Nearly every week, I receive a request to analyze StoneMor Partners’ (NYSE: STON) dividend safety.

It’s not hard to see why the stock is popular with investors. It has a juicy 13% yield and is in a recession-proof industry: death.

StoneMor operates 317 cemeteries and 105 funeral homes in 28 states and Puerto Rico.

[ad#Google Adsense 336×280-IA]No one puts off dying until the economy gets better.

If you could, we’d have done away with term limits, and Jimmy Carter would still be president.

Let’s see if StoneMor’s distribution is as safe as demand for its services is.

The company is a master limited partnership, so it pays a distribution, not a dividend.

And investors own units, not shares.

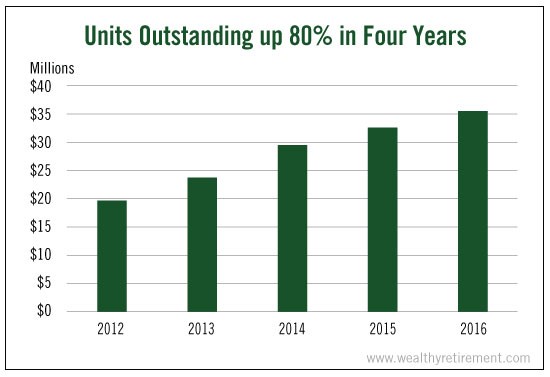

One problem is that any money the company earns is spread out among a rising number of units each year. The company routinely sells units to raise more capital.

In fact, since 2012, the number of units outstanding has nearly doubled.

Meanwhile, cash flow has steadily declined from more than $35 million in 2013 to just $4 million in 2015.

Meanwhile, cash flow has steadily declined from more than $35 million in 2013 to just $4 million in 2015.

The drop led to a distribution cut last quarter. After 10 years of annual increases, StoneMor slashed its distribution in half to $0.33 from $0.66 per unit.

In 2016, it’s estimated that the company will pay unitholders 106% of its cash available for distribution. That means for every $1 in cash flow it generates, it will pay investors $1.06.

Now, that is before the 50% cut to its distribution. So it should be lower and more sustainable going forward.

StoneMor has $314 million in debt. Compared to its assets, that’s not a big number.

But when a company isn’t making enough money to pay down its debt – and also pays a dividend or distribution – that’s a problem for shareholders.

The debt alone doesn’t put the dividend in jeopardy, but it adds to an already negative picture.

The debt alone doesn’t put the dividend in jeopardy, but it adds to an already negative picture.

Lastly, there have been questions about StoneMor’s accounting for years. In September, the company restated financial statements for 2013 through 2015 and the first two quarters of 2016.

This didn’t have a direct effect on its Safety Net rating, but it doesn’t inspire confidence either.

I wouldn’t call StoneMor Partners’ distribution “dead on arrival,” but another reduction is likely.

Dividend Safety Rating: F

Good investing,

Marc

[ad#sa-income]

Source: Wealthy Retirement