Pegasystems (PEGA) is recognized for its low-code platform which enables businesses to build and automate workflows, manage customer relationships, and make data-driven decisions using AI.

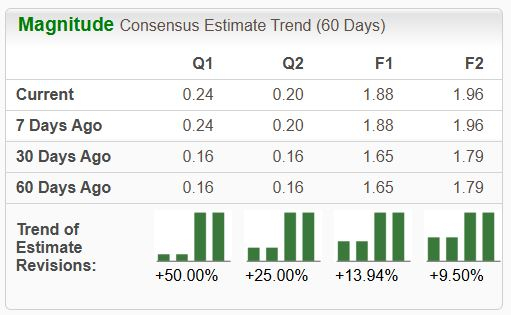

The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with EPS expectations melting higher across the board over recent months.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company also resides in the Zacks Computer – Software industry, which is currently ranked in the top 15% of all Zacks industries. Let’s take a closer look at what’s been driving the positivity behind the stock.

PEGA Benefits from AI

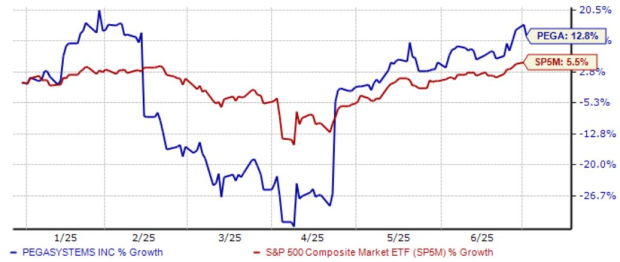

PEGA shares got swept up in broader market volatility back in February but have since recovered in a big way, up 12% overall in 2025 and outperforming relative to the S&P 500. Quarterly results have been notably positive concerning headline expectations, with PEGA exceeding the Zacks Consensus EPS estimate by an average of 94% across its last four releases.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Concerning the above-mentioned release, PEGA posted sales of $475 million, up a strong 44% from the year-ago period. Adjusted EPS totaled $0.76, more than tripling the $0.24 per share mark in the same period last year.

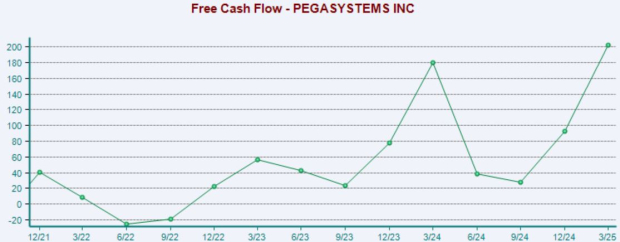

The outsized growth was fueled by strong demand, with the company also seeing 13% year-over-year annual contract value (ACV) growth alongside a 21% move higher in its backlog. Further adding to the positive environment, free cash flow of $202 million reflected a quarterly record.

PEGA’s cash-generating abilities have seen a nice boost over recent periods, as shown below. The amplified abilities provide many opportunities for the company, including paying down debt and reinvesting in the business, just for a few simple examples.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Investors will have to fork up a premium for shares given the company’s high-growth nature, with the current 28.2X forward 12-month earnings multiple reflecting a 25% premium relative to the S&P 500. Earnings are forecasted to grow 25% in its current fiscal year and an additional 5% in FY26, also sporting a Style Score of ‘A’ for Growth.

Bottom Line

Investors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.

The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.

Pegasystems (PEGA) is currently a Zack Rank #1 (Strong Buy).

— Derek Lewis

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks