It’s an exciting time in the stock market right now with the major U.S. indexes eclipsing their former all-time highs. As we make our way deeper into the third quarter, let’s take a step back and try to determine what may lie ahead for the rest of 2025 and beyond.

The see-saw action earlier this year translated to one of the most volatile first halves in recent memory. President Trump’s tariff agenda sent shockwaves through the financial markets, resulting in a sharp correction as investors factored in potential trade outcomes.

By April, market performance began to turn the corner, improving rapidly as investors gained more clarity amid signs of progress in trade talks. The V-shaped, relentless move morphed into a lockout rally, leaving nonbelievers in the dust. And because many investors missed out on significant gains, they will continue to snap up shares on weakness, which should help lift stocks even further.

Still, the doubters and naysayers remain prevalent. This is certainly one of the most hated market rallies since the surge in stocks following the onset of the COVID-19 pandemic. There are always reasons that critics can point to as to why stocks can’t continue higher, but as we know, stocks climb a wall of worry.

History Suggests More Gains on the Horizon

The S&P 500 has been in 11 bull markets (not including the current one) since 1949. The blue-chip index reached a new high in January 2024, following the inflation-induced bear market of 2022.

Dating back to the 1950s, once those former highs were put in the rearview mirror, bull markets have lasted an average of 4.5 years longer. This overlooked fact suggests the potential for substantial gains ahead. Investors commonly underestimate the length and magnitude of bull markets.

Still, with stocks at all-time highs, it’s somewhat normal to be apprehensive in terms of buying at these levels. The prevailing thought in most investors’ minds is – why not just wait for a correction and buy at lower prices?

However, the market is indicating that it is resuming the longer-term secular bullish trend. The biggest mistake we can make in a bull market is thinking stocks look expensive just because the index price is high.

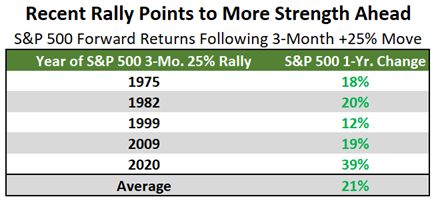

The S&P 500 just delivered one of the greatest three-month rallies in history, advancing more than 25% off the April lows. As we can see below, the index has only accomplished this feat five other times since its inception in 1957:

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In the twelve months following each of these instances, the S&P 500 delivered double-digit gains every time. As the saying goes, strength begets strength.

The ability of stocks to surpass former resistance levels and break out to all-time highs is a key signal. Remember, stocks serve as a leading indicator of the economy.

Corporate Earnings Support Rise in Stocks

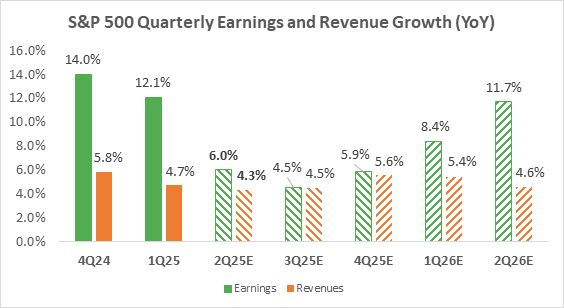

The second-quarter earnings season is off to a strong start, providing further evidence that a resilient corporate backdrop is supporting this new bull market. As has been the case for many consecutive quarters, earnings appear to be turning out better than many market participants had feared, reinforcing the notion that this move to new highs can be sustained.

Upon closer examination, total S&P 500 earnings for Q2 are expected to increase by 6% from the same period in the prior year, driven by 4.3% higher revenues. These figures combine the actual results that have been reported so far with the results from companies still to come. By the time you’re reading this, about one-third of S&P 500 companies will have reported results.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

It is still relatively early in the season, but we remain confident that S&P 500 members will validate the trends established at this stage through the remainder of the Q2 reporting cycle. Earnings and revenue beats are also tracking above historical averages thus far.

Looking Outside of Large-Caps

Market breadth has improved, with a greater number of stocks participating in the bullish rally. One area of the economy that benefits significantly from two key themes of President Trump’s approach – deregulation and lower taxes – is small businesses. There’s less red tape, allowing them to operate more seamlessly.

In terms of earnings, this is where the real growth is occurring. Small-cap companies, as measured by the Russell 2000, are set to deliver more than 60% year-over-year EPS growth in the second quarter.

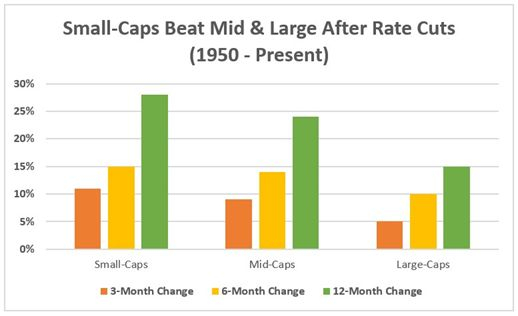

It may be challenging to see now, as small-caps have lagged significantly throughout this latest bull market. Still, from a historical perspective, we need to consider the heightened probability that this group will enter a phase of outperformance amid upcoming rate cuts. Market participants are currently pricing in a roughly 58% chance of an interest rate cut in September.

Small-cap companies tend to be more sensitive to interest rate fluctuations. On a 3-month, 6-month, and 12-month basis, looking forward, small-caps have outperformed both of their counterparts following rate cuts, with data going back to 1950:

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

To top it all off, inflation has remained tame this year even in the face of President Trump’s tariffs. The Fed’s preferred measure of inflation (Core PCE) came in at 2.7% year-over-year in May, a far cry from the 5.6% we saw in 2022. This is a measure of prices that U.S. consumers pay for goods and services that strips out two categories (food and energy), which tend to have volatile price swings. We’ll get an update to the PCE index (June figures) at the end of next week.

Final Thoughts

There are many reasons to be optimistic as this bull market reaches new heights. Buying at all-time highs has proven to be highly profitable, as the uncharted territory is the market’s way of telling us to expect more strength ahead. Fundamentals, including earnings growth and a resilient economy, undoubtedly support the move in stocks.

We shouldn’t fear interest rate cuts, as small-cap stocks have performed admirably after the central bank begins the easing process. And given that we’re in a strong, trending market with little volatility, the probability of further gains ahead remains enticing from a historical perspective.

Here’s to hoping history rhymes once again.

— Bryan Hayes

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks