We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Fortress Biotech, Inc. (NASDAQ: FBIO)

Today’s penny stock pick is the biopharmaceutical company, Fortress Biotech, Inc. (NASDAQ: FBIO).

Fortress Biotech, Inc. engages in the development and commercialization of biopharmaceutical products. The company markets dermatology products, including Emrosi, a minocycline hydrochloride extended-release capsule for the treatment of rosacea; Qbrexza a medicated cloth towelette for primary axillary hyperhidrosis; Accutane, an oral isotretinoin drug for severe recalcitrant nodular acne; Amzeeq, a topical formulation of minocycline for inflammatory lesions of non-nodular moderate to severe acne vulgaris; Zilxi for inflammatory lesions of rosacea; Exelderm, an antifungal cream and solution for topical use; Targadox, an oral doxycycline drug for therapy for severe acne; and Luxamend, a water-based emulsion to provide a moist healing environment for superficial wounds, minor cuts or scrapes, dermal ulcers, donor sites, sunburns, and radiation dermatitis.

It also develops intravenous Tramadol for the treatment of post-operative acute pain; CUTX-101, an injection for Menkes disease; UNLOXCYT for metastatic cutaneous squamous cell carcinoma; Olafertinib for EGFR mutation-positive NSCLC; CAEL-101, a monoclonal antibody for amyloid light chain amyloidosis; and Triplex, a cytomegalovirus vaccine.

In addition, the company’s early-stage product candidates include Dotinurad for gout; MB-101 for glioblastoma; MB-108 for recurrent GBM; MB-109 for refractory glioblastoma and anaplastic astrocytoma; MB-106 for B-cell non-hodgkin lymphoma; AJ201, an androgen receptor degradation enhancer; and BAER-101, a positive allosteric modulator.

Further, its preclinical product candidates comprise AAV-ATP7A and AVTS-001 gene therapies; CK-103 BET inhibitor; CEVA-D and CEVA-102; CK-302, an anti-GITR; CK-303, an anti-CAIX; and oligonucleotide platform. The company was formerly known as Coronado Biosciences, Inc. and changed its name to Fortress Biotech, Inc. in April 2015.

Website: https://www.fortressbiotech.com/

Latest 10-K report: https://www.fortressbiotech.com/investors/sec-filings/all-sec-filings/content/0001558370-25-004160/0001558370-25-004160.pdf

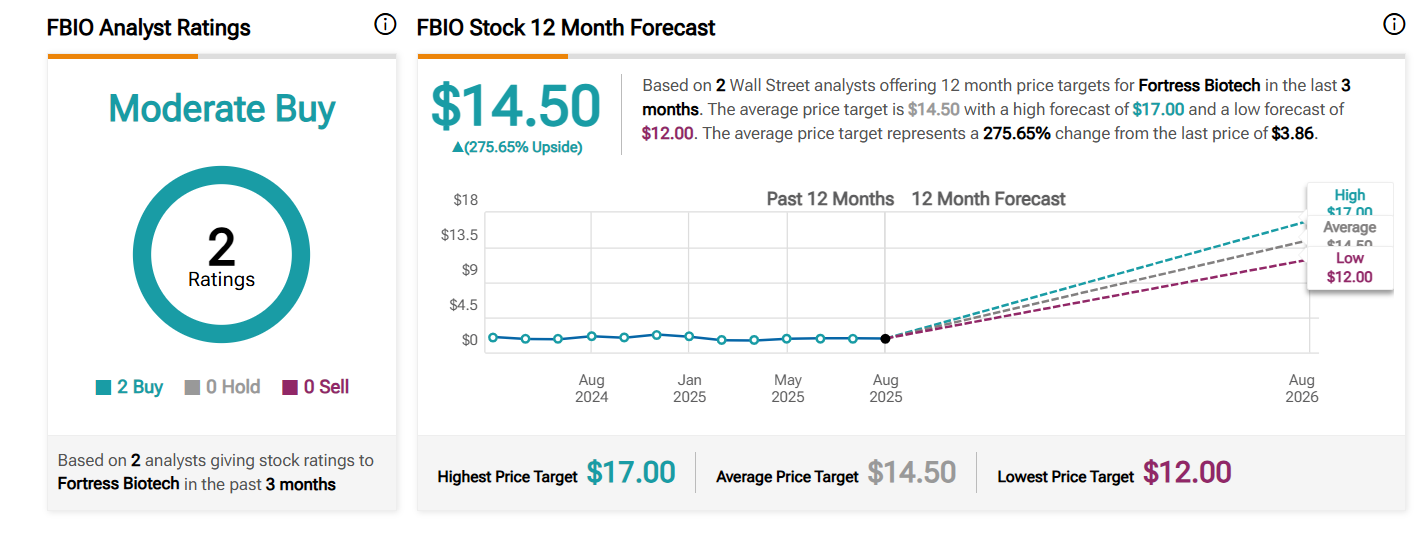

Analyst Consensus: As per TipRanks Analytics, based on 2 Wall Street analysts offering 12-month price targets for FBIO in the last 3 months, the stock has an average price target of $14.50, which is nearly 276% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company reported strong Q2 2025 earnings, with net income of $13.4 million on $16.4 million in revenue, boosted by the $28 million sale of its subsidiary Checkpoint Therapeutics to Sun Pharma.

- The company’s subsidiary Journey Medical reported that its rosacea treatment, Emrosi, now covers 65% of U.S. commercial lives, expanding from 29% in May 2025.

- FBIO holds stakes in multiple biotechs. This provides equity holdings, royalties (like the 2.5% on UNLOXCYT sales post-Checkpoint sale), and dividend potential.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Uptrend Channel Breakout: The daily chart shows that the stock has broken out of an uptrend channel, which is shown as purple lines. This is a possible bullish indication.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day and 200-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink dotted line. This looks like a good area for the stock to move higher.

#6 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for FBIO is above the price of $3.90.

Target Prices: Our first target is $5.00. If it closes above that level, the second target price is $6.00.

Stop Loss: To limit risk, place a stop loss at $3.30. Note that the stop loss is on a closing basis.

Our target potential upside is 28% to 54%.

For a risk of $0.60, our first target reward is $1.10, and the second target reward is $2.10. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

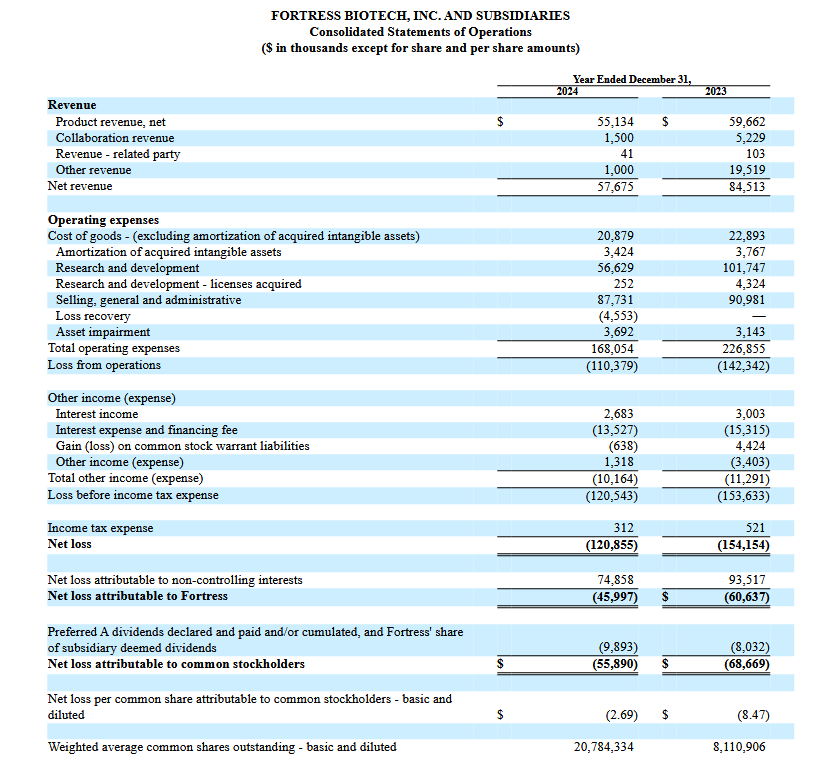

- The company has a history of net losses. FBIO reported losses from operations of approximately $110.4 million and $142.3 million for the years ended December 31, 2024, and 2023, respectively.

- The biotech sector in itself is facing headwinds like macro uncertainty from U.S. tariffs, tax/monetary policy, and drug pricing reforms, which have pressured capital inflows.

- Most of FBIO’s product candidates are in the early stages of development and may not be successfully developed or commercialized, and the product candidates that do advance into clinical trials may not receive regulatory approval. In addition, FBIO’s existing products are also facing generic competition and/or losses of exclusivity.

- Raising additional funds by issuing securities or through licensing or lending arrangements may cause dilution to existing stockholders.

- FBIO has significant debt. As of December 31, 2024, the total amount of debt outstanding, net of the debt discount, was $58.0 million.

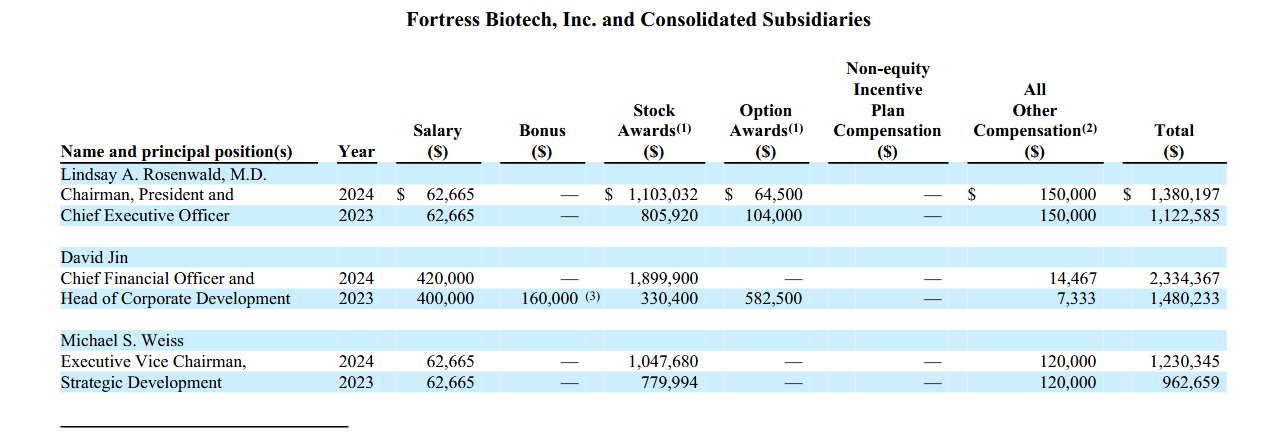

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Trades of the Day