For 2014, REITs were one of the hot, hot sectors in the stock market. The REIT indexes and ETFs put up total returns for the year in excess of 30%.

In an income-focused sector like REITs, that level of returns is not sustainable.

[ad#Google Adsense 336×280-IA]If you own some REIT shares, you know firsthand that the market is now correcting and has been pretty rough on share prices over the last couple of months.

But, that is not bad news at all. In fact, now is a great time to buy a quality dividend growth stock like the one I reveal here.

From a mathematical point of view, the hypothetical total return from a dividend-centric investment is the current yield plus the dividend growth rate.

For the equity REITs (those that own commercial properties), the overall average yield and growth rates are 3.5% and 10%.

So over the years, simple addition shows REIT investors should expect 12% to 15% average annual total returns. Actual returns may swing high above or significantly below this number, but over a period of years, if the yield stays relatively constant the average annual total return must average out to that yield plus dividend growth number.

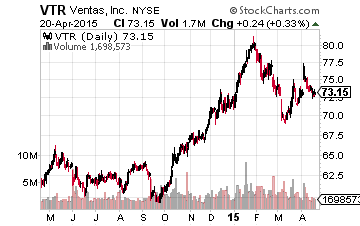

As an example, in June 2014 I added Ventas, Inc. (NYSE: VTR) as a recommended holding in The Dividend Hunter portfolio. Ventas is the cream of the crop out of the healthcare REITs.

When VTR was added to the recommendations list at $66.80 per share, the dividend yield was 4.4% with a steady history of 9% dividend growth. I viewed this as a nice combination from a very high-quality REIT for the yield and growth-focused strategy of The Dividend Hunter.

However, by late January 2015, VTR had climbed 20% to over $80, running well ahead of the dividend growth rate and pushing the yield down well below 4%.

At that point, I recommended the sale of VTR shares and that subscribers take those gains and reinvest into another quality dividend stock with a higher current yield.

At that point, I recommended the sale of VTR shares and that subscribers take those gains and reinvest into another quality dividend stock with a higher current yield.

The timing was pretty good, with a close-out price of $79.80 and currently VTR is trading at about $73.

I am watching company results and the share price to possibly recommend VTR once again to my subscribers.

A Great Deal in the REIT Sector

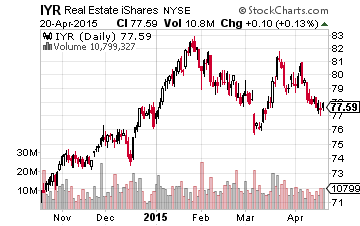

As you can see from this chart of the iShares Dow Jones US Real Estate ETF (NYSE: IYR) that the REIT sector has pulled back about 5% from the January peak.

As you can see from this chart of the iShares Dow Jones US Real Estate ETF (NYSE: IYR) that the REIT sector has pulled back about 5% from the January peak.

Many smaller market cap REITs have fallen farther (as often happens when the index values fall) and there are some attractive yield plus dividend growth combinations that can be picked up at lower share prices.

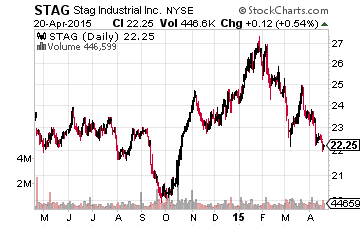

One that I recommended earlier this year is Stag Industrial Inc (NYSE:STAG), which now yields over 6% and should generate close to 10% dividend growth.

One that I recommended earlier this year is Stag Industrial Inc (NYSE:STAG), which now yields over 6% and should generate close to 10% dividend growth.

With the potential for further declines in the REIT sector, I am watching my full database of REITs for similar total return plays.

The other side of the yield plus growth story is that if you own a high-quality REIT that has fallen in value, the dividend growth factor will eventually pull your investment back into positive territory. STAG is off about 9% since I first added it to The Dividend Hunter recommendations list. With future dividend growth the share price will recover and the current pullback is just a great opportunity to add to a position or get in with an initial position to lock in the 6% and growing yield.

— Tim Plaehn

Sponsored Link: High-yield REITs with a solid track record of increasing dividends are one of the core investments we use in my Monthly Dividend Paycheck Calendar. The calendar is set up to make sure you’re getting 6, 7, even 10 dividend paychecks per month from stable, reliable stocks with high yields. It tells you when you need to own the stock, when to expect your next payout, and how much you could make from stable, low risk stocks paying upwards of 8%, 10%, even 17% in the case of one of them. The next critical date is Thursday, April 30th, so you’ll want to take action now to make sure you don’t miss out. This time we’re gearing up for an extra $3,150 in payouts by Memorial Day, but only if you’re on the list by the 24th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Source: Investors Alley