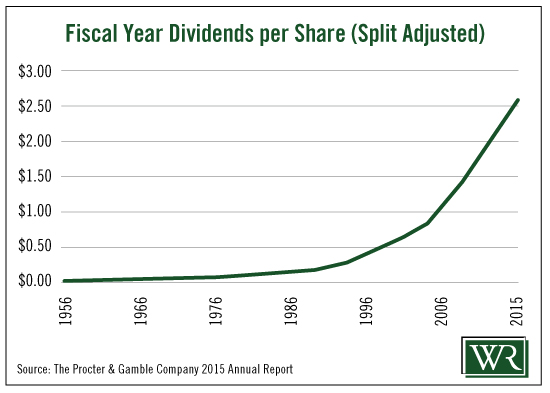

An elite member of the Dividend Aristocrats, Procter & Gamble has been paying dividends for more than 125 years. It has raised its dividend for the last 59 consecutive years. The average raise has been 9%.

But over the last five years, the tides have turned for the company. Growth nearly slowed to a halt as the company became bloated by several of its brand acquisitions.

But over the last five years, the tides have turned for the company. Growth nearly slowed to a halt as the company became bloated by several of its brand acquisitions.

Recognizing the problem, the company brought back one of its time-tested leaders, A.G. Lafley. In 2013, he was re-elected as chairman, president and CEO. His plan: Focus on Procter & Gamble’s stronger, more iconic and profitable brands.

Procter & Gamble took a significant step toward executing its transition plan earlier this year when it sold its Duracell battery brand to Warren Buffett’s Berkshire Hathaway Inc. (NYSE: BRK.A, BRK.B). It also sold its portfolio of beauty brands to Coty Inc. (NYSE: COTY) not long ago.

But the transition hasn’t been easy. And it has taken longer than management and most shareholders expected. Like most multinational companies, the strong dollar has also negatively impacted Procter & Gamble’s results. Investors have taken note, and many have cleaned Procter & Gamble out of their portfolios.

Shares are down over 20% year-to-date. Procter & Gamble’s stock now wears a 3.65% dividend yield. But with stagnant sales, divestitures and continued currency headwinds, how long will the dividend last?

Let’s run Procter & Gamble’s dividend through the rinse cycle and see what comes out in the wash.

Although sales actually declined 5% last year, free cash flow has not been shaved. In fact, it has continued to edge up. Free cash flow grew 7.54% to $10.9 billion in fiscal 2015 and is expected to rise another 3.77% this year. Over the last three years, free cash flow has gone up 16.65%.

An important piece of the Safety Net formula is the free cash flow payout ratio. Last year, Procter & Gamble paid out $7.3 billion in dividends to shareholders. This gives the company a payout ratio of 67.03%.

This year, shareholders expect to receive $7.5 billion in the form of dividends, giving Procter & Gamble a forward payout ratio of 64.66%.

Both payout ratios are comfortably below the Safety Net’s 75% cap.

Both payout ratios are comfortably below the Safety Net’s 75% cap.

Procter & Gamble’s payout ratio is a bit higher than it has been historically, but there is still plenty of wiggle room to protect the dividend in case free cash flow unexpectedly dips.

The Safety Net has failed to find a chink in Procter & Gamble’s dividend safety armor.

Despite the slower-than-expected execution of its transition and the negative impact of the strong dollar, Procter & Gamble’s dividend is safe.

With a 125-year history, it may even be worthy of the company’s famous Gillette razor slogan: “The best a man can get.”

Dividend Safety Rating: A

Good investing,

Kristin

[ad#sa-generic]

Source: Wealthy Retirement