Please keep in mind that these “10% Trade” alerts are for information purposes only. We’re not registered financial advisors and these aren’t specific trade recommendations for you as an individual. Each of our readers have different financial situations, risk tolerance, goals, time frames, etc. The ideas we publish are simply ideas that we feel fit our specific needs and that we’re personally making in our own portfolios. You should also be aware that some of the trade details (specifically stock prices and options premiums) are certain to change from the time we make our trade to the time you’re alerted about it. So please don’t attempt to make this “10% Trade” yourself without first doing your own due diligence and research.

A “10% Trade” can be a safe way to boost your income on some of the best companies in the world.

[ad#Google Adsense 336×280-IA]As a refresher, a “10% Trade” is a conservative income-oriented trade that involves selling either a covered call or a cash-secured put on a reasonably-priced, high-quality dividend growth stock.

If you’re working with a high-quality dividend growth stock that you think is trading at a reasonable price, you may be looking at a low-risk opportunity to generate above average income.

Consider the “10% Trade” I just made with VF Corp. (VFC), a recent Dividend Growth Stock of the Month and one of the 29 stocks selected for Dave Van Knapp’s new dividend growth “ETF”…

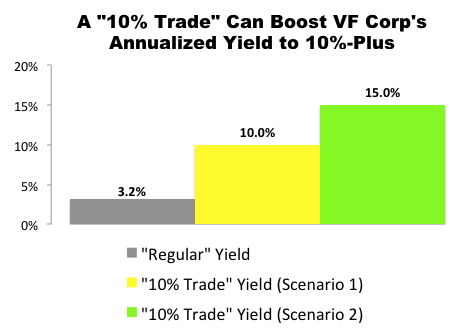

Opportunity to Capture a 10.0% to 15.0% Annualized Yield from VFC

On January 6, I bought 100 shares of VFC for $53.26 per share and simultaneously “sold to open” one August 18, $55.00 covered call for $3.36 per share.

With this in mind, there are likely two ways this trade will work out — and they both spell at least double-digit annualized yields on my purchase price…

Please note: To be conservative, I don’t include any dividends in my calculations for either of the following scenarios. I require “10% Trades” to generate at least 10% annualized yields from options premium and applicable capital gains alone. So any dividends collected are just “bonus” that will boost the overall annualized yields even further.

Scenario #1: VFC stays under $55 by August 18

If VFC stays under $55 by August 18, I’ll get to keep my 100 shares.

In the process I’ll also have received $336 in covered call income ($3.36 x 100 shares).

The covered call income — known as a “premium” in the options world — was collected instantly on Friday. It was deposited in the account where I made the trade, which is my 401(k) retirement account.

At the end of the day, if “Scenario 1” plays out I’ll be looking at $326.55 in profit after commissions and fees.

On a percentage basis, I received an instant 6.3% yield for selling the covered call ($3.36 / $53.26).

When I subtract out the commissions and fees I’m looking at a 6.1% yield in 7.5 months, which works out to a 10.0% annualized yield.

Scenario #2: VFC climbs over $55 by August 18

If VFC climbs over $55 by August 18 my 100 shares will get sold (“called away”) at $55 per share.

Like “Scenario 1”, I get to keep the $336 in covered call income ($3.36 x 100 shares)… and I’ll also realize a $174 capital gain ($1.74 X 100) since I bought shares at $53.26 and will be selling at $55.

In this scenario, after commissions and fees I’ll be looking at a $491.10 profit.

From a percentage standpoint, this “10% Trade” will deliver an instant 6.3% yield for selling the covered call ($3.36 / $53.26) and a 3.3% capital gain ($1.74 / $53.26).

After subtracting out the commissions and fees, I’m looking at a 9.2% total return in 7.5 months.

That works out to a 15.0% annualized yield from VFC. Not bad, considering the stock’s “regular” yield is 3.2%.

Greg Patrick

DailyTradeAlert.com

P.S. I realize the typical financial advisor may think it’s crazy to trade individual stocks in a retirement account… no matter how safe the stocks may appear. And in many cases they’re probably right — especially if you’re not properly diversified, you’re not mindful of your position sizing, and you’re heavily dependent on the income from this account. So I urge you not to blindly follow my lead today without first speaking to a professional advisor or doing your own due diligence and research. In addition, I’m not a tax advisor and I don’t claim to be… so please consult a professional for any tax related questions you have.

[ad#agora]