We love it…

We love it…

Many so-called “experts” are now worrying about a property bubble here in the U.S.

Meanwhile, home prices are still cheap. And our True Wealth Systems computers tell us it’s time to buy homebuilders.

We’d bet on our computers over the “experts” any day.

[ad#Google Adsense 336×280-IA]Let us explain…

Longtime readers know we’ve been fans of homebuilders for years…

And yes, shares of the iShares U.S. Home Construction Fund (ITB) – which holds a basket of homebuilder stocks – are up BIG since we first recommended them.

Our True Wealth Systems readers pocketed 90% gains in homebuilders over a 19-month period from 2011 to 2013.

And now, our computers say it’s time to buy again.

Based on history, this is a signal you don’t want to miss… We’ve tested it over nearly 50 years of data. And when our system was in “buy” mode, your money would have compounded at a 29% annual rate… WITHOUT leverage.

Conditions are in place for similar gains today. It comes down to supply and demand…

You see, housing starts (the number of new homes being built) in the U.S. are still at ultra-low levels. Homebuilders simply haven’t done their job over the past few years. And now, we have a supply-demand imbalance in housing.

In short, the U.S. needs more houses… and homebuilders are going to be the ones to build them!

The thing is, most people have no idea just how high shares of homebuilders can go when that happens.

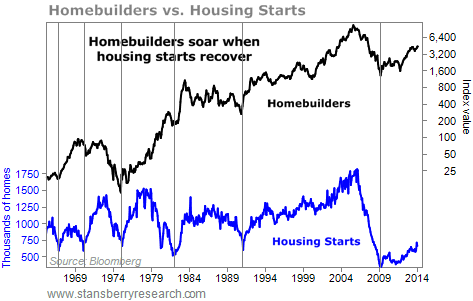

Hundreds-of-percent profits have been the norm after housing starts bottom:

On average, opportunities this good have led to nearly 300% gains in less than three years.

On average, opportunities this good have led to nearly 300% gains in less than three years.

You can see it in the chart below… When the housing starts (the blue line) bottom out, homebuilder stocks (the black line) soar:

Housing starts today are still very low. We are a long way from “normal.” Today, we are roughly where housing starts have typically bottomed in the past.

Housing starts today are still very low. We are a long way from “normal.” Today, we are roughly where housing starts have typically bottomed in the past.

The U.S. needs more homes… and homebuilders are going to build them. Of course, more building leads to more profits… and more gains for us as investors.

Right now, our True Wealth Systems computers say homebuilders are a “buy.” Our readers walked away with 90% gains the last time that happened. And thanks to housing’s supply-and-demand imbalance, it could happen again now.

Sure, shares of homebuilders have gone up over the past few years. But it seems the move isn’t over yet… Check out shares of homebuilders today…

Good investing,

Steve Sjuggerud and Brett Eversole

Sponsored Link: We’ve spent more than $1 million developing the strategies we use in True Wealth Systems. The data we use costs six figures a year. And we have a team of programmers headed by a PhD in math responsible for the deep “number crunching.” We now have 48 systems that we track every month, and we’re continually testing for new ideas. You can learn about a few of our most profitable strategies here.

Source: DailyWealth