If you’re watching tech stocks grind higher every day, you’ve probably been just a little tempted to jump in.

… or should you wait? After all, the high-flying tech space—particularly fan faves like Facebook (FB), Apple (AAPL), Amazon (AMZN) and Google (GOOGL), a.k.a. Alphabet—has to pull back sometime, right?

The short answer is yes, there are plenty more gains ahead for tech—especially if you’re investing over the long haul—making now a great time to buy.

A 9% Dividend From Google (for real)

But we’re not going to “buy direct” and hope for more upside, like your S&P 500-focused friends are likely doing.

Instead we’re going to sign up for nearly 9% in cash upfront, through two little-known tech funds that both pay massive dividends today.

And while we’re enjoying those sturdy payouts, we’ll be lined up for big gains as FAANG roars higher.

We’ll do it through two closed-end funds (CEFs) that invest in every FAANG stock.

These two funds have fallen under the radar, but their big tech holdings (and one particularly crafty management team) are what’s driving those massive 8.8% dividends.

Let’s move on to our first FAANG income play now.

FAANG Dividend Pick No. 1

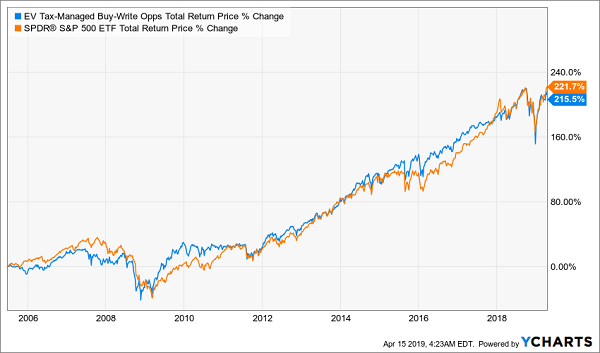

Our first CEF is the Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV), whose 8.8% yield is just part of the story. ETV has pretty much matched the S&P 500’s return since its inception, but thanks to its massive dividend (which crushes the pathetic 1.8% yield on the average S&P 500 stock), investors got a big slice of this profit in cash:

Pacing the Market, Paying in Cash

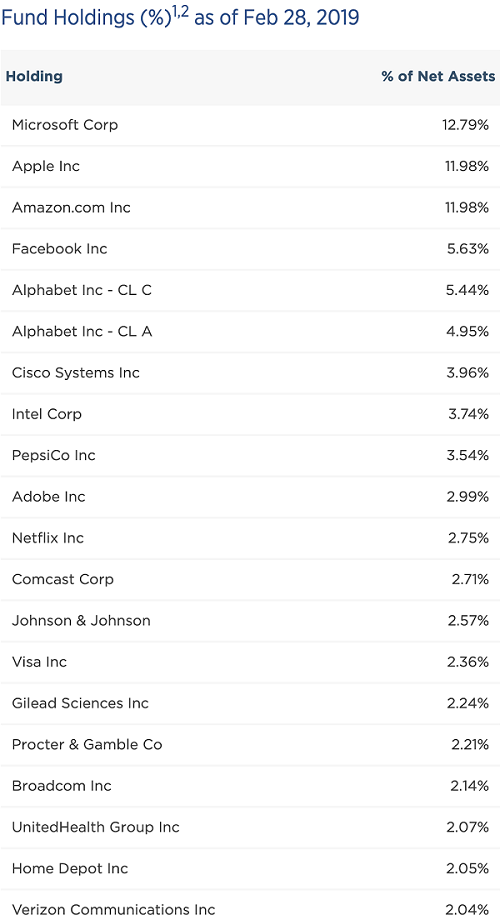

ETV doesn’t depend just on FAANG to fund its payouts, though. Its tech-heavy portfolio also has some healthcare and big-cap consumer names to add some diversification:

ETV doesn’t depend just on FAANG to fund its payouts, though. Its tech-heavy portfolio also has some healthcare and big-cap consumer names to add some diversification:

Source: Eaton Vance

Source: Eaton Vance

Here’s another plus of investing in ETV: the fund’s management sells call options on the portfolio, which both generates extra income for investors (fueling that big payout) and delivers some downside protection for the share price. The fund’s long-term track record—matching the market while fending off downturn after downturn—proves it.

Because of ETV’s strong track record, the fund typically trades at a premium to net asset value (NAV, or the value of its portfolio), and its premium has been climbing higher recently as more and more investors buy into this high-yielding tech fund.

FAANG Dividend Pick No. 2

Our other fund with FAANG holdings is the Eaton Vance Tax-Managed Buy-Write Strategy Fund (EXD), which also yields 8.8% and has a very similar portfolio—but it’s much more focused on FAANG:

Source: Eaton Vance

Source: Eaton Vance

With EXD, you’re getting 42.7% of the fund in FAANG stocks, making it a more confident bet on FAANG’s future. Plus, EXD is trading at a 7.3% discount to NAV, which makes this fund an incredible steal—you can actually get FAANG stocks for less than you’d get if you bought them outright on the market.

Market Ignores This Massive Shift—for Now

There’s a reason for that discount, though—EXD doesn’t have much of a track record. While its long-term return is a pitiful 9% total since its 2010 inception, that doesn’t bother me. EXD has two new managers, Michael Allison and Thomas Seto, who just took up the reins this year. They have aggressively changed the fund’s portfolio and are clearly looking to revamp the fund after years of crummy underperformance.

EXD’s past has nothing to do with its future, and that’s something investors aren’t paying enough attention to.

In February, Eaton Vance announced that the fund will invest in S&P 500 and Nasdaq 100 stocks as management sees appropriate. This is a complete change from its former focus on short-term bonds, which the fund has completely abandoned as a strategy.

If you still aren’t sure, this should clinch it: Allison and Seto are the fund managers who have been managing ETV for years, giving it the big income stream and market-matching returns we just looked at above. It’s only a matter of time before they work the same dividend magic on EXD.

— Michael Foster

Beyond FAANG: My Top 4 CEFs for 2019 (8% Dividends, 20%+ Gains) [sponsor]

When you buy 4 other massive CEF dividends I’m pounding the table on now, you get an unbeatable dividend “triple play”:

- Cash dividends up to 8.4%, paid monthly! And that’s just the start, because you’re also primed for …

- Fast double-digit upside: Each of these 4 funds trades at an incredible discount to NAV, setting them up for 20%+ price upside in the next 12 months!

- Dividend growth! The payouts on each of these 7.5%+ payers are growing like weeds. That’s right: management is begging us to take cash off their hands! In fact, they’re forcing us to, through their sky-yields and regular dividend growth.

I’m one of a handful of analysts in the world devoted 100% to high-yield CEFs. I’ve spent hours sifting and analyzing to come up with these 4 “best of breed” funds—which span the entire market, not just tech—and I can tell you this:

If you want to protect and grow your nest egg—no matter what happens in the market—you need to buy these 4 funds now.

Don’t miss out! As with pretty well every stock these days, these 4 funds have seen their discounts chipped away in the latest upswing. If you want to lock in the biggest gains to go along with your huge monthly dividends, then the time to buy is now.

Click here now and I’ll give you everything you need to know about these 4 cash-spinning CEFs: names, ticker symbols, buy-under prices and my complete research, so you can kick-start your own reliable 8%+ income stream today.

Source: Contrarian Outlook