No one’s talking about it yet, but one of the rules in the Republicans’ tax reform proposal could have a profound effect on companies’ bottom lines, cash flows and ability to pay dividends.

If the tax package goes through with the rule intact, dividend investors may see a nice bump in their payouts.

[ad#Google Adsense 336×280-IA]Let me explain…

Under the new policy, capital expenditures (capex) would be counted as an expense. Currently, they’re not. Here’s why it’s important…

Capex is money spent buying or maintaining land, buildings and other fixed assets.

Currently, it’s a cost that can’t be deducted from revenue as an expense.

So expanding a manufacturing plant is not considered an expense, but paper for the office printer is.

If capex becomes allowable as an expense, it will lower earnings and the taxes companies pay on those earnings. But it will increase their cash flows.

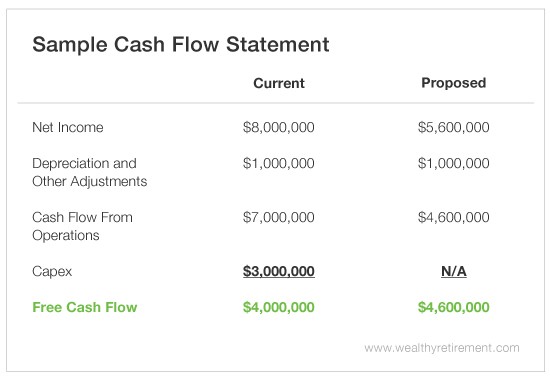

Here’s a sample income statement. It outlines the way the rules stand now versus how they would change if the treatment of capex changes.

For the tax rate, I used the proposed 20% rate in both examples to keep it simple.

You can see that, as a result of including capex, net income (or earnings) was reduced from $8 million to $5.6 million. Taxes were reduced by 30%, or $600,000.

But now look at what happens to cash flow…

You can see here that the company generated $600,000 more in free cash flow thanks to the tax savings of an extra expense (capex) subtracted from revenue.

The $3 million in capex still went out the door. But when it’s accounted for on an income statement, a company pays less in taxes, which means it keeps more cash.

This rule could reduce corporate profits as the new expense hits a company’s income statement. But remember, it’s money the company was spending anyway. It was just being accounted for differently.

Now, because the company is paying less in taxes, cash flow increases.

This example assumes the tax rate was 20% in both circumstances. In reality, the average company pays 25.9%.

So companies could also see benefits from reduced taxes both in their earnings and cash flows.

If companies have more cash flow, they can return more cash to investors in dividends.

For example, Myers Industries (NYSE: MYE) posted $16.2 million in operating income last year. It paid $6.5 million in taxes, or 40%.

If it had been allowed to expense its $12.5 million in capex, Myers’ taxes would have been reduced to $1.5 million (assuming the same 40% tax rate).

That $5 million savings would have been extra free cash flow that could be used to raise the dividend or buy back shares. It’s a meaningful number, as free cash flow was $21.2 million – so a $5 million boost would have lifted free cash flow 24%.

This is an important rule to keep an eye on. Extra cash flow should mean more dividends in the future.

I’ll keep you posted as this situation develops.

Good investing,

Marc

[ad#wyatt-income]

Source: Wealthy Retirement