Debt is a four-letter word – literally and figuratively.

Debt is figuratively akin to your typical “four-letter” word. It’s rightly a curse word when used to purchase consumable items.

To incur debt to pay for a trip to Tahiti, a dinner at a Michelin-star restaurant, a bottle of Château Cheval Blanc is to hock the future for the present. That’s inevitably a curse.

But debt need not be akin to your typical “four-letter” word. Debt incurred to purchase an appreciating asset or a promising investment can be a financial blessing.

Astute businessmen use debt in its non-cursing derivation. They use debt — cheap debt, in particular — to boost investment returns.

We can agree that Warren Buffett and Jeff Bezos are astute businessmen.

Each has loaded his respective company with cheap debt to boost investment returns.

Bezos’ company, Amazon.com (NASDAQ: AMZN), has tripled its debt load to $24 billion over the past three years. Bezos is hardly improvident. Amazon.com can borrow long-term at 2.5%. Its returns on invested capital exceeds 25%. We see a similar dynamic at work at Buffett’s Berkshire Hathaway (NYSE: BRK.b).

You can employ a similar strategy to boost returns on your investment portfolio. Cheap debt can be used to boost returns on your investment portfolio.

I’ll demonstrate by way of example.

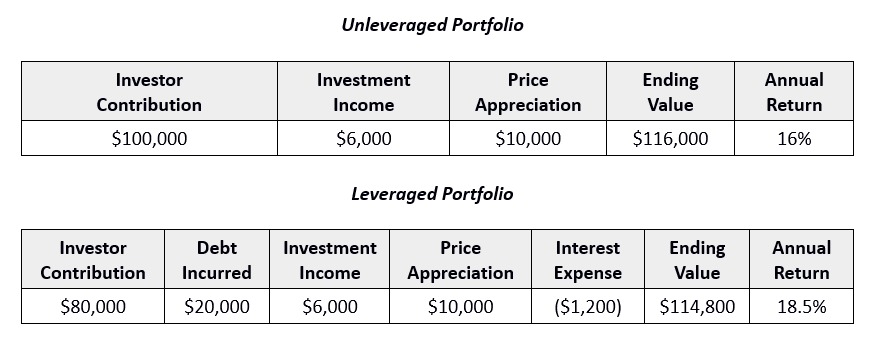

We have two $100,000 investment portfolios. Both generate $6,000 in investment income; both appreciate 10% annually. One is unleveraged. The other is leveraged 20% with debt priced at an annual interest rate of 6%.

The tables below show the ending value and investment return of both portfolios after one year.

Leverage enables you to increase the return on your investment — specifically, your contribution.

Had you contributed the full $100,000 to your investment portfolio, you would have generated a 16% return. By contributing only 80% and borrowing the other 20% to invest the same $100,000, you would have generated an 18.5% return on your contribution ($14,800 divided by $80,000).

But let’s not infer we’ve stumbled upon a unicorn — the free lunch.

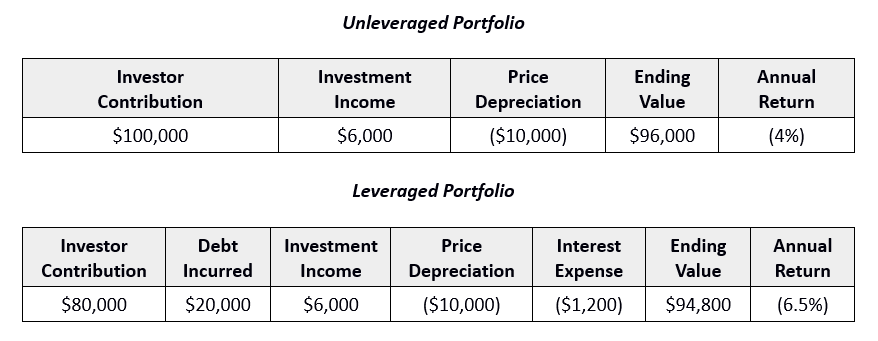

Leverage is a double-edged sword. I’ll use the same information as above, except this time the portfolio depreciates 10%.

The unleveraged portfolio experienced a 4% negative return on a 10% drop. The leveraged portfolio experienced a 6.5% negative return.

A couple of points are worth highlighting.

In both examples – positive and negative return – the return centers on the investor contribution. In the unleveraged portfolio that’s $100,000; in the leveraged portfolio that’s $80,000. Gains and losses are always centered on the investor’s contribution (the equity). The debt always remains the same.

Leverage, then, is more attractive to investors with a higher risk profile. Returns will be amplified in both directions where debt is involved.

Keep in mind, too, that the interest rate on margin debt is variable rate. The rate will rise and fall. This is something to consider with the Federal Reserve continually raising interest rates.

Fortunately, the risk can be mitigated.

A diversified portfolio is a primary mitigating factor. A diversified portfolio is less volatile than a single stock. A diversified investment portfolio will trend higher over time. Therefore, debt can be a powerful tool for increasing investment returns over the long haul.

If you’ve never used leverage here are a couple of caveats worth considering: Keep leverage to under 20% of total portfolio value (under 10% if you’re a beginner). Leverage only a diversified portfolio – one composed of stocks, bonds, and other assets.

A leveraged portfolio isn’t for everyone, but if you can stomach the increased risk, your discomfort will be likely rewarded with higher investment returns over time.

Buffett et al. know this. Now you know it, too.

— Steve Mauzy

Source: Wyatt Investment Research