Most investors don’t understand how this works… but I KNOW it’s true, because I did it myself.

Most investors don’t understand how this works… but I KNOW it’s true, because I did it myself.

I’m talking about the Secret of the “Money Flows.”

It’s a secret that I used every day as the vice president of a mutual fund years ago. And you can use this secret to position yourself for safe profits. I’ll show you my favorite way to use it right now.

Let me explain…

Part of my job description as vice president of a global mutual fund in the mid-1990s was to put the fund’s excess cash “to work” overnight.

[ad#Google Adsense 336×280-IA]So I parked our money overnight where it was “treated best.” I was looking for a safe country that paid a high amount of interest. I wasn’t the only one doing this. Thousands of institutional investors, controlling trillions of dollars, were doing the same thing.

In short, that money flowed to where it was treated best.

Today, the Australian dollar is a good example…

You earn more interest in Aussie dollars than in any other safe, major currency. And that’s caused the Aussie dollar to jump 60% in the last three years.

You can use the Secret of the Money Flows in more than just currencies, too. The same things happen in the stock market…

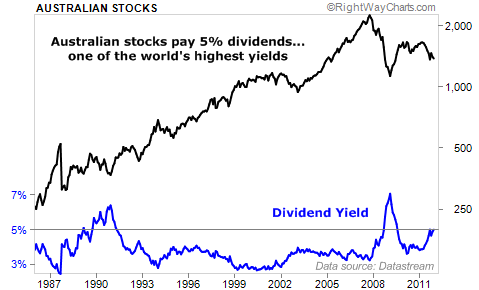

Right now, Australian stocks are dirt-cheap. Currently, Australian stocks pay a ridiculous 5% dividend yield.

As you can see, Aussie stocks haven’t paid this kind of yield in over 20 years (excluding the financial crisis).

A 5% dividend yield is enormous compared to the rest of the world… The S&P 500 pays just 2.1%. Japanese stocks pay just 2.2%. And even the demolished German stock market pays just 3.8%.

What’s more important, it’s nearly impossible to find a 5% yield on any asset, anywhere. The bank pays 0%. CDs aren’t much better. The U.S. government pays just 2% on 10-year debt. Quality corporate bonds pay around 4%.

Finding a 5% yield is just about impossible. But Australian stocks are paying it right now…

Investors are desperate for yield… And like I said, money flows where it’s treated best.

Therefore, I expect the Australian stock market could go much higher from here.

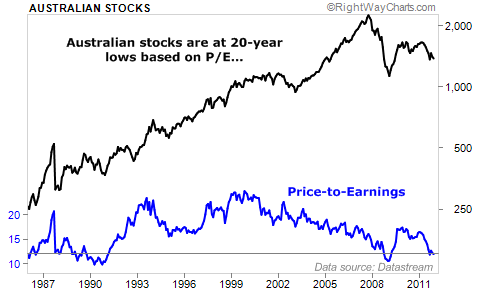

Aussie stocks are a great deal just based on dividends. But Aussie stocks are also ridiculously cheap based on price-to-earnings (P/E)…

Aussie stocks are at 20-year lows (excluding the financial crisis), trading at about 12 times earnings.

I like to buy Australian stocks through the iShares Australia Fund (NYSE: EWA). It’s a simple fund that trades on the U.S. stock market.

Major commodity companies (like BHP Billiton and Rio Tinto) and four large banks dominate the Australian stock market. These banks are in good shape… none of them lost money in the global economic crisis.

I believe investors will reevaluate the merits of having money in Australia… and they will push Aussie stocks higher. Trade accordingly…

Good investing,

Steve

[ad#jack p.s.]

Source: Daily Wealth