If I could boil down everything I believe into one simple message… what would that message be?

I needed to come up with an answer to this…

Last week, I spoke with group of twentysomethings. These folks were right out of school for the most part.

They weren’t investing experts. I needed to get my message across – as simply and as clearly as possible.

[ad#Google Adsense 336×280-IA]”Let’s say you have $1 million,” I told them. “Now that you’ve made your million bucks, you want to retire. What are you going to do with your money so you don’t run out?”

The obvious answer would be to live off the interest… right?

If you could live off 5% interest per year, then you’d have $50,000 a year for the rest of your life, and you’d never cut into your $1 million.

“So far, so good,” they thought.

“The thing is, interest rates today are about zero percent. So let me ask you a simple math question… What is zero percent of $1 million?”

They all answered “zero,” of course – zero-percent interest on $1 million is nothing.

“OK, well what if you had more money saved? What if you had $10 million? What is zero percent of $10 million?”

Once again, they all answered “zero.” That’s when the light bulbs started going off in people’s heads…

In a zero-percent-interest world, you can’t live off interest. You have to do something with your money.

“That dilemma is what is driving nearly every investor on the planet today,” I explained to them. “With interest rates at record lows, retirees and investors realize they have to do SOMETHING ELSE with their money other than earn no interest on it.”

So… what are people doing with their money?

They are putting it into the stock market and real estate.

Global interest rates are near record lows. And that causes stock prices and house prices to keep hitting new highs.

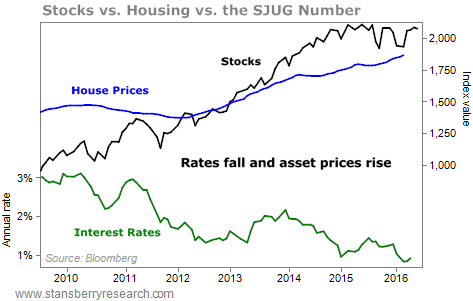

The simple chart below tells you everything you need to know…

Please, examine the chart and understand what it’s telling you. It is just about everything you need to know in finance right now.

Let me explain it for you:

Global interest rates are near record lows. This has caused house prices and stock prices to soar. (I define global interest rates as the average interest rate on 10-year government bonds in four major countries: the U.S., Germany, Japan, and the U.K.) Specifically:

- U.S. house prices are at their highest levels since the great housing bust. (This is the S&P/Case-Shiller National Home Price Index, times 10.)

- U.S. stock prices continue to push up against all-time highs. They are only about 2.5% below their all-time highs right now (as measured by the S&P 500 Index).

This story has been in place for a few years now… Can it possibly continue?

In short, yes…

We’ve had a number of good years in the stock market and the housing market recently. Because of this, most people think the good times have to end soon.

You have to keep the big picture in mind, though…

Retirees and investors everywhere are coming to the realization that you can’t live on zero-percent interest. You have to do something with your money.

The lightbulb is going off in people’s heads these days – out of necessity. People are putting money to work in the stock market and the real estate market, whether it’s the right thing for them or not.

As long as global interest rates remain low, I expect that this will continue.

I could be wrong, of course. You’d be surprised at how high I think things could go… I expect house prices and stock prices will rise to unimaginable heights before it’s all over.

I think that’s the natural outcome of our zero-percent world. Take advantage of it…

Good investing,

Steve

[ad#stansberry-ps]

Source: Daily Wealth