I’ve been talking a lot lately about the $4 trillion that’s about to fall into the laps of businesses in the healthcare sector due to the number of Baby Boomers who are now turning 65.

I’ve been talking a lot lately about the $4 trillion that’s about to fall into the laps of businesses in the healthcare sector due to the number of Baby Boomers who are now turning 65.

And we know that the older we get, the more we spend on healthcare.

Consider:

- The average senior takes between two and seven prescription medications.

- Two out of three seniors will suffer a physical or mental impairment.

- One out of three seniors will spend time in a nursing home.

All of those things cost money – not to mention, chemotherapy, insulin, rehab stays, regular doctor appointments, weight loss programs and nutritional supplements.

[ad#Google Adsense 336×280-IA]That’s why it’s a great time to put money to work in the sector.

Revenue and earnings are going to explode higher in the coming year, particularly in the two most innovative groups – biotech and medical technology.

But the time to get in is now. Here’s why.

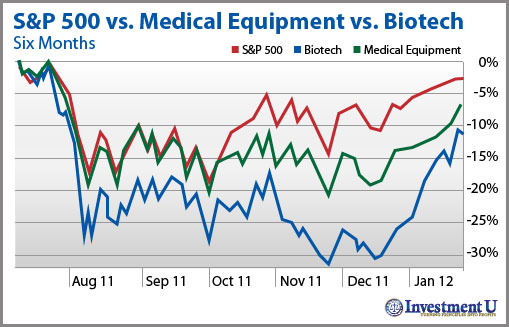

On the chart below, over the last six months, starting right before the market sell-off over the summer, biotech and med tech have underperformed the S&P 500.

Six Months:

- S&P 500: -3%

- Medical Equipment: -7%

- Biotech: – 11%

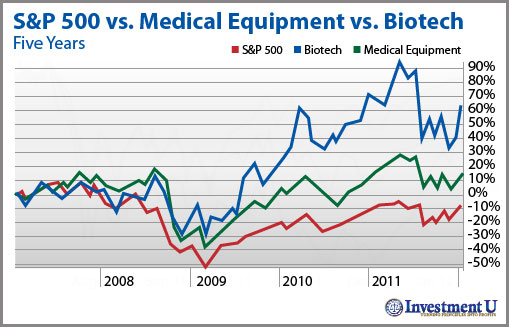

However, that underperformance isn’t the norm.

As you can see on the following charts, biotech and medical technology strongly outperform the S&P 500 over five- and 10-year periods.

Five years:

- S&P 500: -7%

- Medical Equipment: +20%

- Biotech: +71%

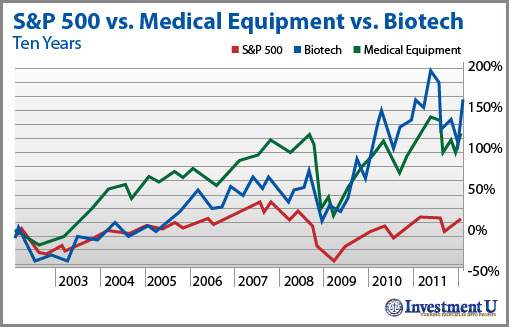

Ten Years:

- S&P 500: +16%

- Medical Equipment: +117%

- Biotech: +163%

So, history tells us that medical technology stocks like Intuitive Surgical (Nasdaq: ISRG) and biotech stocks like Celgene (Nasdaq: CELG) blow away the market averages. Yet right now, the group is underperforming.

I don’t expect that to last. Not when the fundamentals are lining up to create a boom in healthcare that some experts are saying will be similar to the beginning of the internet.

If any sector is going to dominate the news, politics and your finances in the coming decade, it’s going to be healthcare.

And because of the near-term underperformance, the sector is giving you a great opportunity to get in while the getting’s good.

This is a trend that’s going to have legs for a long time. But if you can start scooping up some of the best small- and mid-cap biotech and medical technology stocks now, imagine what they’ll be worth five and 10 years from now.

Anyone who bought Celgene 10 years ago is sitting on a 1,000% profit. Investors in Intuitive Surgical have made nearly 25 times their money. A $10,000 investment in 2002 is now worth $245,000.

With Baby Boomers aging and $4 trillion building up like flood waters against a levee, the underperformance of the sector isn’t going to last long. The market is giving us a rare opportunity to buy a group of stocks that are going to generate enormous profits for investors – and those stocks are currently on sale. It’s time to go shopping and fill up the cart.

Good Investing,

Marc Lichtenfeld

[ad#jack p.s.]

Source: Investment U