Our Penny Stock of the Day ideas are geared towards traders with an extremely high risk appetite.

The candidate is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Oramed Pharmaceuticals Inc. (NASDAQ: ORMP)

Today’s penny stock pick is the diversified healthcare company, Oramed Pharmaceuticals Inc. (NASDAQ: ORMP).

Oramed Pharmaceuticals Inc. engages in the research and development of pharmaceutical solutions with a technology platform for the oral delivery of therapeutic proteins. It develops ORMD-0801, an oral insulin capsule, which is in phase III clinical trial for the treatment of individuals with diabetes. The company has license agreements with Oravax Medical Inc. to commercialize oral vaccines for COVID-19 and other novel coronaviruses.

Website: https://www.oramed.com/

Latest 10-K report: https://oramed.gcs-web.com/static-files/20f3e326-9a9f-4625-a120-2f8bf32c3c88

Analyst Consensus: Not covered by Wall Street analysts.

Potential Catalysts / Reasons for the Hype:

- ORMP currently holds a 49.9% stake in Lifeward (formerly ReWalk) and a massive position in Alpha Tau Medical, making this a strategic pivot towards a biotech “Holding Company.”

- On January 8, 2026, the board declared a $0.25 per share special dividend. January 16, 2026 is the Ex-Dividend Date.

- ORMP recently received a $18 million payment from Scilex Holdings, making it a total of $118M recently, which fueled the dividend and buyback plans.

- The company has a robust pipeline. Oral insulin JV accelerates development; positive Phase 2 NASH data and oral COVID vaccine Phase 1 results; and South Korea distribution deal with Medicox for oral insulin.

- Rumors about Oramed potentially becoming a target for a reverse merger or a larger acquisition by a company looking for a clean NASDAQ shell with a massive cash pile.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Uptrend Channel Breakout: The daily chart shows that the stock has broken out of an uptrend channel with high volume. This is shown as purple color lines. This is a possible bullish indication.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for ORMP is above the price of $3.70.

Target Prices: Our first target is $4.70. If it closes above that level, the second target price is $5.50.

Stop Loss: To limit risk, place a stop loss at $3.10. Note that the stop loss is on a closing basis.

Our target potential upside is 27% to 48%.

For a risk of $0.60, our first target reward is $1.00, and the second target reward is $1.80. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

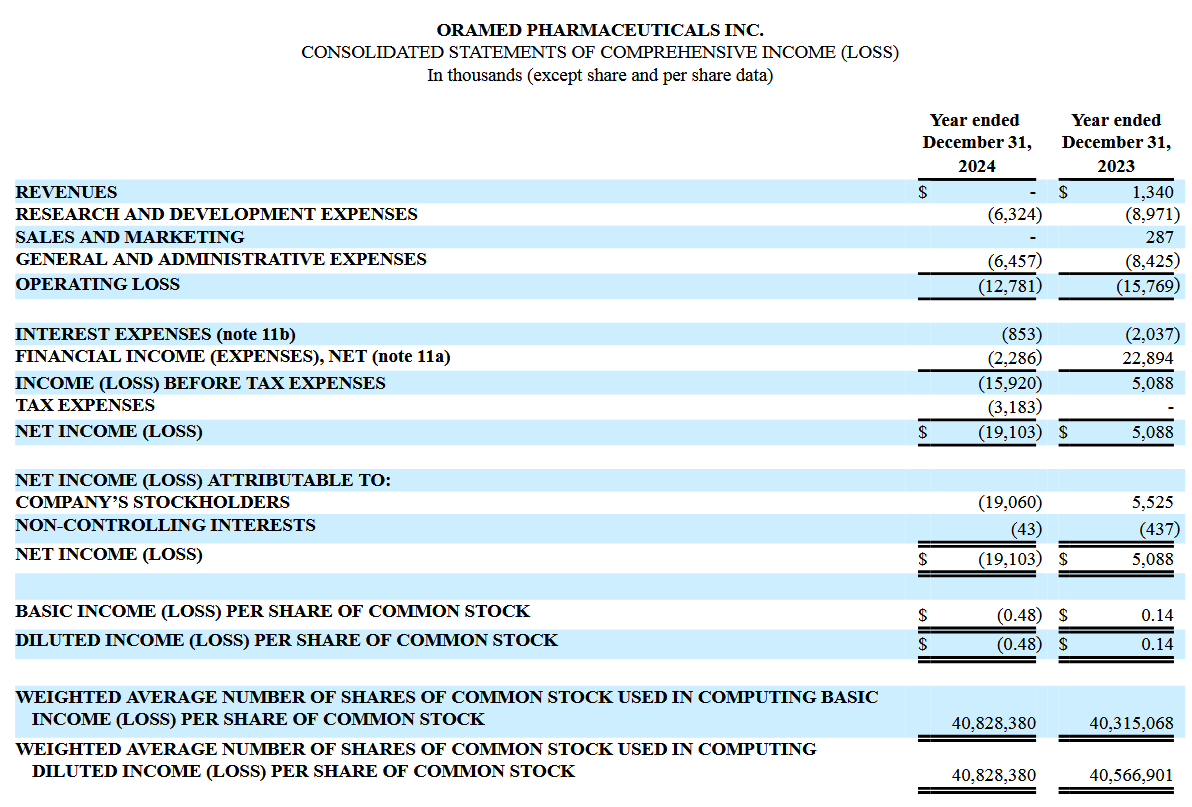

- The company has a history of net losses.

- The company has a history of failures, such as the past FDA Phase 3 failure for ORMD-0801 (oral insulin) in 2023.

- The company has only licensing revenues and no product revenues, and may not succeed in developing or commercializing any products that could generate product revenues.

- Shifting from a pure-play biotech to an investment/holding company creates complexity. Investors are now tasked with not just valuing the company’s drugs, but also the management’s ability to pick other winning stocks.

- Biotech sector stocks, especially penny stocks, are sensitive to interest rates and general risk-off environments.

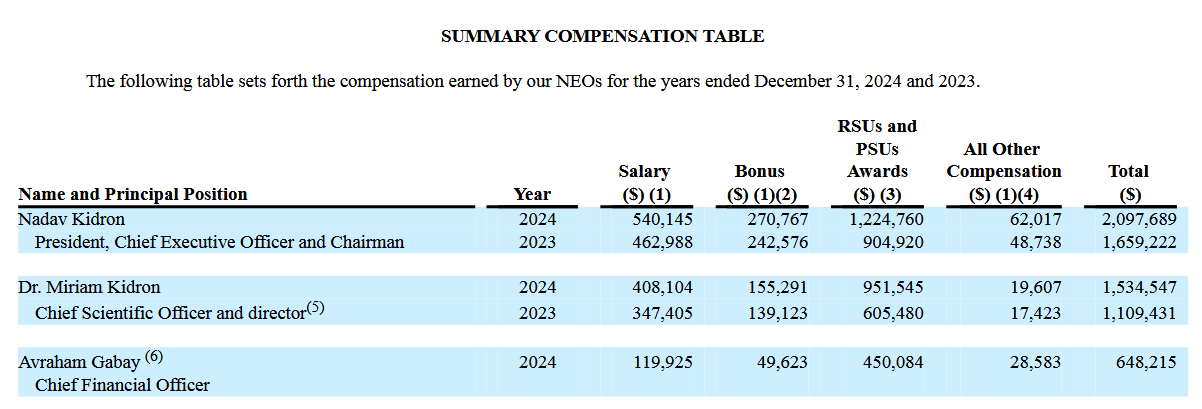

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.