It’s one of the biggest fears of every retiree…

It’s one of the biggest fears of every retiree…

The thought that rampant inflation will eat away at your nest egg… leaving you to live out your final years in poverty.

Because inflation is such a big fear, it’s easy for folks to swallow any sort of statement about how bad it is… or how much worse it’s going to get. There’s practically an entire industry based on claims of how bad inflation is.

As I’ll show you in today’s essay, that industry is wrong.

Inflation is no problem right now… and if you think otherwise, your investments could suffer a terrible 2012. All you have to do is ignore the hype and focus on the numbers and facts.

[ad#Google Adsense 336×280-IA]Back in January of this year, I showed readers of my Retirement Millionaire advisory how inflation was no near-term investment concern.

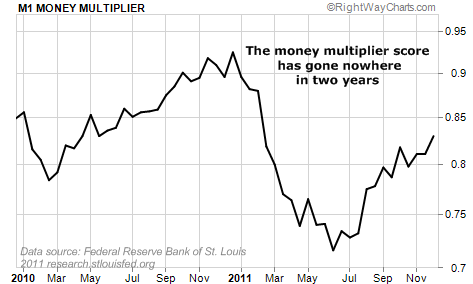

That’s because the “M1 money multiplier” was below 1.0.

The M1 multiplier is a measure of how quickly money is flowing around the economy.

All you need to know about this statistic is if it’s over 1.0, banks are taking their depositors’ money and loaning it out – money is flowing.

As long as it stays below 1.0, the money is not circulating.

Back then, with such a low score, it just wasn’t pointing to trouble ahead. Almost a year later, it’s still below 1.0. As you can see in the chart below, we’re right back where we were two years ago…

This tells us one major thing…

In spite of the government’s best attempts to stimulate the economy, things remain slow. Factories aren’t buzzing. Jobs aren’t being created. And prices have decreased. This is not inflation, but deflation.

Today, when I look at other charts of commercial loans, construction spending, business inventories, and manufacturing utilization rates, I see the same thing. The economy, while not in the pits, sure isn’t moving at a high enough rate of speed to generate inflation.

You can also see the economy’s sluggishness by looking at this chart of the CRB Commodity Index below. This index is a gauge of raw material prices (things like crude oil, copper, corn, sugar, gold, and platinum). It’s near its lowest level in a year… which is also the level it was at seven years ago.

The bottom line for you as an investor or retiree is that inflation is no near-term worry… certainly not in 2012.

That’s why I still encourage readers to hold onto blue-chip, dividend-paying businesses like Exelon (EXC), Johnson & Johnson (JNJ), and Microsoft (MSFT). These provide safety, growth potential, and stable income.

I’m also going against the crowd and recommending you hold onto municipal bonds. Like inflation fears, worries over municipal bonds are overblown. The default rates are still miniscule… and some of my favorite bond funds pay nearly 6% in income (which equates to a 9% rate in a taxable bond for someone in the 35% tax bracket). These are still great income vehicles for retirees.

Don’t get me wrong. I’ve been in the financial markets for over 30 years, and I’ve never seen such extreme government overreactions to economic problems. The government’s bungling will likely cause inflation down the road. But for at least the next year or two, we need to invest as I’ve described. All you have to do is look at the facts to realize it.

Here’s to our health, wealth, and a great retirement,

Doc Eifrig

P.S. If you follow the crowd with your investments, and let hype dictate your strategies – you’re going to miss out on some of the safest wealth-building ideas out there. But if you take advantage of the ideas I showed you today – and a few more unconventional strategies – you can retire rich with a much smaller nest egg than you might think. Learn how here.

[ad#jack p.s.]

Source: Daily Wealth