Dominion Energy (D) and its predecessors have delivered energy since 1898. Today the company is one of America’s largest diversified utilities with a customer base of 7.5 million gas and electric customers in 18 states.

In recent years Dominion has grown through various acquisitions including its 2016 purchase of Questar (natural gas distributor) for $5.9 billion and its $14.6 billion acquisition of SCANA (regulated gas and electric utility in South Carolina) which closed in January 2019. The firm also completed the roll-up of its midstream MLP, Dominion Midstream Partners, in January 2019.

The company’s earnings are diversified by both region and business focus:

- Regulated electricity: 55% of earnings

- Regulated gas: 38% of earnings

- Merchant power (including renewables): 7% of earnings

Over 90% of Dominion’s overall sales are from its regulated operations, with the rest mostly coming from long-term power purchase agreements with investment grade utilities. In other words, Dominion’s revenue, earnings, and cash flow are quite stable.

As a result, Dominion has managed to pay uninterrupted dividends for nearly 90 consecutive years while increasing its payout for 16 consecutive years.

Business Analysis

For over 120 years, Dominion has reliably and affordably generated and delivered energy for its customers. The utility’s durability has been driven by management’s disciplined and conservative approach to investing capital, which has resulted in predictable regulated activities driving almost all of the company’s business.

Regulated utilities are essentially government regulated monopolies.

Building and maintaining power plants, transmission lines, and distribution networks typically costs billions of dollars to cover a particular region.

Since the number of customers in a service territory is only so big and often grows slowly, it is usually uneconomical to have more than one utility supplier.

Competition is further limited by state utility commissions, which have varying degrees of power over the companies allowed to construct generating facilities.

Despite the monopoly status of most regulated utilities, their profit potential is limited because state commissions control the price they can charge for their services.

This is done to keep prices reasonable for consumers while providing utility companies with enough of an incentive to earn a reasonable return on their investments made to provide safe and reliable service.

As a result, it’s very important to analyze the geographic regions that a utility company operates in. Some states have more favorable demographics and regulatory bodies than others.

For example, Dominion’s Virginia Electric and Power Company, which accounts for around 40% of profits, benefits from a friendly regulatory environment in its core Virginia and North Carolina electric markets. Relatively fast population and business growth rates in these states causes regulators to want to incentive expanded infrastructure spending through higher-than-average allowed returns on capital (above 10%), as well as increasing electric rates over time.

Similarly, in Dominion’s new market of South Carolina, SCANA’s regulated gas and electric operations enjoy a 10.25% allowed return on equity and 1.5% to 3% annual customer growth. For context, the average integrated electric utility enjoys a return on equity authorized of about 9.7%, according to S&P Global Market Intelligence. Simply put, many of Dominion’s regulated operations enjoy above-average profitability and business climates.

Besides operating in generally attractive regions characterized by constructive regulatory relationships, Dominion has made significant efforts to branch out into faster-growing businesses, including natural gas distribution.

Dominion’s 2016 acquisition of Questar, a Rockies-based integrated natural gas distributor, is a primary example. Questar’s utility residential rates run about 20% below the U.S. average, demonstrating its efficient operations, and the combination significantly expanded Dominion’s presence out west.

Essentially, the deal gave Dominion better balance between its electric and gas operations while also improving the company’s scale and diversification by geography and regulatory jurisdiction.

Since then the company has made big investments in midstream (gas transportation) infrastructure including the $4 billion Cove Point liquified natural gas export terminal which it completed in 2018. With all of its capacity already contracted out under 20-year deals with two major global utilities (one in Japan and one in India), Cove Point should supply Dominion with many years of predictable cash flow with no volume risk.

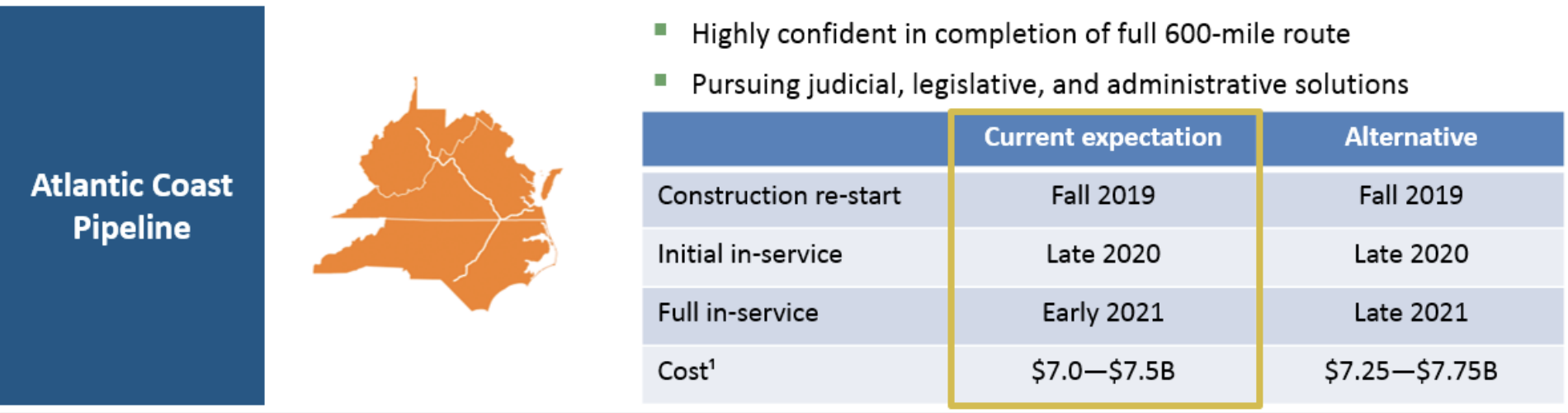

The company’s other major midstream project is the Atlantic Coast Pipeline, which is expected to go in service in late 2020. This $7.25 billion gas pipeline (which Dominion owns 48% of and will operate) connects the Marcellus shale formation of West Virginia to end customers in Virginia and North Carolina. Like Cove Point, it’s capacity is under 20-year fixed-rate contracts with investment-grade utilities, ensuring stable and commodity insensitive cash flow for years to come.

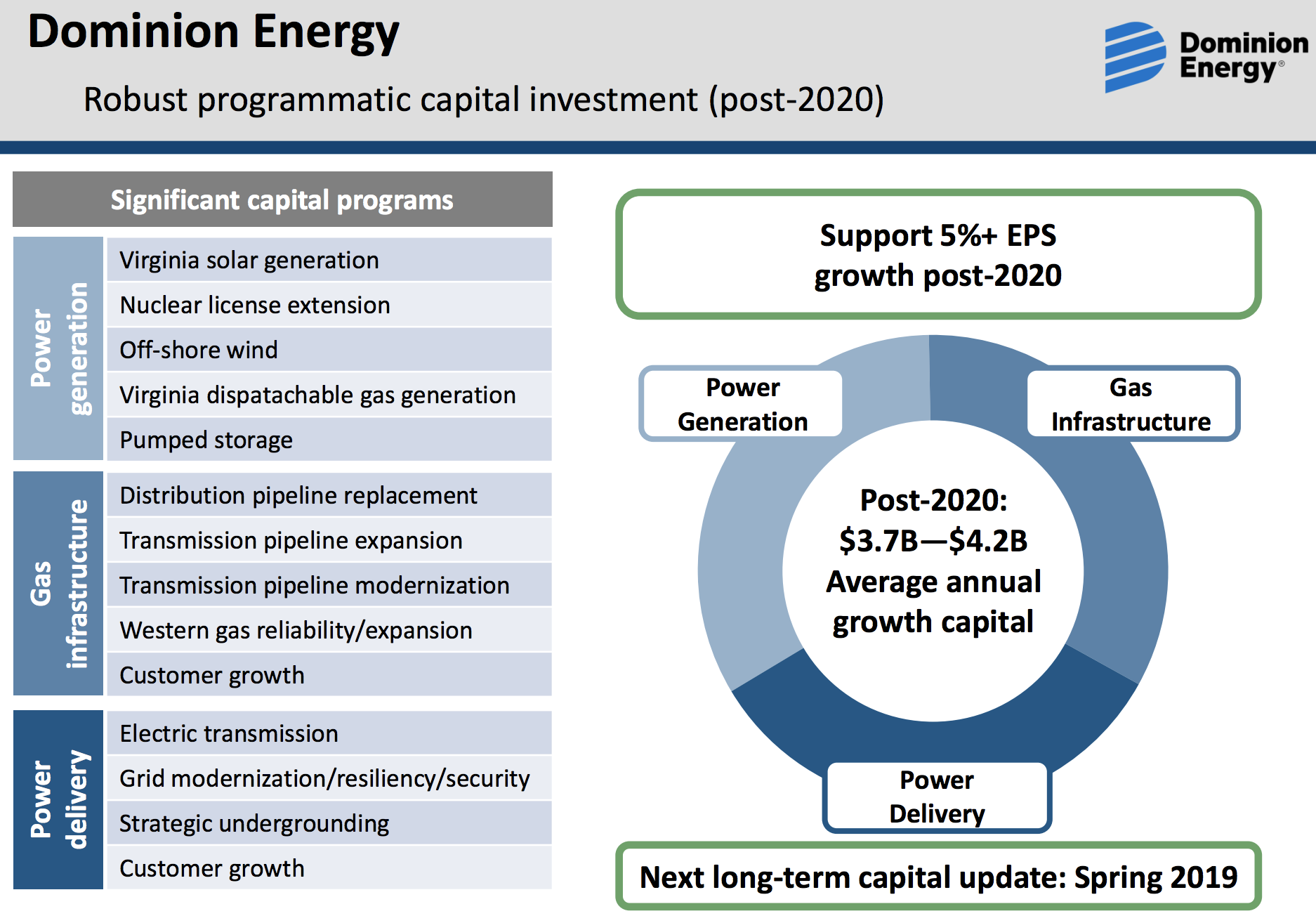

Like all utilities, Dominion’s long-term growth plan also relies on expanding its rate base (regulated assets on which it earns an approved return on equity). Management expects the firm’s growth capital expenditures to increase 6% per year from 2019 through 2021, helping drive about 5% growth in adjusted EPS in 2019 and 2020.

The firm’s projects are nicely diversified and include everything from expanding its renewables portfolio to replacing gas distribution pipes and carrying out electric transmission work. Combined with the SCANA deal finally closing and ongoing midstream investment opportunities, beyond 2020 management expects Dominion to deliver at least 5% adjusted EPS growth over the long term.

Dominion can fund these growth projects with little risk thanks to its healthy liquidity (over $5 billion available under its revolving credit lines) and strong balance sheet which enjoys a BBB+ investment grade credit rating from S&P.

Management plans to further strengthen Dominion’s financial position in the future as well. Specifically, Dominion’s dividend growth rate is expected to slow, reducing the company’s payout ratio over time to allow the firm to fund more of its projects with retained cash flow (rather than issuing debt and equity).

Overall, Dominion’s strong base of regulated assets, disciplined management team, industry-leading profitability, attractive portfolio of growth projects, lengthy history of paying dependable dividends, and exposure to favorable secular themes (cleaner energy, low-cost gas, renewables) make it one of the more appealing utilities in the sector.

With that said, Dominion still faces some important challenges and risks that will likely mean far slower dividend growth than the 10% annual payout hikes investors have enjoyed in the past few years.

Key Risks

There are several risks to be aware of with Dominion Energy.

First, while the company’s cash flow is highly stable, changes in the weather and power prices can affect short-term results. Milder weather can reduce demand for electricity and gas services, for example, and Dominion’s merchant power business can face challenging market conditions from time to time.

None of these issues seem like risks to Dominion’s long-term earnings power, and fortunately, the growth initiatives coming online over the coming years should drive the company’s profits higher.

More importantly, like every other utility, Dominion also faces execution and regulatory risks from its major growth projects. The company has proven to be a quality operator over the years, but regulators are political appointees, and future rate cases (where new allowed returns on equity are set) could result in lower rates than Dominion has enjoyed in the past.

This is especially true in South Carolina, where controversy continues over the VC Summer nuclear project which ended up about $13 billion over budget and was canceled after it was 33% completed. That led to higher electric rates for SCANA customers, which the Dominion buyout has now partially undone, but also led to an epic legal battle with the state’s legislature, governor, and regulators, who threatened to kill the acquisition for much of 2018.

Residual animosity over the nuclear debacle could result in lower allowed returns for Dominion’s new South Carolina regulated assets in the future. For now, management deserves the benefit of the doubt.

But regulatory risk is not only found in Dominion’s core electric business. In the fast-growing midstream segment, the company also faces numerous challenges. The Atlantic Coast Pipeline has faced several lawsuits from environmentalists that caused the multibillion-dollar project to become delayed by at least nine months and increased its cost by $500 million.

While the company is confident it will eventually complete its most important midstream growth project, it’s possible that Dominion will need to adopt an alternative pipeline route that could delay the project further (a total of two years) and increase its ultimate cost by as much as $1.25 billion.

Management and analysts agree that this project is likely to eventually get built, but the point is that major midstream projects, especially long interstate pipelines, face meaningful execution and regulatory risks that could cause these opportunities to fall short of management’s long-term growth expectations.

Finally, income growth investors need to understand that Dominion’s dividend growth rate is going to slow significantly in the coming years due to management’s deleveraging plans.

Here’s what Dominion’s CEO Thomas Farrell told analysts on the firm’s fourth-quarter 2018 conference call:

“We recognized that it (dividend growth) is not going to be 10% in 2020, highly unlikely. And over time, we will bring the dividend growth rate, not going to be a cut in our dividend, that’s not even in contemplations, the notions will bring our growth rate of our dividends more in line with our peers after this year.”

Dominion’s previous payout growth guidance was for 10% dividend growth through 2020, but that was later revised down to 10% through 2019 (which it delivered on) and 6% to 10% growth in 2020 depending on whether or not it had to absorb its MLP.

The above quote indicates that for 2020 income investors are unlikely to see even the lower end of the firm’s earlier guidance, because according to Dominion’s CFO:

“We will talk about that at the end of March. But we will be setting the dividend growth rate to reach a target payout ratio that’s more in line with peers.”

Most regulated utilities target a 65% to 75% payout ratio, and based on 2019 guidance Dominion’s adjusted EPS payout ratio will be about 87% (thanks to the final 10% dividend hike it announced in December 2018).

Most utilities grow their dividends at 2% to 4% per year, which is probably what investors should expect from Dominion going forward given management’s most recent capital allocation statements.

How long Dominion’s dividend will grow slower than its earnings will depend on management’s long-term payout ratio target, which the firm might disclose at its March 25, 2019 annual investor meeting.

Once the company achieves its payout ratio target, then investors can likely expect dividend growth to increase to the same rate as earnings growth (about 5% per year). For a predictable regulated utility that’s not bad, even if it’s about half the rate of dividend growth shareholders have enjoyed in recent years.

As conservative income investors will appreciate, the upside to slower dividend growth will be an even stronger balance sheet thanks to lower leverage. The utility’s lower payout ratio will make for an even safer dividend as well, further improving Dominion’s chances of becoming a dividend aristocrat in 2028.

Closing Thoughts on Dominion Energy

Thanks to its regulated business model and management’s conservative capital allocation, Dominion Energy has long been a source of safe and growing dividends. Combined with strategic acquisitions and diversification into the midstream industry, the company has delivered some of the best earnings and dividend growth rates of any regulated utility.

Going forward, Dominion’s much larger asset base (thanks to the SCANA deal closing) seems likely to allow the firm to deliver mid-single-digit earnings growth, and eventually dividend growth along those lines.

However, for the next few years management has said it will grow the dividend at a much slower pace than in recent years (most likely 2% to 4%) in order to strengthen the balance sheet, lower the payout ratio, and make the dividend even safer.

While Dominion remains a solid high-yield choice for conservative investors, just keep in mind that the days of 10% dividend growth are likely permanently behind it.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends