Last week, Fed Chair Jerome Powell signaled that the Fed is likely to lower interest rates this year.

The market jumped as a result.

Investors should tread carefully – not because valuations are at historically high levels (though that is true), but because inflation is likely to burn hot if the Fed lowers rates.

Powell himself said the Fed has to manage both employment, which continues to stagnate, and inflation, which continues to rise. A rate cut only adds gasoline to the inflation fire.

In January, in the Forecast Issue of my newsletter, The Oxford Income Letter, I predicted that inflation would spike in 2025. A Fed rate cut would likely make that forecast a slam dunk.

There are not many investments that keep up with inflation – particularly ones that generate income.

Fixed income doesn’t do the trick. If you’re earning $1,000 a year in fixed income and prices rise 5%, something that used to cost $1,000 last year now costs $1,050. But your $1,000 in fixed income interest doesn’t budge, so you have a $50 hole to make up.

One of the only ways to combat inflation is with dividend growth stocks.

These companies pay dividends (usually quarterly) and raise their dividends each year. If you have a stock whose dividend is hiked by a meaningful amount, you could actually increase your buying power, even in periods of rising inflation.

For example, Civista Bancshares (Nasdaq: CIVB), a microcap bank based in Ohio, has been around since 1884. Today, the stock yields 3.2%, but the company has raised its dividend every year since 2012 at a compound annual growth rate of over 13%. The most recent dividend increase was lower at 6.3%, but that is still above the current inflation rate, so it still boosted shareholders’ buying power.

Chevron (NYSE: CVX) is another solid dividend growth stock. The oil and gas giant has a current yield of 4.3% and has raised its dividend every year for 36 years.

The most recent increase was 5%, which as of now is higher than inflation.

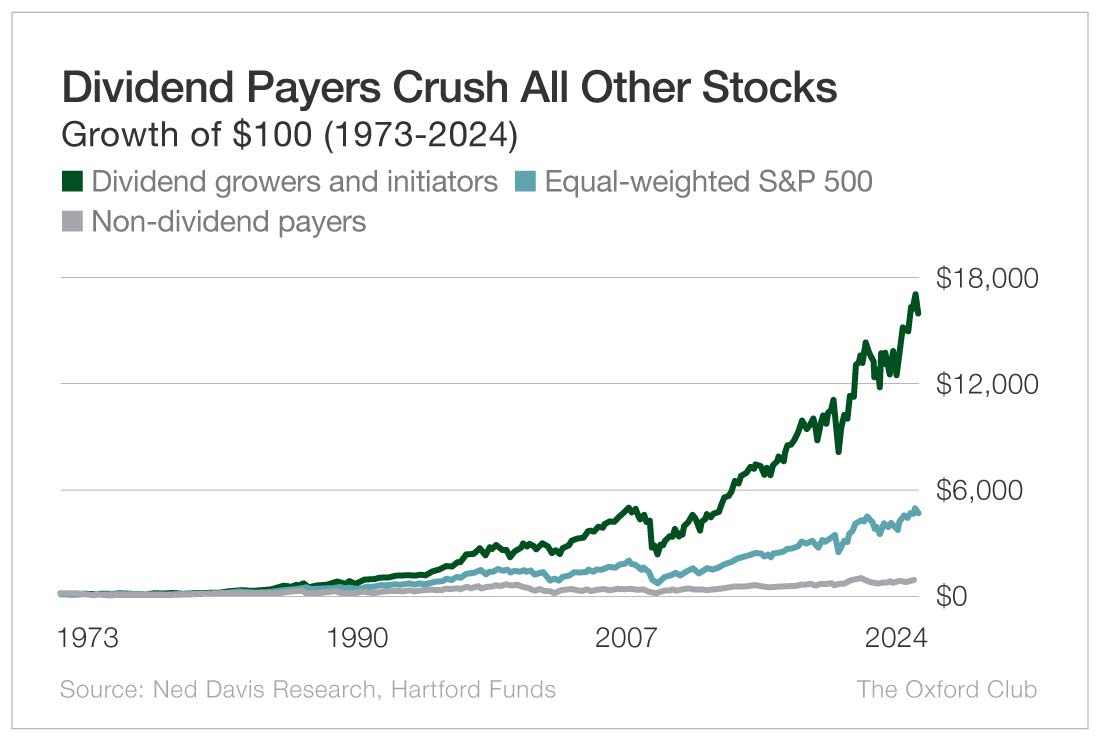

Over the past 50 years, companies that raised or initiated a dividend outperformed the equal-weighted S&P 500 by nearly 3.5 times. They beat non-dividend payers by more than 1,700%.

Furthermore, when the spit hits the fan, dividend growers are safer than the overall market. The S&P 500 Dividend Aristocrats Index, which tracks companies in the S&P 500 that have raised their dividends every year for at least 25 years, is 10% less volatile than the broad market.

Furthermore, when the spit hits the fan, dividend growers are safer than the overall market. The S&P 500 Dividend Aristocrats Index, which tracks companies in the S&P 500 that have raised their dividends every year for at least 25 years, is 10% less volatile than the broad market.

In other words, during a correction, the Aristocrats should decline less than other stocks.

Rates are coming down, and inflation is going higher. Investors should look toward dividend growth stocks to keep up with inflation – or else risk seeing their purchasing power be reduced.

— Marc Lichtenfeld

$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.

Source: Wealthy Retirement