It happens like clockwork.

Sooner or later, portfolios that are 100% allocated to stocks experience reductions in value of 50% or more. Even when I’ve told subscribers (correctly) that a downturn was about to happen again, most people have tended to ignore these warnings, believing they are “buy and hold” investors who can handle the storm.

But they can’t. I know that 90% or more of people who claim to be buy-and-hold investors are really “buy and fold” investors. Sooner or later, things will get bad enough to make them sell.

[ad#Google Adsense 336×280-IA]Yesterday, we discussed how adding gold into your portfolio allocation can ensure that this never, ever happens to you… while increasing your average returns.

Today, I’ll describe exactly how you can use gold to maximize your returns and reduce drawdowns by more than 50%…

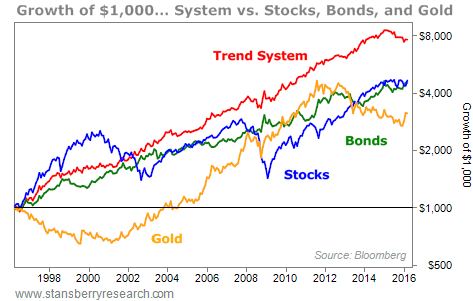

As I said yesterday – and as Steve explained in the April [6] DailyWealth – we tested a basic, “dumb” trend-following strategy in which investors bought each asset only when it was in an uptrend.

And we found that stocks and gold on their own are extremely volatile.

They suffer from major drawdowns and, often, disappointing returns.

But simply adding gold to the typical stock/bond allocation model and using a basic, “dumb” trend-following strategy had a profound effect.

The stocks/bonds/gold portfolio produced 13.1% annual returns for the period – better than almost any mutual fund or hedge fund – while having little volatility. The maximum drawdown in our model was a little greater than 20% – a level of volatility almost any investor can withstand…

And remember, this basic model doesn’t include any of the advantages of investing in gold stocks. During a bull market in gold, certain gold stocks will move as much as 50 times more than the price of gold. Sure, these stocks are insanely volatile. You wouldn’t want to allocate a lot of your portfolio to them. But they are a fantastic way to build wealth if you buy at the right times… and in the right ways.

And remember, this basic model doesn’t include any of the advantages of investing in gold stocks. During a bull market in gold, certain gold stocks will move as much as 50 times more than the price of gold. Sure, these stocks are insanely volatile. You wouldn’t want to allocate a lot of your portfolio to them. But they are a fantastic way to build wealth if you buy at the right times… and in the right ways.

Bought at the right time, adding a gold allocation (both bullion and gold stocks) can probably double your average portfolio returns, while reducing the volatility and the size of the drawdowns in your portfolio. If that doesn’t get you interested in gold, you’re ignoring what could be your single greatest advantage as an investor.

But… even if all you ever do is simply buy bullion or a gold exchange-traded fund… I’m 100% certain you’ll increase your total returns and reduce risk from your portfolio if you add gold to your allocation mix and buy it at the right times. The key thing to remember is that gold goes up the most when stocks and bonds are going down.

If you think, like I do, that stocks are generally pretty expensive after a huge six-year bull market and bonds are insanely expensive (who wants to lend money to bankrupt governments for 10 years and earn nothing?)… then it’s not hard to figure out that gold is likely to be the best-performing asset this year… and maybe for longer.

Here’s another timing model I think is useful. Gold tends to follow big rallies in stocks. Why? Well, I believe that monetary inflation tends to drive equity valuation. As credit availability increases and interest rates fall, investors are more and more willing to pay up for growth stocks and “momentum” plays.

Sooner or later, though, the inflationary nature of these trends is exposed. Investors, fearing the loss of purchasing power then, eventually flee to gold. Think about the big run up in stocks from 1996 to 2000… and then the huge move in gold that followed from 2001 through 2008. Or think about the big move in stocks from 2002 through 2008… and the big move in gold that followed from 2009 through 2011. Today, we’ve seen another five- or six-year move higher in stocks… and now I believe we’ll see gold follow.

Sometimes gold does much better than stocks. And sometimes stocks do much better than gold. But these trends don’t last long… and they tend to reverse dramatically.

We’re now coming off a period (2011-2015) where stocks did much better than gold. I suspect the opposite will be true for the next couple of years at least.

Regards,

Porter Stansberry

[ad#stansberry-ps]

Source: Daily Wealth