On Friday night, just hours after the Dow Jones Industrial Average closed down 530 points and the S&P 500 slipped below 2,000 for the first time since January, my parents came over to my house.

My dad asked the same questions he always does after a big sell-off.

Dad: What caused the sell-off?

Me: More sellers than buyers.

(Dad gives me the “stop being a wiseass” look.)

[ad#Google Adsense 336×280-IA]I then proceed to go over the various causes being attributed to the market slide. The answer changes every time.

Dad: What do they say is going to happen next?

Me: If “they” knew, everyone would make a lot of money in the market.

No one knows what’s going to happen next.

Flash-forward 24 hours and I’m having the same conversation with my father-in-law.

My wife’s father told me how one of his friends lost $25,000 on Apple (Nasdaq: AAPL). “Wow, when did he buy it?” I asked. “A long time ago,” he replied. “But he’s lost 25 grand from the top.”

Losing $25,000 and being down $25,000 from the top are two very different things.

And then [Monday] happened. The Dow fell 1,000 points at the open. Some blue chip names fell 10%. And the market closed another 4% lower.

The drop in the market was scary. There are no doubt thousands of discussions going on right now just like the ones I had with my family. It doesn’t matter what the economic or investing climate is. When markets go down, people start to panic.

But let’s put things in perspective.

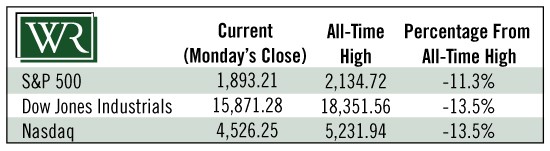

Despite the recent drubbing, the S&P 500 is 11.3% off its all-time high. The Dow and Nasdaq are each down 13.5%.

The markets are now officially in correction territory.

While a correction is not pleasant, it’s the first one in four years. Four years!

Could it get worse? Absolutely. This could be the beginning of a bear market. Could it get better? Absolutely. This could be a terrific buying opportunity as the market moves on to new highs.

No one can consistently predict the market.

But history can sometimes serve as a useful guide.

Let’s look back at last autumn. The S&P 500 fell 8.7% in one month. At that time investors were fearful of rising rates, the emergence of ISIS, Russia-Ukraine violence, unemployment that couldn’t get below 6%, Ebola, a death cross (when the 50-day moving average crosses below the 200-day moving average – a bearish signal) on small cap and midcap stocks, and overvaluation of stocks.

Stocks rose another 16.2% after that period of fear.

So here’s what you should do now:

- If you need the money invested in the markets in three years or less, take it out now. In fact, it shouldn’t have been in the market at all. Any funds that are needed in the short term should not be exposed to stock market risk, no matter what the market is doing.

- If you don’t need the money within three years, leave it alone. Markets go up over the long term, so the best chance you have for your money to grow is in a well-diversified portfolio of stocks.

- If you have money sitting on the sidelines, start doing your homework now. As I said earlier, stocks could continue lower or they could bounce. No one knows. But if you have money you’re waiting to deploy into the markets, start researching. This could be an opportunity to buy stocks you’re interested in 10% cheaper than you could have just a few weeks ago.

- If your money is in the market, stick to your trailing stops. Trailing stops help ensure you don’t take too big of a loss in any one position. And if things get really bad in the market, you’ll be out way ahead of time. Then you’ll be able to put those funds back into the market at even lower prices. Don’t change or ignore your stops. You put them in for a rational reason when you entered the position. Don’t let your emotions lead to a bad decision.

Anytime the markets drop suddenly like they have in recent weeks, investors begin to panic. It’s normal and quite predictable. But it’s important to remember that these things happen regularly in bull markets. Keep a cool head, stick to your game plan and don’t let the media frenzy affect your decision-making.

Hoping your longs go up and your shorts go down,

Marc

[ad#IPM-article]

Source: Wealthy Retirement