One of the major themes to the markets and global economy over the past few decades has been the consistently increasing “globalization” of the world.

One of the major themes to the markets and global economy over the past few decades has been the consistently increasing “globalization” of the world.

This has had a substantial impact on trade, economic growth, geopolitics, labor dislocation and of course travel.

If one wanted to visit Europe from the United States one hundred years ago it would involve making one’s way to a major port, shelling out a huge amount of cash for passage on an ocean liner and many, many days of voyage across the pond.

[ad#Google Adsense 336×280-IA]Now a person can fly directly to many capitals of Europe from multiple destination points in the States in eight to 12 hours.

The faster and cheaper means of travel has opened up the world to more people than ever before.

On the whole, this development is very positive on a variety of fronts.

However, the increase mingling of people from around the globe has its downside, too.

One of the major risks that have increased because of this trend is the increased risk of a major pandemic.

Over the past decade the world has seen the outbreak of SARS and bird flu in Asia and MERS in the Middle East. Recently markets were rattled by the first cases of Ebola in the United States. It is important to remember how deadly a global contagion can become. The Spanish Flu outbreak of 1918-1919 killed more people worldwide than World War I.

This makes the vaccine space very interesting at the present moment and luckily some major progress is being made to develop vaccines for known scourges of humanity as well as some of the new ones that will surface due to the greater global interactivity brought about by an immense increase in travel. Here are a couple of attractive but speculative small cap concerns that play in this space.

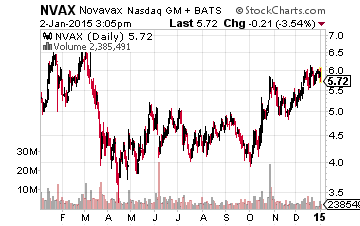

Long time readers will not be surprised that NovaVax (NASDAQ: NVAX) is on my short list of attractive vaccine makers.

Long time readers will not be surprised that NovaVax (NASDAQ: NVAX) is on my short list of attractive vaccine makers.

I first highlighted this promising small cap concern in March of 2012 when its stock traded at just $1.30 a share.

The company has started to deliver against its promise and the equity is closing in on $6.00 a share.

I have taken some profits on this better than four-bagger but still retain a stake in this biotech firm. With its recent rally, the market capitalization of NovaVax has shot up to some $1.4 billion.

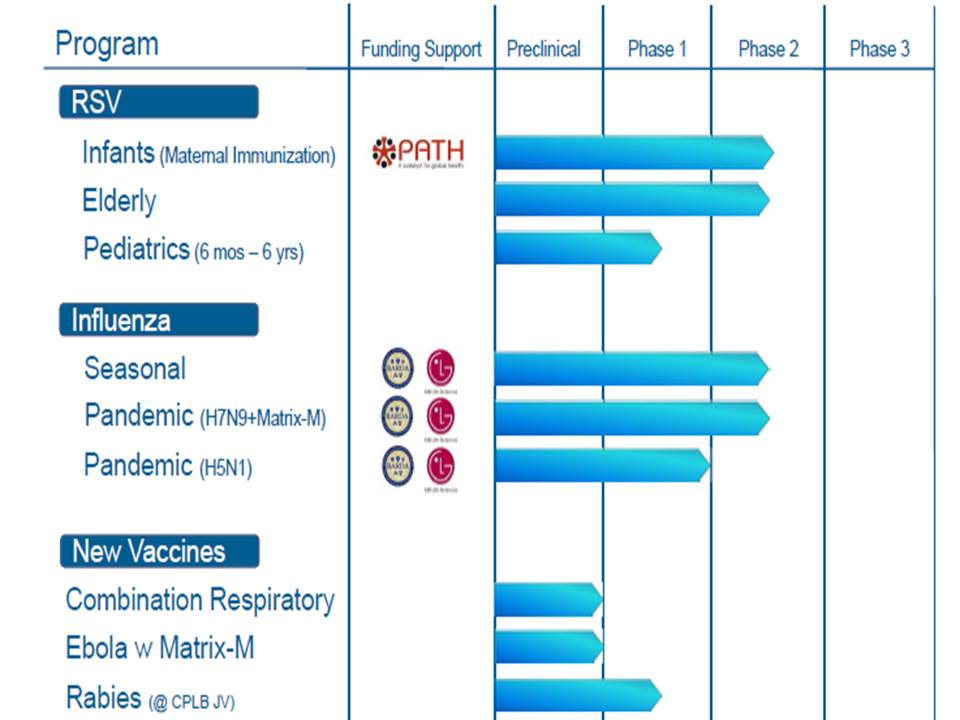

Despite the huge rise in the stock over the past almost three years, there are still plenty of reasons to like the long term prospects of NovaVax. The company received FDA fast track approval in late November for its RSV F-Protein nanoparticle vaccine candidate for protection of infants via maternal immunization. This disease causes approximately 150,000 infants to be hospitalized annually in the United States.

In addition, the Department of Health & Human Services exercised their option with NovaVax in September to have the company continue its work on advanced development of its recombinant seasonal and pandemic influenza vaccines and manufacturing capabilities for pandemic preparedness.

This provided Novavax with continued access to the remainder of the $97M base period funding, which has just over $30 million remaining on the agreement plus an additional $70 million to support development activities leading to a planned Phase III clinical trial in 2016.

Obviously this is a huge vote of confidence and could lead to major positive catalysts in the years ahead. The company has a deep pipeline of early stage vaccines in development which provides the multiple “shots on goal” I like to see before I make an investment in this inherently volatile space.

NovaVax is currently posting small losses. If the company’s vaccines in development successfully move through the development process, I expect the company to be profitable by 2017. The company has over $170 million in net cash on the balance sheet and analysts are still positive on the equity with a median price target of $10.00 a share by the seven analysts that cover the company.

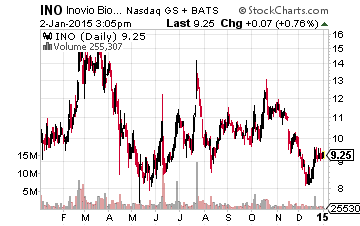

Another vaccine maker that is interesting here is Inovio Pharmaceuticals (NASDAQ: INO).

Another vaccine maker that is interesting here is Inovio Pharmaceuticals (NASDAQ: INO).

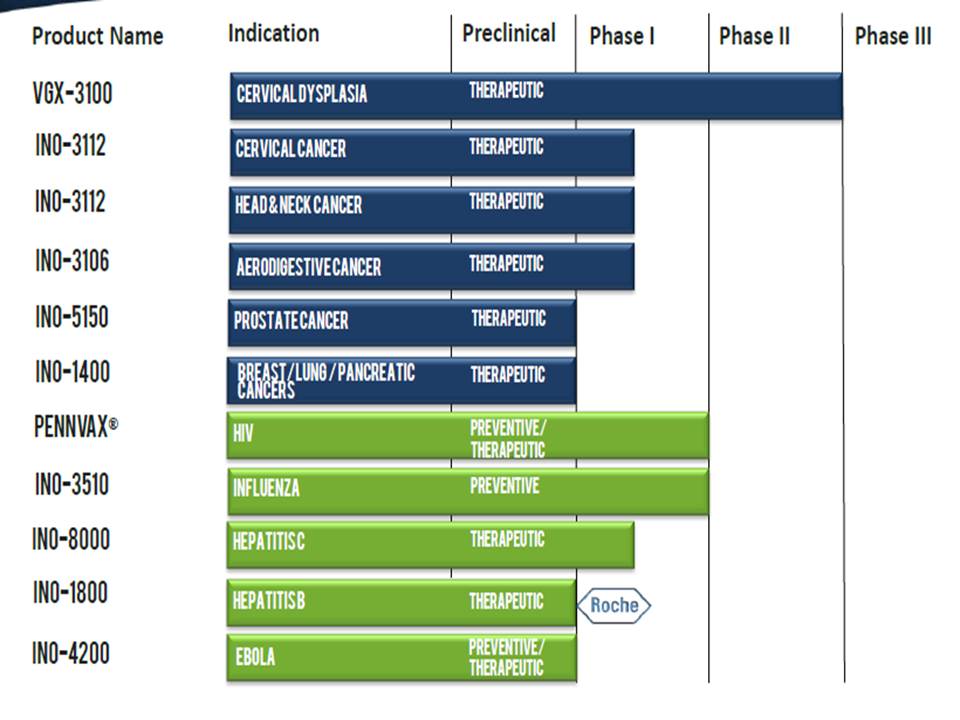

The company is focused on developing synthetic vaccines and immune therapies focusing on cancers and infectious diseases.

Inovio is slightly more speculative than NovaVax at this point and sports a market capitalization just north of $500 million.

Inovio does share some similar traits to NovaVax in that it has several vaccines in development, many of which are being funded by giant pharma player Roche. The company also has approximately $100 million in cash on hand to fund development.

Inovio does share some similar traits to NovaVax in that it has several vaccines in development, many of which are being funded by giant pharma player Roche. The company also has approximately $100 million in cash on hand to fund development.

I find it encouraging that insiders have been significant buyers of the stock in the back half of 2014. The stock trades for just over $9.00 a share. Five analysts have price targets on Inovio ranging from $19.00 to $29.00 a share.

I also still like Agenus Inc. (NASDAQ: AGEN) which is a part of the Small Cap Gems portfolio. The stock has had a nice rally since I last covered the firm here on these pages in Mid-December (see here). The company makes an adjuvant that is used by a myriad of vaccines under development. GlaxoSmithKline (NYSE: GSK) should receive permission to distribute its new malaria vaccine using Agenus’ compound this year and a shingles vaccine just successfully move through Phase III trials and should be on the market soon thereafter.

— Bret Jensen

[ad#ia-bret]

Source: Investors Alley