We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Osisko Development Corp. (NYSE: ODV)

Today’s penny stock pick is the junior gold developer, Osisko Development Corp. (NYSE: ODV).

Osisko Development Corp. acquires, explores, and develops precious metals resource properties in Canada, Mexico, and the United States. The company explores for precious and base metal, gold, silver, copper, lead, and zinc deposits. Its flagship asset is the 100% owned Cariboo Gold Project, which covers an area of approximately 192,000 hectares consisting of 443 mineral titles located in British Columbia, Canada. The company also holds a portfolio of marketable securities.

Website: https://osiskodev.com/

Latest 10-K report: https://www.sec.gov/Archives/edgar/data/1431852/000155837025004047/odv-20241231x40f.htm

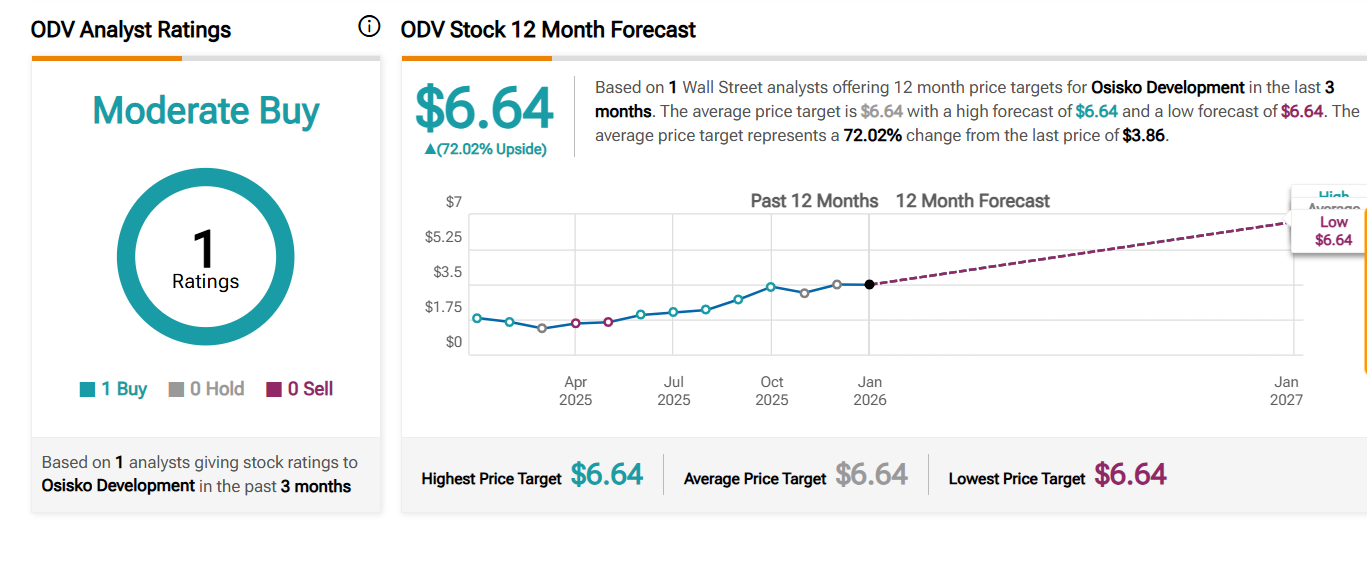

Analyst Consensus: As per TipRanks Analytics, based on 1 Wall Street analyst offering 12-month price targets for ODV in the last 3 months, the stock has an average price target of $6.64, which is nearly 72% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The record highs (~$5,200/oz) of gold prices, the 2.07 million ounces of probable reserves at Cariboo, are becoming exponentially more valuable in the company’s net asset value (NAV) calculations.

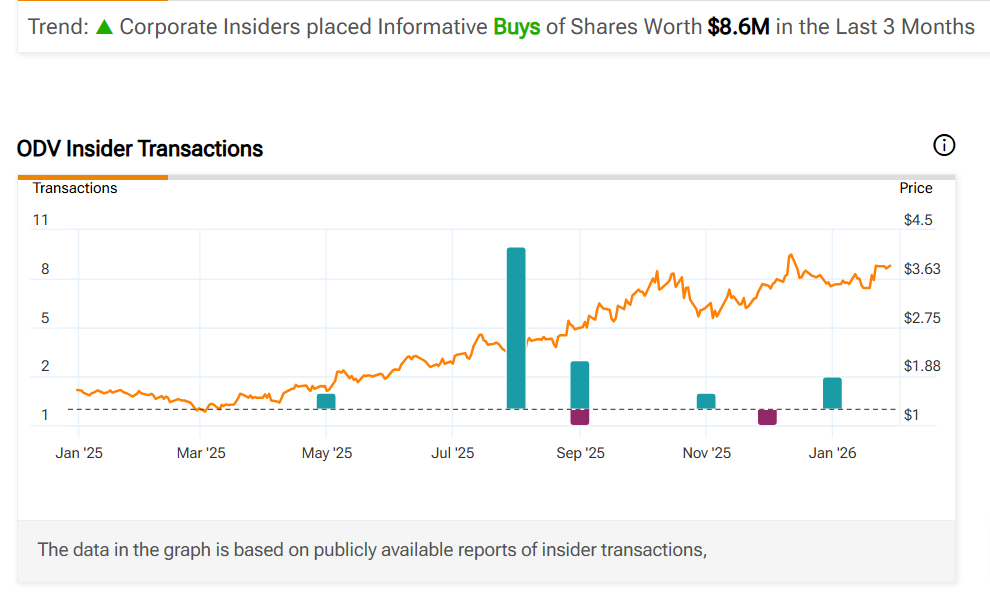

- Corporate Insiders placed Informative Buys of Shares Worth $8.6M in the Last 3 Months.

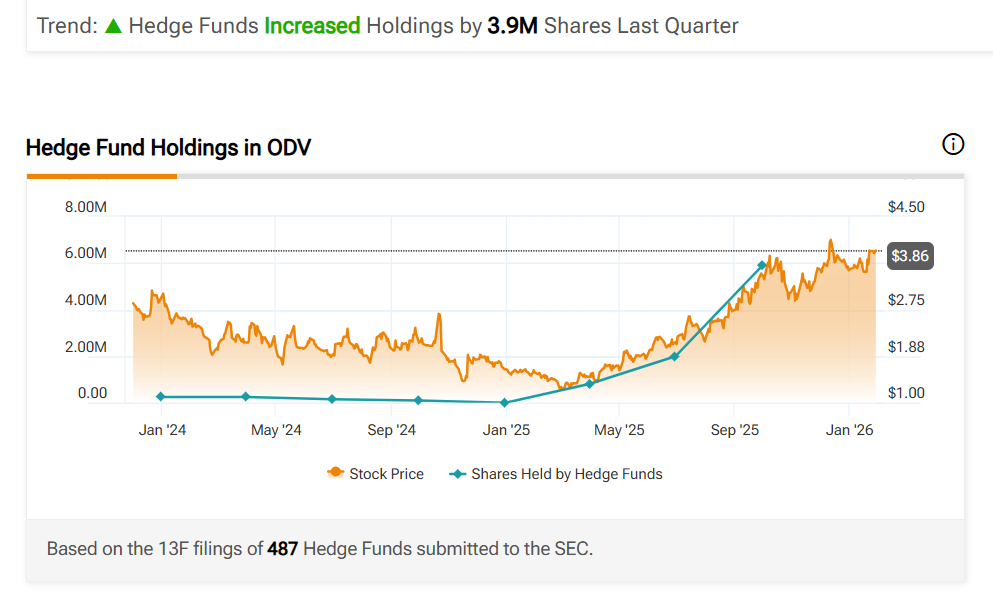

- Hedge Funds Increased Holdings by 3.9M Shares Last Quarter.

- Through a US$450 million project loan facility secured from new strategic partner Appian Capital Advisory, ODV has cleared the “funding gap” that plagues junior miners. They have the cash to reach the “first gold pour” at Cariboo.

- On January 27, 2026, ODV completed the sale of the San Antonio Gold Project in Mexico. This cleans up the company’s balance sheet, allowing management to focus 100% on their Tier-1 assets in British Columbia and Utah.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern: The daily chart shows that the stock has currently formed a symmetrical triangle pattern, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 200-week SMA, indicating that the bulls are gaining control.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for ODV is above the price of $3.95.

Target Prices: Our first target is $5.00. If it closes above that level, the second target price is $6.00.

Stop Loss: To limit risk, place a stop loss at $3.30. Note that the stop loss is on a closing basis.

Our target potential upside is 43% to 90%.

For a risk of $0.65, our first target reward is $1.05 and the second target reward is $2.05. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

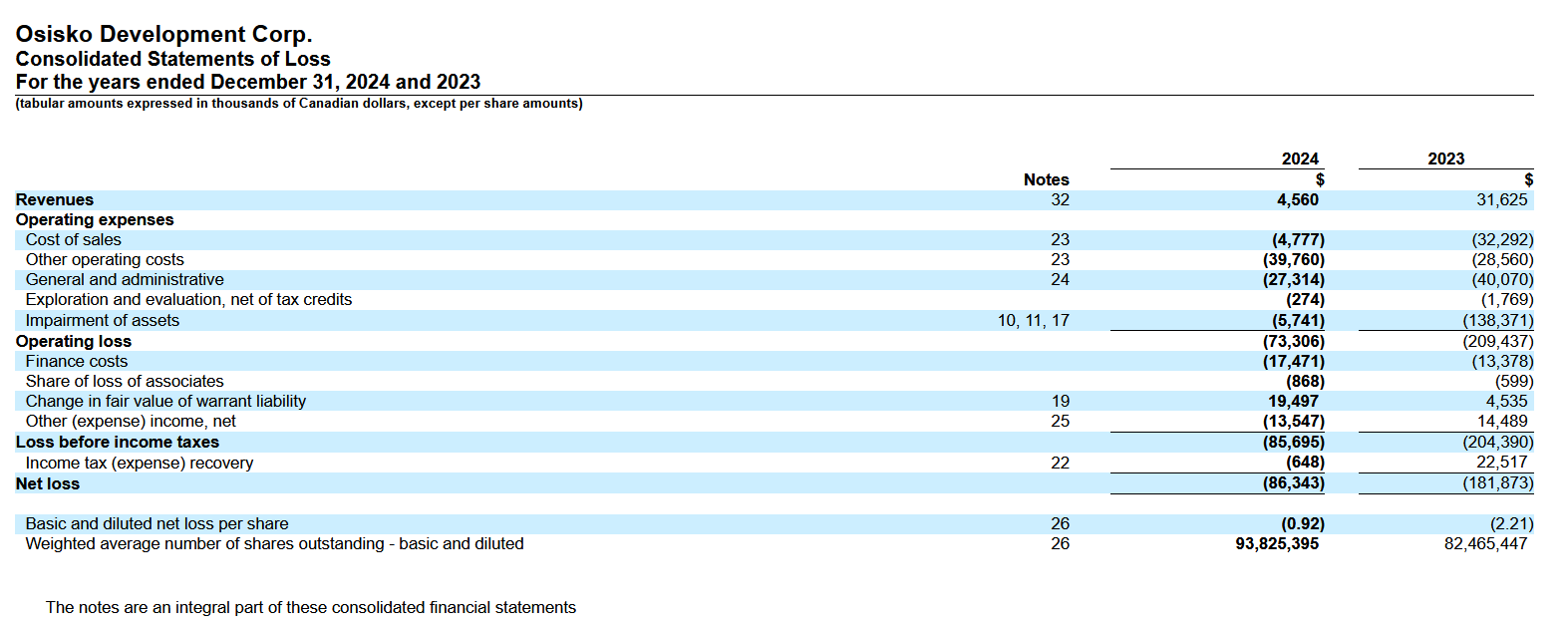

- The company has a history of net losses.

- The recent contractor fatality at CGP (Jan. 22, 2026) could lead to regulatory scrutiny, delays, or reputational harm.

- The company’s massive US$125 million “bought deal” financing on January 26, 2026, has offering price of $3.54 which is below market value. This has created a near-term price ceiling as new shares hit the market.

- Certain operations of the Corporation, including the test mining at Bonanza Ledge II Project and the Tintic Project, have been operated without the benefit of a feasibility study including mineral reserves, demonstrating economic and technical viability, and, as a result, there may be increased uncertainty of achieving any particular level of recovery of material or the cost of such recovery.

- Certain directors and officers of the Corporation also serve as directors and officers of other companies involved in natural resource exploration and development. Consequently, there is a possibility that such directors and officers will be in a position of conflict of interest.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day