Let’s talk about three dividends averaging 12%. I bring them up because everyone on Wall Street hates them.

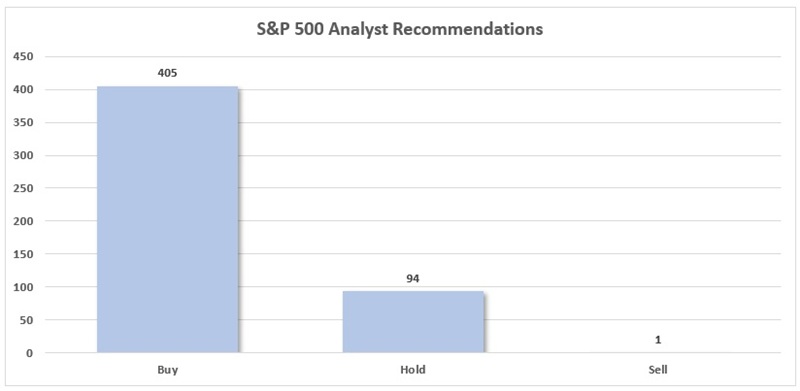

This is notable because the suits are paid to be bullish. Sell calls are rare, especially among S&P 500 stocks. In fact, analysts shun just one index component today!

Just 1 “Sell” Call Out of 500!

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Buy calls? They are numerous—405 out of 500. Eighty-one percent!

Are 81% of the companies in the S&P 500 really buys? Normally, no, but now—especially not. AI is disrupting business models and many of these Buy-rated names are doomed companies.

Here’s another problem with Buy ratings—there is no room for improvement. Sells are better. They set the stage for upgrades! And it doesn’t take much for analysts to flip a stock from a Sell to a Buy.

Which is why savvy contrarians dig through the Sell bin.

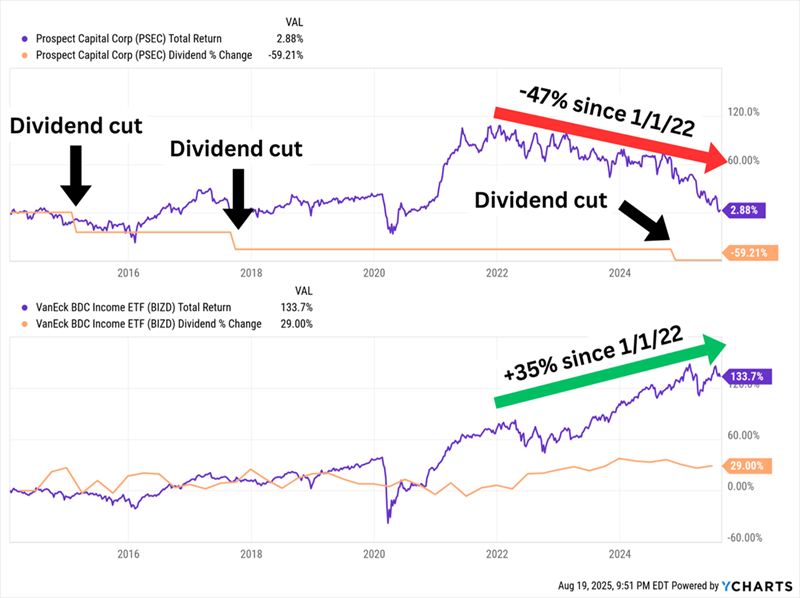

Today we’ll discuss three hated names yielding from 6.1% to 15.7%. Before getting to those, let’s use Prospect Capital (PSEC, 18.7% yield), as a cautionary tale and highlight the difference between being contrarian and being foolish.

PSEC is a business development company (BDC) that provides capital to middle-market companies, primarily through first lien and other secured debt. It has a diverse portfolio of 114 companies across 33 industries. And it’s one of the largest BDCs at well more than $1 billion in market cap.

But despite being a monthly dividend payer with a yield that could be confused for a credit card APR, and despite being the cheapest BDC on the market, Wall Street can’t find a reason to like it. It has just two covering analysts, and only one of them has a rating on the stock (Sell, unsurprisingly). While that smacks of too small a sample size, the lack of coverage itself is telling. Research firms would prefer not to bite the hands that provide them with access, to the point where many would choose to temporarily stop covering a company over calling a spade a spade.

Why the lack of love? Among other reasons, how about three dividend cuts in the past decade, including a 25% reduction less than a year ago.

BDCs as a Whole Haven’t Set the World on Fire, But at Least They’re Not All PSEC

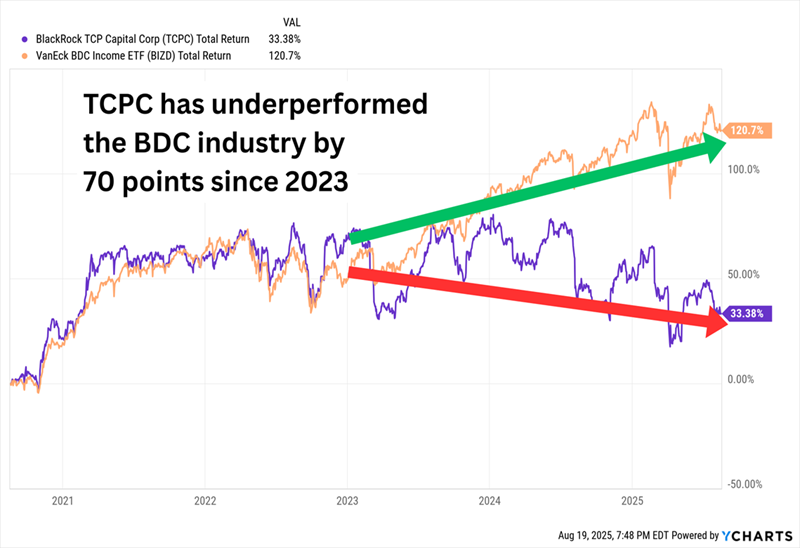

All right. What about a BDC with a slightly less bearish camp? BlackRock TCP Capital Corp. (TCPC, 15.7% yield) is technically a consensus Sell call, but the majority of analysts covering it say it’s a Hold. So at least as far as pro ratings go, it’s not a disaster.

All right. What about a BDC with a slightly less bearish camp? BlackRock TCP Capital Corp. (TCPC, 15.7% yield) is technically a consensus Sell call, but the majority of analysts covering it say it’s a Hold. So at least as far as pro ratings go, it’s not a disaster.

TCPC is a middle-market lender that prefers companies with enterprise values of between $100 million and $1.5 billion. It currently boasts more than 150 portfolio companies across 20 different industries, and its deal mix is heaviest (82%) in first-lien debt, and the vast majority (94%) of its lending is floating-rate in nature.

The case for BlackRock TCP Capital Corp. is BlackRock. The BDC is externally managed by a BlackRock subsidiary, which gives it access to BlackRock resources. In theory, that should make TCPC competitive.

In Practice, It Doesn’t

Again, the pros likely have a legitimate case here. TCPC is in the process of restructuring deals amid credit issues in the portfolio, and management fees have been waived to make up for some of the financial slack. The dividend—which BlackRock TPC cut earlier this year, just a few months after I flagged the potentially brewing trouble in its distribution—isn’t necessarily at risk yet, but it bears watching if portfolio losses continue.

Again, the pros likely have a legitimate case here. TCPC is in the process of restructuring deals amid credit issues in the portfolio, and management fees have been waived to make up for some of the financial slack. The dividend—which BlackRock TPC cut earlier this year, just a few months after I flagged the potentially brewing trouble in its distribution—isn’t necessarily at risk yet, but it bears watching if portfolio losses continue.

Hated BDCs might be asking for it. Let’s look at other high-yield acronyms instead.

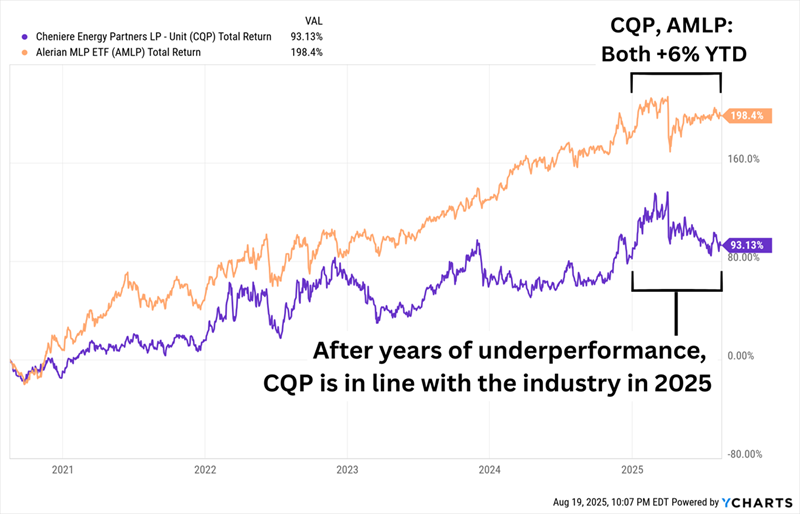

Cheniere Energy Partners LP (CQP, 6.1% yield) is a midstream subsidiary of Cheniere Energy (LNG). It owns the Sabine Pass LNG (liquefied natural gas) terminal in Louisiana, which includes natural gas liquefaction facilities and regasification facilities. It also owns the Creole Trail Pipelines, which connects the Sabine Pass terminal with inter- and intrastate pipelines.

Cheniere Partners owns the Sabine Pass LNG terminal located in Cameron Parish, Louisiana, which has natural gas liquefaction facilities with a total production capacity of over 30 mtpa of LNG. The Sabine Pass LNG terminal also has operational regasification facilities that include five LNG storage tanks, vaporizers, and three marine berths. Cheniere Partners also owns a Corpus Christi liquefaction facility and a connected pipeline, as well as Creole Trail Pipeline, which interconnects the Sabine Pass LNG terminal with a number of large interstate and intrastate pipelines.

CQP is pouring itself into expansions at its Sabine Pass and Corpus Christi facilities—big capital outlays that required Cheniere to reduce its variable distribution in 2024. That payout came up a smidge earlier this year, however, and the company’s underperformance last year has turned into more respectable performance this year.

Shares Stabilizing as Cheniere Builds Toward the Future

There’s no telling what the master limited partnership (MLP) will do in the short term as its various project details are fleshed out. But if these projects do bear fruit, CQP could be looking at a potential explosion of distributable cash flow (DCF) generation a few years down the road.

There’s no telling what the master limited partnership (MLP) will do in the short term as its various project details are fleshed out. But if these projects do bear fruit, CQP could be looking at a potential explosion of distributable cash flow (DCF) generation a few years down the road.

How about a real estate investment trust (REIT)?

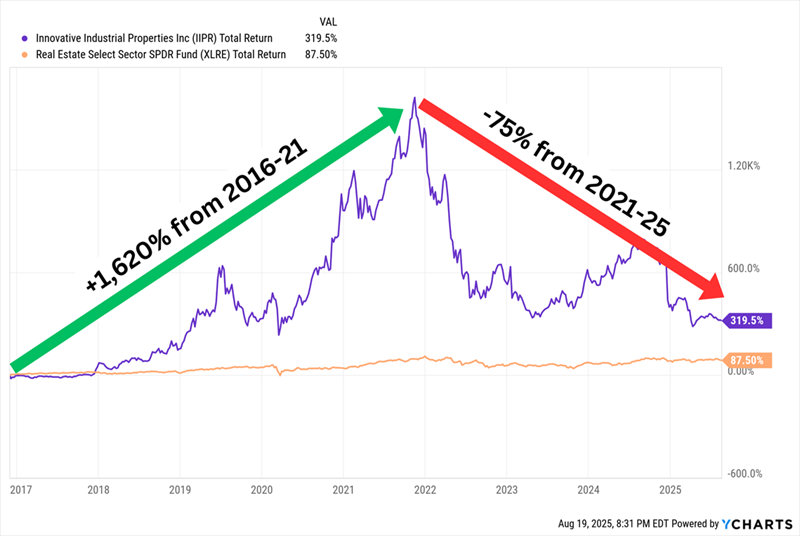

Innovative Industrial Properties (IIPR, 14.4% yield), a REIT tied to the marijuana industry, is what I call a “bearish Hold.” Most of the pros say it’s a Hold or a Sell, but a lone Buy call raises its consensus average.

Still, Wall Street really doesn’t like this stock—a massive change of fortune to a stock that over the past decade has been among both the sector’s biggest success stories and its biggest flops.

One Ticker, But Two Totally Different Stocks Since 2016

IIPR provides capital for the regulated cannabis industry through a sale-leaseback program. It buys freestanding industrial and retail properties (most of which are marijuana growth facilities) from cannabis operators, then leases them right back to the sellers. This provides cannabis operators with much-needed influxes of cash that they can use to expand their operations, and provides the REIT with ongoing cash flow. Currently, IIPR owns 108 properties in 19 states, representing nearly 9 million square feet, which it leases out to 36 tenants.

IIPR provides capital for the regulated cannabis industry through a sale-leaseback program. It buys freestanding industrial and retail properties (most of which are marijuana growth facilities) from cannabis operators, then leases them right back to the sellers. This provides cannabis operators with much-needed influxes of cash that they can use to expand their operations, and provides the REIT with ongoing cash flow. Currently, IIPR owns 108 properties in 19 states, representing nearly 9 million square feet, which it leases out to 36 tenants.

It’s not like Innovative Industrial Properties has operationally reverted to where it was 10 years ago—not even close. The company went public in 2016 and generated negative $7.5 million in funds from operations (FFO). It has cleared $210 million in FFO in each of the past three years, including $231 million in 2023 and $230 million in 2024.

However, the stock exploded even more than the business did, and the past few years have seen shares come back to earth. And everything’s not exactly rosy in the core business, which still is dealing with a cracked, state-by-state regulatory environment. That’s a big reason why IIPR recently invested $270 million into IQHQ, a life science real estate platform with more than $2 billion in assets—a move that could provide much-needed stability and growth.

It’s worth noting, however, that FFO has been declining significantly over the past few quarters, driving its adjusted FFO payout ratio to nearly 95%; that’s uncomfortably higher than the 85% ratio IIPR averaged between 2017 and 2024.

— Brett Owens

An 10% dividend… paid monthly? Yes, but you’ll want to move quickly. [sponsor]

One of my top buy-and-hold income plays for this market is the brainchild of one of the smartest investment minds on the planet… It dishes an incredible 10% yield… paid like clockwork every single month! And my research suggests that it’s poised for big price gains in the months ahead… no matter which way the broader market swings. I’m so excited about this fund that I’ve made it a core holding in my “Monthly Payer Portfolio” – an easy-to-buy collection of stocks and funds that could hand you $4,000+ in payouts every single month! Don’t delay! Details are ready for you HERE.

Source: Contrarian Outlook