Janet Yellen was hawkish in last Wednesday’s U.S. Federal Reserve meeting and even referred to the slowed economic growth in the first quarter as “transitory.”

Translation – no big deal.

So while the Fed’s holding interest rates steady for now, you’re looking at more than a 90% chance of another interest rate hike on June 13, when the FOMC meets again.

Now, higher interest rates could affect everything from your mortgage and credit card payments to the equities in your portfolio.

But here’s how you can protect yourself…

The Two Best Fund Considerations Ahead of the Next Fed Meeting

When the Fed decided to hold rates steady for the next few weeks, it didn’t cause a sell-off in the markets, nor did it spur an upward movement of equities prices.

[ad#Google Adsense 336×280-IA]All in all, it was a pretty ho hum kind of response to the announcement. The bond market, on the other hand, didn’t fare as well. Now, it didn’t sell off dramatically, but it was definitely weakened by a couple of points.

This is the primary relationship between equities and bonds – when one goes up, the other goes down. Earnings drive stock prices.

Interest rates drive bond prices. And this can make it extremely difficult to know exactly how to protect your portfolio (and still profit) in the markets – especially ahead of an almost-certain interest rate hike.

So here’s an easy solution: exchange-traded funds (ETFs).

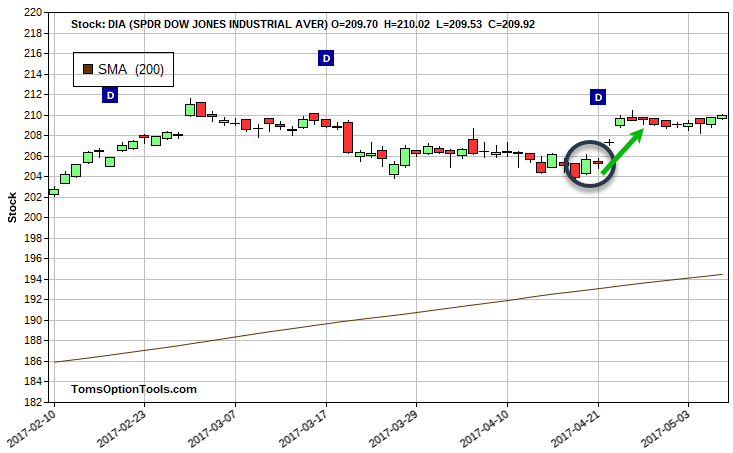

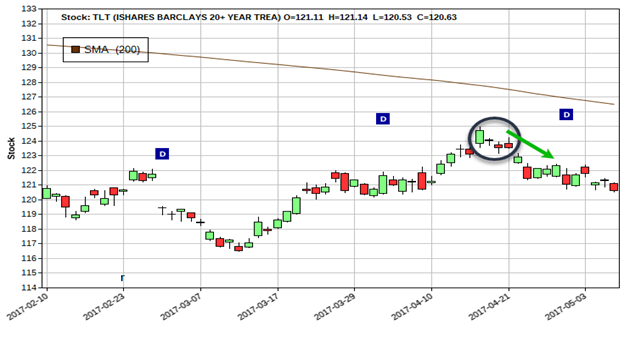

An ETF is a fund that tracks indexes such as the Dow Jones Industrial Average and the S&P 500. ETFs basically let you trade an entire sector instead of having to pick and choose specific stocks to trade within a sector. ETFs are also a great way for you to hedge against rising interest rates. When it comes to equities, a good ETF to monitor is the SPDR Dow Jones Industrial Average ETF (NYSE Arca: DIA). For bonds, the iShares 20+ Year Treasury Bond ETF (NYSE Arca: TLT) is a good way to gauge the bullishness or bearishness of the overall bond market.

Now, bonds and equities don’t always have an inverse correlation, but most of the time, they do. So when the Fed decides to jack up rates on June 13, DIA and TLT are the best two considerations to have in your portfolio for both protection and profits.

Here’s a look at how each one moved when the Fed made its latest decision to not raise rates:

DIA:

TLT:

If for any reason the Fed changes its mind about raising rates and you’re feeling bullish about equities, then you’ve got a bearish profit opportunity in bonds. That means you could consider opening a bullish trade on DIA and a bearish trade on TLT. Likewise, if it does raise rates and you’re feeling bearish on equities and bullish on bonds, then you could consider opening a bullish trade on TLT and a bearish trade on DIA.

If for any reason the Fed changes its mind about raising rates and you’re feeling bullish about equities, then you’ve got a bearish profit opportunity in bonds. That means you could consider opening a bullish trade on DIA and a bearish trade on TLT. Likewise, if it does raise rates and you’re feeling bearish on equities and bullish on bonds, then you could consider opening a bullish trade on TLT and a bearish trade on DIA.

In either case, you’ve got a way to hedge against and profit from any action the Fed takes next month – and any time after that.

— Tom Gentile

[ad#mmpress]

Source: Money Morning