Japan’s Nikkei stock index just closed out the first quarter of 2013 up 19%. That’s the best stock market performance of any major country this year.

Japan’s Nikkei stock index just closed out the first quarter of 2013 up 19%. That’s the best stock market performance of any major country this year.

The Nikkei was also the best-performing index in the preceding quarter – up 17%. That is the best six-month stock market performance in Japan since 1972.

After such big gains, you might think that you’ve missed it already in Japan. But you haven’t…

[ad#Google Adsense 336×280-IA]I call it “Abe’s Revenge.”

In September 2007, the unpopular Shinzo Abe resigned as Japan’s leader.

After his resignation, the Nikkei fell by half.

And the Japanese yen soared 40% versus the U.S. dollar.

But now, Abe is back for his revenge…

As the newly elected prime minister, he has sworn to NOT make the same mistakes…

Instead, he will use every government tool possible to aggressively create inflation to pump up the economy.

Right now, for example, long-term interest rates in Japan are the lowest in the world. A 10-year government bond in Japan today pays less than 0.6% a year in interest. Such a low return on bonds will force more folks into stocks.

These aggressive actions by Abe should mean Japanese stocks are a one-way ticket higher for 2013.

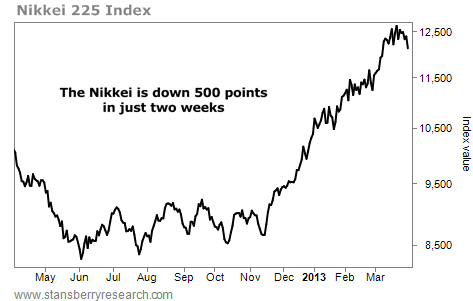

Even better, you have a solid buying opportunity right now… After such an incredible run over the last six months, the Nikkei stock index has fallen by 500 points over the last two weeks.

The Nikkei has fallen in part because the latest economic numbers in Japan haven’t been good. The economy didn’t grow at all in the last quarter of 2012. And core inflation was negative for the most recent month.

The Nikkei has fallen in part because the latest economic numbers in Japan haven’t been good. The economy didn’t grow at all in the last quarter of 2012. And core inflation was negative for the most recent month.

These bad numbers will only stoke Abe to do more to inflate the economy. And one of the major side effects of that will be a much higher stock market.

Paid subscribers to my True Wealth newsletter have made big gains quickly on this trade… I recommended shares of the WisdomTree Japan Hedged Equity Fund (NYSE: DXJ) on December 20. And readers are up 19% so far.

I believe this is just the beginning. Japan has the three things I look for in a trade…

Japanese stocks are cheap. With the exception of some of Europe’s “troublemakers” – like Greece and Portugal – Japan is the cheapest major country in the world based on price-to-book value.

Japanese stocks are hated. Even after such a big run, most investors do not own Japanese stocks.

And after two quarters of fantastic gains, Japanese stocks are in a solid long-term uptrend.

We know that Prime Minister Abe will not quit until his “Revenge” is complete.

DXJ is still “my favorite recommendation for 2013.” If you’re not invested in Japan already, use this recent little pullback to get your money in.

Good investing,

Steve

[ad#stansberry-ps]

Source: DailyWealth