“Down 62% in Four Years… Now the Most Hated – Ever… And the Uptrend Has Begun!”

That was a headline in my latest True Wealth issue…

The story has all the ingredients I want to see for a great trade. It’s down 62%, making it super cheap. It’s the most hated it has ever been. And the uptrend is just getting started.

[ad#Google Adsense 336×280-IA]Since I wrote that, this trade has gone from “great” to “picture perfect” – as the uptrend is now clearly in place, confirming our idea.

I want to share the story with you, exactly as it appeared to my paid subscribers a couple of weeks ago…

Again, the setup is now perfect.

I urge you to read the story below and take advantage of it. Here it is…

Nobody’s talking about wheat…

And that’s exactly the way I like it.

Wheat has never been more hated than it is today… seriously.

My friend Jason Goepfert (of SentimenTrader) tracks investor sentiment better than anyone on the planet.

There has never been another day in history (going back a quarter-century) when wheat was more hated than it was at the beginning of this month. I love it.

One day, in August 1998, wheat was almost as hated as it is today… That’s the closest comparable point in history.

Just two months after that 1998 “hated” extreme, the price of wheat was up 20%. That is an extraordinary move in a commodity.

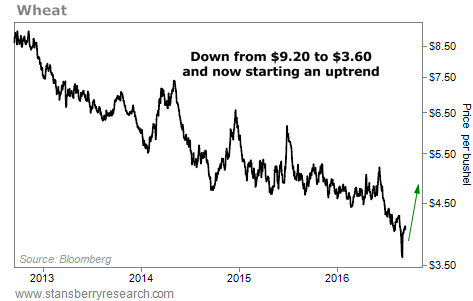

After hitting a hated extreme at the beginning of this month, wheat has been rocketing higher (following the 1998 example). Take a look…

It’s not just wheat… The chart for corn looks exactly the same.

It’s not just wheat… The chart for corn looks exactly the same.

Both of these grains are down 62% peak to trough over the last four years… But they have spiked powerfully from the bottom earlier this month.

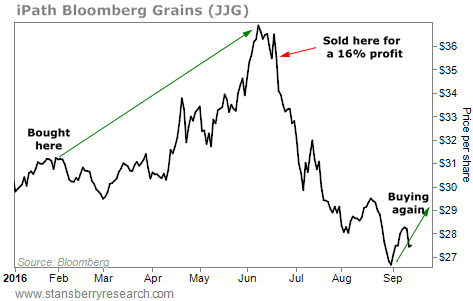

We have exactly what we want to see. Corn and wheat are cheap, hated, and likely starting uptrends. So it’s time to revisit an old friend… shares of the iPath Bloomberg Grains Subindex Total Return Fund (JJG).

The last time we put on this trade, we made 16% in five months, from January to June, as grains moved from hated to loved. Then we bailed.

Wheat, corn, and soybeans are the three grains that make up JJG. We have the setup we want to see.

Wheat, corn, and soybeans are the three grains that make up JJG. We have the setup we want to see.

We can set up a great reward-versus-risk trade here… As I write, JJG is trading not far from its recent closing low of $26.67. That’s only 2.7% away from its current price. We will set our stop loss there.

Our downside risk is only 2.7%. And our upside potential is 25% within 12 months. That’s an incredible reward-versus-risk setup – particularly when you consider that grains like wheat have literally never been more hated… I love it!

Buy the iPath Bloomberg Grains Subindex Total Return Fund (JJG) today. If JJG closes below $26.67, then sell the next day. Plan on being in this trade for 12 months or until we hit 25% gains, whichever comes first.

Remember, these numbers above are directly from my True Wealth newsletter from a couple of weeks ago. The important thing is that the principles are still the same today, and again, the setup is even better, as the strong new uptrend gives us more confidence in our idea. Take advantage of it with JJG!

Good investing,

Steve

[ad#stansberry-ps]

Source: Daily Wealth