OpenAI just handed out two major deals.

AMD’s getting a massive chip order… but there’s a catch. Oracle’s building cloud infrastructure… but margins are already collapsing.

Both stocks gapped higher. But only one deserves your attention.

Here’s what most investors missed – AMD’s deal includes a $600 price target that OpenAI has every reason to help reach. Meanwhile, Oracle’s spending billions to build data centers on razor-thin 14% margins.

In today’s Buy This, Not That, I reveal the fine print on both deals and show you which gap trade makes sense right now.

Click on the thumbnail below to dive in.

Transcript

Hey everybody, Shah Gilani here with your weekly BTNT, as in Buy This, Not That. Going to do something a little different today. I’m going to talk about a Buy This, Not That matchup, but it’s going to be through the prism of gaps.

Meaning when a stock gaps higher, usually on some positive news or spin on positive news or expectations or an earnings report or something that jolts investors. Sometimes it’s a matter of shorts covering, which happens a lot with meme stocks on any good news, and other times it’s for solid fundamentals that are revealed. So speaking of solid, I’m going to talk about two solid companies who have recently had gaps and which one you might want to consider buying in, which one maybe not so much. So let me share with you the first stock.

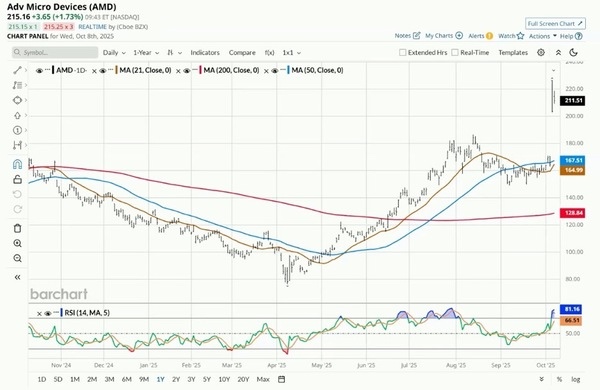

And here is the chart. It is Advanced Micro Devices, AMD. Now this is a one-year chart, and this is the gap I’m talking about. So on October third, AMD closed at $164.

The next day, AMD opens up at $226. It closed that day at $203, but a huge gap up. Now, the reason that AMD gapped up is because they announced a deal with OpenAI.

The next day, AMD opens up at $226. It closed that day at $203, but a huge gap up. Now, the reason that AMD gapped up is because they announced a deal with OpenAI.

Now AMD is in competition with NVIDIA. I don’t think their chips are anywhere as good as NVIDIA GPUs, but I got to give AMD credit. They’ve done a pretty good job and their chips are, while they’re behind NVIDIA’s, they’re still pretty darn good. They’re up there amongst the offerings that AI spenders are looking for.

So AMD chips, yes, pretty good. And they wouldn’t be in demand if they weren’t good. OpenAI, which owns and developed and introduced the world to ChatGPT, has created a deal with Advanced Micro Devices. Now, the deal with AMD, which is what caused the stock to pop, was, hey, here’s what we’re going to do with AMD.

We are going to sell AMD a piece of our business.

Selling AMD a piece of our business, what does that really mean? It means that, hey, Advanced Micro Devices, if you build out these hyperscale data centers, we will use your data centers fulfilled 100% with your chips. So in other words, hey, you go out, you build this data center, all of them, as many as you want to build, we will fulfill all your needs in terms of what you’re going to put and build into those data centers using your chips. So AMD says, wow, wait a second, this is basically an order for our chips, a massive order for our chips.

Yes, we have to build the infrastructure in order to put our chips on server racks in those data centers, which sounds really good because how much is OpenAI going to buy of AMD’s chips to fulfill the giant needs that OpenAI has, which continue to expand if you listen to OpenAI. Now, that’s what investors want to hear. But there was a little bit of a twist to it. The investors also heard, Hey, by the way, AMD, there’s a little more to it.

If you reach these milestones, this is OpenAI telling AMD. If you reach these milestones, we are going to invest in AMD stock. We are going to buy AMD stock. Well, that sounds pretty good, except it’s not, because AMD is going to sell them stock and warrants.

They got a deal where OpenAI will eventually buy maybe 160 million shares worth of Advanced Micro Devices. And guess what? At about a penny a share. So it’s not like they’re paying up and giving Advanced Micro Devices tons of equity capital that they can apply to actually build the data centers.

No.

What OpenAI gets is an opportunity to buy AMD stock at a penny a share. Now that benefits OpenAI. But the milestones they have to reach are such that OpenAI says, We’re not going to necessarily do that unless you reach these milestones. In other words, you’ve got to build out these data centers, fill them with your chips, which we will… It’s not even clear whether they’re going to buy the chips eventually or lease the data centers with AMD chips in it, which is a completely different deal. So the particulars aren’t really out there yet. And that’s because they’re still really working on the parameters of the deal.

If they are leasing the data centers and leasing the chips in the data center, yes, that could be very beneficial to AMD and the stock could rise.

The ultimate goal for AMD stock is to get to above $600 in which case then OpenAI says it’ll fully own a big chunk of AMD. Now, that’s incentive enough for investors to maybe help push AMD or think that AMD can get to $600, in which case it’s part of this gap when you look through the generalities of the deal and you recognize that there’s almost a hurdle there that they’re pushing AMD to get to, which is $600 a share. That sounds really interesting. But here’s the gap.

And the gap is based on expectations of things that haven’t even happened yet. So that’s AMD. I’ll come back to it. The other gap happens in Oracle, which itself made a deal with guess who?

OpenAI. And this is the gap that Oracle got. The gap that Oracle got was based on a deal that they announced.

By the way, this is the day before the gap is when Oracle reported earnings. And Oracle reported in their earnings, which were pretty good, they showed that, let’s see, I don’t know if you can find the exact term that they use.

By the way, this is the day before the gap is when Oracle reported earnings. And Oracle reported in their earnings, which were pretty good, they showed that, let’s see, I don’t know if you can find the exact term that they use.

It’s essentially a proxy for future contracted revenue.

And this metric of future contracted revenue rose by something like 300-plus percent, a huge number. But that didn’t really move the stock, even though they’re basically saying, oh by the way, we have even more of a backlog. That’s the equivalent of what their proxy is telling us. Backlog for our cloud services is a heck of a lot, 300-plus percent more than we reported last quarter a year ago.

But that didn’t move the stock until the next day when the gap happened. And what caused the gap? Well, we found out that the previous day’s earnings report and the mention of this increase in backlog comes from a deal with OpenAI. So the next day on the tenth, we understand how that happened, how that backlog was created.

It’s because OpenAI, the leader, the big dog in terms of large language learning models, GPT as you know it, is going to use Oracle’s cloud. And guess what? Oracle has to build out all of the facilities that OpenAI needs on their own dime, people. So this is pretty interesting stuff.

Here’s the expectation that, okay, OpenAI is going to lean into Oracle, but Oracle is going to have to build out more stuff.

Yeah, here’s this pop. It’s a similar situation. None of this has happened yet, people. And the expectations investors have are it’s going to happen and it’s going to result in huge revenues for Oracle.

Well, no. A report out the other day talked about the artificial intelligence-driven cloud division of Oracle – margins are crumbling. The margins now are about 14% gross margins relative to the overall margins at Oracle being north of 70%. So it’s likely the spending and the CapEx that they’re allocating to build out the data centers to support their cloud build in order to supply OpenAI with cloud services that is crushing the margins.

So this is now as things have unfolded, this is what’s happened to the stock. It’s come down dramatically. And what I often see is these gaps get filled. So could Oracle stock come right back down to $260?

Could it come down lower? Sure it could. It could fill that gap. So when it comes to Oracle versus AMD, Oracle’s already started moving down.

I don’t think that AMD is going to remain elevated up here. I think AMD is going to come down because the expectations have got years to be met. So I think AMD is going to eventually come down. Maybe not fill the gap, maybe.

I would say over time, probably. Certainly if we get a strong enough correction in the stock market, AMD is going to fill that gap back down here. So which one to buy, which one not to buy? I would buy AMD on a pullback and I wouldn’t necessarily buy Oracle on a pullback.

I would say over time, probably. Certainly if we get a strong enough correction in the stock market, AMD is going to fill that gap back down here. So which one to buy, which one not to buy? I would buy AMD on a pullback and I wouldn’t necessarily buy Oracle on a pullback.

Because AMD has this $600 mark on its back that investors are going to try and push this and people are going to be talking about, including retail investors, that oh my gosh, I want to own Advanced Micro Devices because that $600 a share target is out there.

And it certainly behooves OpenAI to help Advanced Micro Devices stock rise higher because they’re going to own a chunk of it, a huge chunk of AMD. So this week’s BTNT about gaps and about AMD versus Oracle. I’d buy AMD on a pullback, not Oracle.

Cheers, everybody. Catch you guys next week.

— Shah Gilani

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Total Wealth Research