When do we start worrying about inflation?

The Federal Reserve keeps printing money. Won’t that eventually create inflation… and cause all kinds of problems?

The Federal Reserve keeps printing money. Won’t that eventually create inflation… and cause all kinds of problems?

Won’t inflation eventually crush the stock market?

The answer might surprise you…

Stocks can actually soar during inflation… for a lot longer than people think.

Stocks can do well even during wild bouts of money printing (hyperinflation), as Jeremy Siegel explains in the book Stocks for the Long Run:

In the event of hyperinflation, stocks will be, by far, the best performing financial assets. Over the past several decades, the currencies of Brazil and Argentina have depreciated by more than a billionfold against the dollar, yet their stock markets have appreciated by an even greater extent.

[ad#Google Adsense 336×280-IA]Based on history, U.S. stocks have held up pretty darn well, even after inflation starts to rise.

It’s a funny thing… companies think they’re doing better, sales appear to be higher because of inflation, and so do earnings… So therefore, business looks good.

Looking at the data, though, you can see this only works to a certain point…

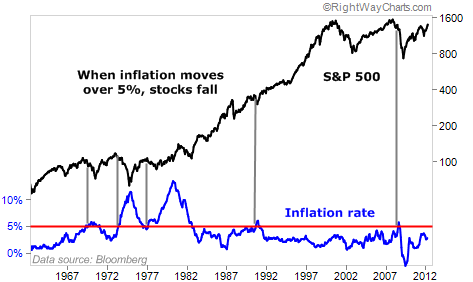

Over the last 50 years, stocks do well during inflation… until they reach an “uh oh” moment.

The “uh oh” moment happens when inflation touches 5%. When inflation reaches 5% in the U.S., stocks fall. Take a look…

So when the 12-month inflation rate rises above 5%, it’s time to get worried.

What happens at 5%? I don’t know specifically… Maybe 5% inflation is the point when investors get scared that the Fed will get serious about whipping inflation. They get scared the Fed will dramatically hike short-term interest rates… which will slow inflation AND the economy.

Right now, inflation is at 2.9%. The Federal Reserve forecasts inflation in 2014 will be around 1.8%. The current survey of Wall Street economists (by Bloomberg) shows they believe inflation in 2014 will be around 2.5%.

In short, 5% inflation might be a long way off.

When we start approaching 5% inflation, it’s time to consider making some changes… It’s time to tighten your trailing stops. Sell the investments that have gotten expensive. And get ready to move out of some of your positions.

But we’re not there yet.

Right now, I believe we’re still in the “sweet spot” in stocks.

I believe we’re in the “legitimate uptrend” portion of a bull market in stocks – the time when the big gains are made…

All the ingredients are in place for an incredible year in stocks (and most other investments, too). We’re in the early innings of the Bernanke Asset Bubble I’ve been writing about for years now.

Don’t let your fear of government money-printing lead you to bail out now. Based on history, as inflation rises, times will get much better in stocks before they get bad.

Good investing,

Steve

[ad#jack p.s.]

Source: Daily Wealth