Investors are scared—and that’s setting up a terrific opportunity for us in 8%+ yielding covered-call CEFs.

That’s because volatility fuels the income these stout funds get from their option strategies. And that income flows right into our dividend checks.

I’ve got two 8%+ payers delivering growing “option-boosted” dividends for you below.

And thanks to the market’s relative calm these last few months, these funds are bargains. But the last four years of history say we’re likely headed into a storm. That’s because three of those years started with stocks tripping over their shoelaces.

I think 2026 will make it four out of five.

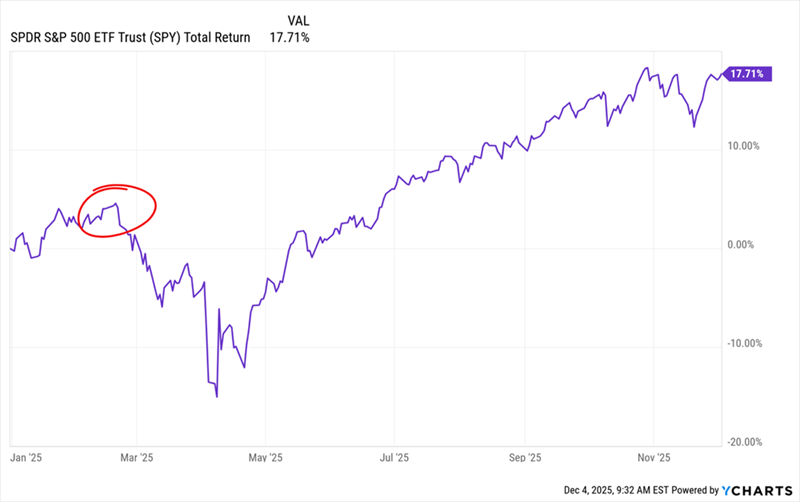

Remember the “tariff terror” earlier this year? Most people think it happened in April, but the collapse really kicked off in February:

Spring Selloff? Try Winter

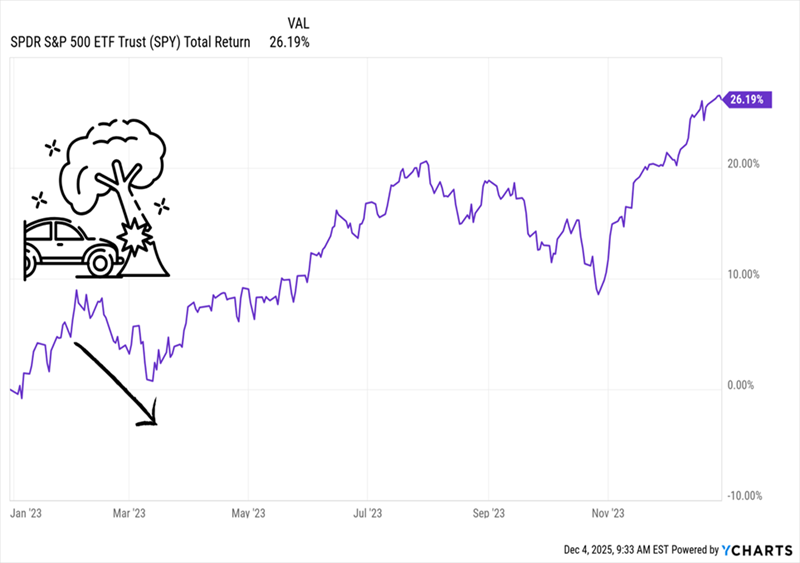

Then there was winter 2023, when Silicon Valley Bank and friends went poof:

Then there was winter 2023, when Silicon Valley Bank and friends went poof:

2023 Started Off Rough, Too

I know no one wants to talk about 2022, so I’ll just point out that that dumpster fire started early in the year, too. That leaves 2024 as the only recent year with a serene start.

I know no one wants to talk about 2022, so I’ll just point out that that dumpster fire started early in the year, too. That leaves 2024 as the only recent year with a serene start.

If 2026 follows the pattern we saw in 2022, 2023 and again in 2025, covered-call funds give us the ideal setup: high income now plus extra income when their option income spikes.

Here’s why I see that IF as more of a WHEN.

For one, it’s hard to argue that many stocks—especially tech stocks—aren’t priced to perfection. Even if you’re an AI believer (and I am, especially its power to boost the profits of high-yielding business development companies), stocks look set for a breather.

Add to that the fact that investors are skittish, set to sell on any bad news. The CNN Fear & Greed Index tells the tale:

A Snapshot of Investor Worry

Source: CNN.com

Source: CNN.com

Before we go further, I should clearly say that I expect any drop to be temporary. That’s because the economy is ticking along fine, with the Atlanta Fed’s GDPNow indicator showing strong 3.8% growth.

Plus, need I remind you that 2026 is an election year? That alone says money will be pumped into the economy.

Plus, need I remind you that 2026 is an election year? That alone says money will be pumped into the economy.

Meanwhile, Wall Street has lost the plot because they’re looking at “old-school” indicators like jobs reports. But profits are still growing. This is not the opening act of a recession—it’s an efficiency boom.

This fear/growth combo is perfect for covered-call funds, which sell, or “write,” options that give the buyer the right to purchase their holdings at a fixed future price and date.

If the stock hits that target, it’s likely to be sold. If not, nothing happens. Either way, the fund keeps the fee it charges for the option. And that boosts our dividends.

Why is now a great time for us to take a look at these funds? Three reasons:

- We don’t have to abandon our current holdings, since many of these funds—closed-end funds (CEFs), to be exact—hold the stocks many of us own now: The Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), the first fund we’ll look at next, holds all the stocks in the S&P 500.

- Big dividends: SPXX yields 7.9%, while the more “global” fund below, the BlackRock Enhanced Equity Dividend Trust (BDJ), yields a stout 8.1%.

- And most important, these funds thrive on volatility, since whipsawing markets boost option income.

Let’s discuss both, starting with SPXX.

SPXX: A 7.9% Payer Going for More Than Double Its Usual Discount

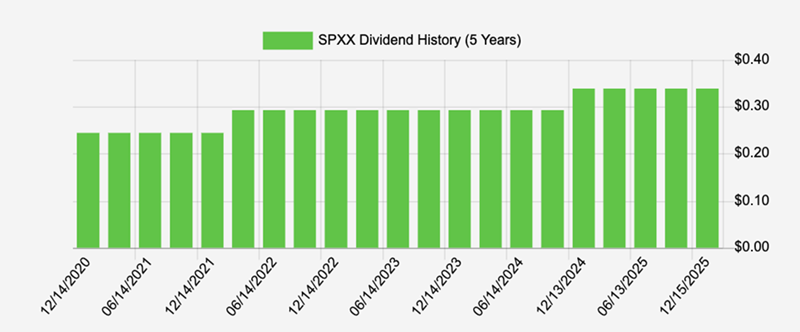

The Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) sells options on 35% to 75% of its portfolio. The fees it collects run straight into its 7.9% payout, which has risen 38% in the last five years.

A 7.9% Payout That’s Soared

Source: Income Calendar

Source: Income Calendar

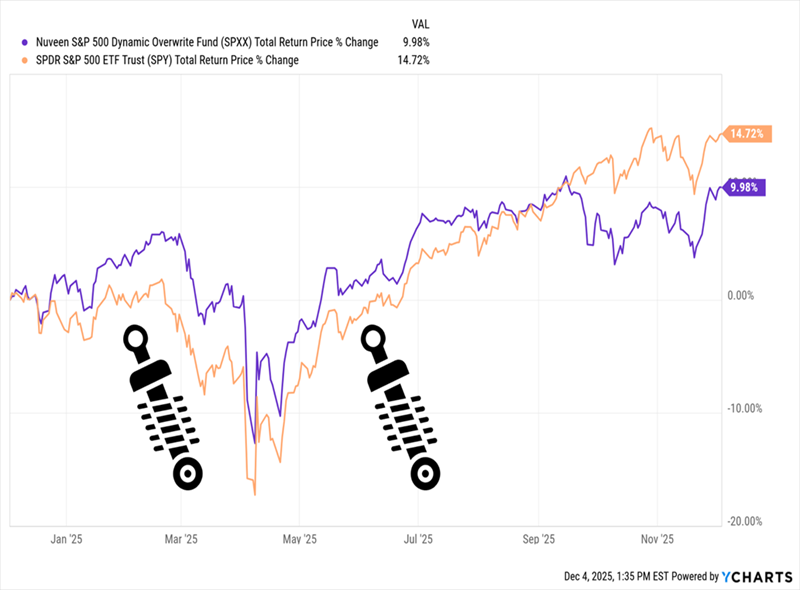

SPXX has posted a total return of 10% in the past year (in purple below). Yes, that’s a few points behind the S&P 500, but that’s normal for a covered-call fund, as their strongest stocks are sold, or “called away,” under their options strategy.

But SPXX’s job isn’t to beat the S&P 500—it’s to smooth the ride while delivering a high, reliable payout. And it did just that through the tariff selloff, falling far less than the S&P 500, as you can see in purple below:

SPXX: A Portfolio “Shock Absorber”

This clearly shows the value of a fund like this in worrying times. And the chart above suggests another buy window is open now, with volatility ticking up. The fund’s 7.9% discount to NAV, far below its five-year average 3.1% discount, underlines that point.

This clearly shows the value of a fund like this in worrying times. And the chart above suggests another buy window is open now, with volatility ticking up. The fund’s 7.9% discount to NAV, far below its five-year average 3.1% discount, underlines that point.

A “Global” Covered-Call Fund Yielding 8.1% (and Paying Monthly)

The BlackRock Enhanced Equity Dividend Trust (BDJ) gives us two things we demand in this pricey, tech-heavy market: a portfolio balanced among sectors—finance is the biggest slice, at 19.6% of assets—and a dash of global exposure.

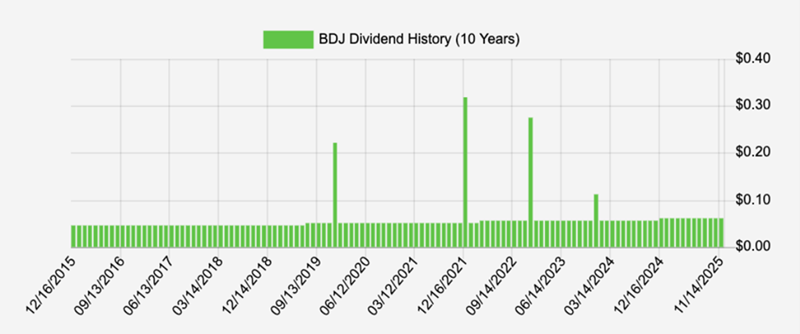

Let’s start with BDJ’s dividend, which is not only hefty but has risen a stout 33% in the last decade (not including special dividends, which BDJ has paid four times in that span):

Source: Income Calendar

Source: Income Calendar

The fund aims to park 80% of its portfolio in dividend-paying stocks. It further bulks up the divvie by selling options on 48% of its holdings. An added bonus: BDJ pays dividends every month, right in line with our bills.

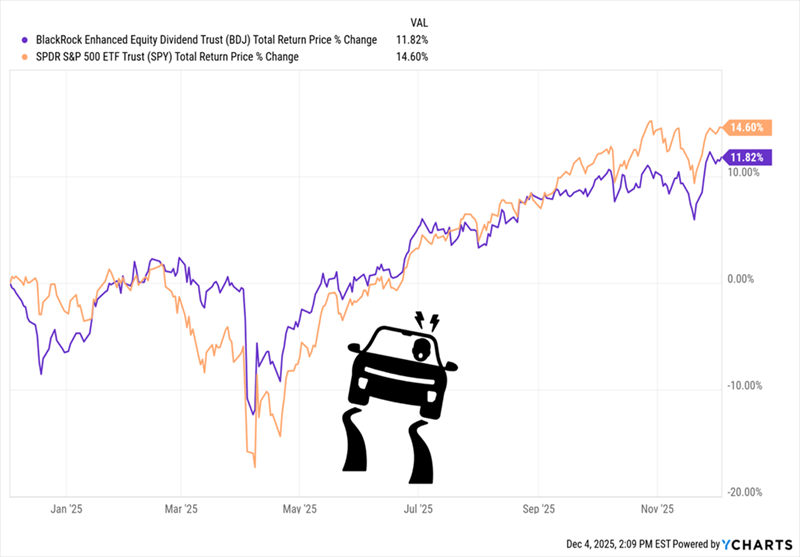

We can see its “crash resistance” in action in the past year, with BDJ only slightly behind the S&P 500 and boasting much less volatility, thanks in part to its non-US stocks:

International Exposure + Options Give BDJ “Crash Resistance”

BDJ trades at a 6% discount, around its five-year average. But in the 2022 mess, it flipped to a premium. While history doesn’t repeat perfectly, I do expect another narrowing discount in the opening months of 2026.

BDJ trades at a 6% discount, around its five-year average. But in the 2022 mess, it flipped to a premium. While history doesn’t repeat perfectly, I do expect another narrowing discount in the opening months of 2026.

— Brett Owens

You Only Have A Few DAYS Left to Claim This Incredible 11% Dividend [sponsor]

The clock is ticking toward the “drop date” of my top income fund’s next big dividend, and the time to make our move is now. Massive payouts of $1,000, $2,000 and $3,000+ could be at stake. Don’t miss this chance to get in while you still can. Click here to unlock the full story.

Source: Contrarian Outlook