One of the big events in the market last week was the over $20 billion purchase of Pharmacyclics (NASDAQ: PCYC) by drug giant AbbVie (NASDAQ: ABBV). The main draw of this company that had a market capitalization of around $4 billion two years ago was its blood cancer drug Imbruvica which posted sales of less than $1 billion in its first year on the market in 2014.

This is believed to be just the beginning of a string of major acquisitions taking place this year in the biotech sector that has the potential to make certain investments extremely lucrative.

[ad#Google Adsense 336×280-IA]Just think, AbbVie paid full price for Pharmacyclics which went for a 50% premium to where the stock was trading just one month ago.

AbbVie had little choice as there were reportedly multiple bidders and AbbVie needs to start replenishing its product portfolio given its blockbuster drug Humira starts to come off patent late in 2016.

Facts like this are what lead investors to profit from acquisitions in this sector, and the two stocks detailed here are giving off strong signals that they could be acquired, giving their shareholders massive instantaneous returns.

It was the biggest acquisition in the biotech space in quite some time, but it won’t be the last. Blockbuster drugs will continue to come off patent at major pharmaceutical companies which have not had much success developing their own pipelines in recent years.

Even mighty Gilead Sciences (NASDAQ: GILD) acquired their blockbuster hepatitis C franchise by acquiring Pharmasset in 2011 rather than developing those compounds in house. In addition, financing rates are near historical lows which make issuing debt for the majority of the purchase price achievable and inexpensive.

Even with the closing of the “tax inversion” window late last year, an uptick in merger and acquisition activity in this area in 2015 seems highly likely. With that in mind, here are a couple of biotech plays that have solid prospects as standalone entities but also could attract the attention of the bigger fish in the pond over the coming year.

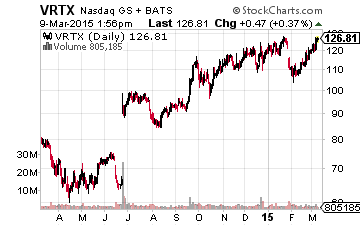

If a large pharma or biotech company is looking to make a major splash in 2015, Vertex Pharmaceuticals (NASDAQ: VRTX) could fit the bill.

If a large pharma or biotech company is looking to make a major splash in 2015, Vertex Pharmaceuticals (NASDAQ: VRTX) could fit the bill.

The stock has a market capitalization of roughly $30 billion despite having projected revenues this year of just over $1 billion.

The stock has doubled in the last year to some $125 a share.

The attractiveness of the stock is its emerging Cystic Fibrosis franchise. Cystic Fibrosis is a life-threatening genetic disease that affects nearly 70,000 people worldwide, about 30,000 in the United Sates and the disease has a half dozen known mutations. In 2012, Vertex became the first drug maker in more than a decade to have a new drug approved to treat the disease. The drug Kalydeco works on only a small portion of the population of Cystic Fibrosis patients and racked up approximately $500 million in sales in 2014.

However, the company has paired Kalydeco with an experimental drug also from Vertex to treat a larger portion of the Cystic Fibrosis community. The combination has seen great results in trials and is before the FDA, which is expected to render a decision in the summer. This combination could eventually ring up $2.5 billion to $3 billion in global annual sales according to a recent analysis by Bernstein. The company has other efforts underway to penetrate the Cystic Fibrosis population further.

It is important to note the Kalydeco does not cure the disease like Sovaldi/Harvoni does for hepatitis C, rather it just alleviates the effects and prolongs life expectancy. This creates a recurring and significant revenue stream given the annual cost of Kalydeco is approximately $300,000 per year.

Analysts expect approval and project the approximately $1.50 loss per share expected in FY2015 will turn into $3 to $5 a share of profit by FY2016. Obviously this could pique the interest of a larger player with a global sales force that wants the potential of owning the Cystic Fibrosis franchise.

Most of the larger plays that have been rumored as possible buyout candidates have had huge runs in the past six months such as BioMarin Pharmaceuticals (NASDAQ: BMRN), Medivation (NASDAQ: MDVN) and Juno Pharmaceuticals (NASDAQ: JUNO). I would be hesitant to take a position in any of them other as pure speculative plays as possible acquisition targets.

The smaller cap names look like better values.

The smaller cap names look like better values.

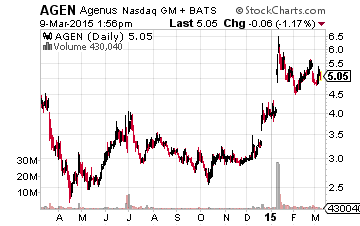

One I still like as a takeout candidate is Agenus Inc. (NASDAQ: AGEN) which is up some 60% since being included in the Small Cap Gems portfolio several months ago but whose shares do not reflect recent positive catalysts or the company’s potential value as acquisition candidate.

The company has two vaccines, for malaria and shingles, developed in conjunction with drug giant GlaxoSmithKline (NYSE: GSK) that should hit the market during the next year and a more than a dozen others in development.

More importantly the company recently entered into a global licensing deal with Incyte (NASDAQ: INCY) around its checkpoint inhibitor platform for four targeted inhibitor combinations. Checkpoint inhibitors are combined with drugs from these partners to develop a vaccine that stimulates the immune system to attack the cancer, plus the checkpoint inhibitor to prevent the cancer from protecting itself against the vaccine.

The deal with Incyte provides significant potential financial benefits. For each royalty-bearing product, Agenus will be eligible to receive up to $155 million in milestones and tiered royalties ranging from mid-single to low double-digits. Agenus also signed a deal with Merck (NYSE: MRK) in the second quarter of 2014 that could provide the company with $100 million in milestone payments if trials there are successful.

Even with the stock’s recent run-up Agenus has a market capitalization of a little over $300 million of which over $40 million is represented by net cash on the balance sheet. Given its potential milestones and commensurate royalties and partnerships with three major pharma players it is hard to see how this stock either doesn’t go higher by itself or by being acquired at a substantial premium over the next 12 months.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley