It’s hard to know exactly where to start after such a wild week, but I have a hunch that you’re as keen to answer one question as I am…

Will whiplash trading conditions continue?

That depends on two very specific things.

First, the computers that are causing this mess have to calm down.

Studies vary but computerized trading accounts for 70% to 80% or more of total trading volume in today’s markets. Once they decide to buy or sell, humans are along for the ride.

The situation is very much like Newton’s Cradle – a device created to demonstrate the conservation of momentum and energy using a series of stationary spheres.

When the ball smacks one side, the energy transfers to the other and there’s an opposite reaction.

Only in this case, imagine buying on the left and selling on the right.

As one computer lets go, every other computer adjusts and so on… until the amount of “energy” they create is absorbed.

That’s why you’ve got such huge up and down moves lately.

Most investors, of course, are totally ill-equipped to handle what’s happening because (a) they let their emotions interfere with otherwise rational decisions and (b) they don’t have the proven discipline and tactics we do here and at Total Wealth.

From lining up with Unstoppable Trends to prioritizing “must-have” investments to trailing stops and lowball orders… everything we discuss is specifically designed to take away Wall Street’s advantage and put the odds in your favor.

That way you can invest confidently no matter what the markets throw at you and, most importantly, laugh in the face of rocky trading activity that has most investors crying into their beer.

Second, huge bets against volatility have to unwind.

Many investors think that volatility is causing rocky conditions but, in reality, it was the extended period of no volatility that did.

That’s because money managers running hundreds of billions of dollars got greedy and placed huge (very naïve) bets that market conditions would remain the same using highly leveraged instruments like the ProShares Ultra VIX Short-Term Futures ETF (NYSE Arca: UVXY) and the iPath S&P 500 VIX Short-Term Futures ETN (NYSE Arca: VXX).

To give you an idea, the iPath opened at $45 last Thursday but hit $55 – making anyone who owned it $10 a share. However, those who had bet against it lost the same $10. Many probably lost a whole lot more, though, as the leverage went against ’em because they borrowed to take on the position. That doesn’t sound like a big deal until you realize that 85 million shares changed hands – or $4.6 billion on just this one instrument… and there are dozens of similar inverse leverage funds out there.

Where this really gets painful for Wall Street is the big funds and institutional players who thought they were so smart by placing these bets don’t usually have the cash to back ’em up. They’re leveraged up to their proverbial eyeballs to maximize returns. So, they have to sell other positions to raise cash or risk a “margin call” that could destroy their funds and their firms alike.

Very quickly FOMO – fear of missing out – turns into “oh no” and vice versa as prices bounce in both directions.

Now, we saw huge amounts of money on the move last week, so the situation is a lot better coming into this week, but Monday’s trading action combined with what I saw Tuesday tells me this isn’t over.

Market data reinforces this.

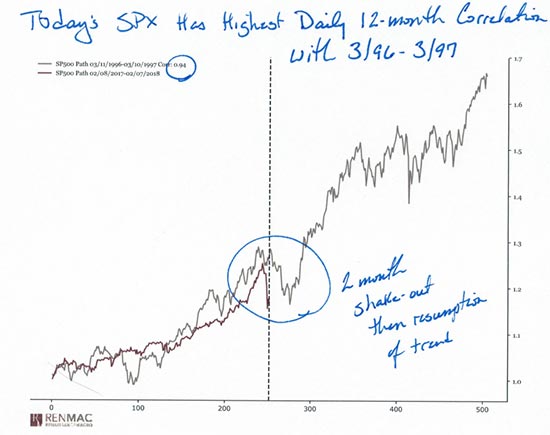

In fact, there are huge parallels between current conditions and those from March 1996 to March 1997, when the markets underwent a massive correction before shooting another 86.03% higher to peak in March 2000.

Interestingly, Jeff deGraaf, chairman of Renaissance Macro Research, also picked up on this. He noted to CNBC Monday that the picture associated with the top 25 correlations to current trading action suggests “a pause of a few weeks and resumption of trend.”

Source: CNBC/RENMAC

Source: CNBC/RENMAC

The speed with which we saw the correction materialize is critical. The S&P 500, for example, dropped 3.75% in a single day on Monday, Feb. 5, and 5%-plus in six trading days after reaching its all-time high on Jan. 26. According to Sam Stovall, chief investment strategist of CFRA, that means a correction bottom could happen a full 10 days earlier than normal.

My research agrees – most corrections end within 90 days, albeit after some very bumpy trading.

So now what?

I’m actually very excited by the volatility that’s giving most people fits because there is no doubt in my mind that the markets are giving you an engraved invitation to buy a few world-class stocks at “super-silly” prices.

Even if we haven’t hit THE bottom, it’s worth nibbling in to the right companies.

One of my favorite stocks right now, for example, is JPMorgan Chase & Co. (NYSE: JPM).

The bank is helmed by CEO Jamie Dimon who is, in my opinion, the savviest financial leader in the business. The company’s global, it’s positioned to profit from expanding margins, and it’s trading 5.5% below its 52 week high as I write with a PE ratio of 17.65 – that’s 7.1% lower than the S&P 500’s at 19.00, according to data from The Wall Street Journal.

I spoke about JPMorgan just a few weeks ago, but the company is such a good deal right now that I need to bring it to your attention again, just as I did to paid subscribers in our sister service, The Money Map Report.

Banking, generally speaking, will benefit from rising consumer spending and confidence. Small business optimism is increasing, which fuels loans. And more ill-informed – but decidedly hawkish – Fed commentary could jack rates, which means the bank will benefit from expanding margins.

To be fair, there are six very dangerous words in play… “it could be different this time.”

It could be… but probably won’t be.

At least for us.

Stick to the Unstoppable Trends and “must-have” companies, and you’ll be in the clear practically no matter what kind of monkey wrench the markets decide to throw your way.

Speaking of “monkey wrenches,” I’ll be back soon with a look at how rising rates really impact stocks and the specific investments that will put a huge smile on your face even as most unsuspecting investors get taken for another white-knuckle ride.

I’ll be with you every step of the way.

— Keith Fitz-Gerald

Source: Money Morning