We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Seres Therapeutics, Inc. (NASDAQ: MCRB)

Today’s penny stock pick is the microbiome therapeutics company, Seres Therapeutics, Inc. (NASDAQ: MCRB).

Seres Therapeutics, Inc. develops microbiome therapeutics to treat the modulation of the colonic microbiome. It develops a novel class of biological drugs that are designed to treat by modulating the microbiome to restore health by repairing the function of a disrupted microbiome to a non-disease state. The company’s lead product candidate is VOWST, an oral microbiome therapeutic that has completed Phase III clinical trial for the treatment of recurrent Clostridioides difficile infection.

Its product pipeline also includes SER-155, an investigational oral fermented microbiome therapeutic that is in Phase 1b clinical trials for the treatment of gastrointestinal infections, bacteremia, and graft versus host disease in immunocompromised patients including patients receiving allogeneic hematopoietic stem cell transplantation. In addition, the company engages in the development of SER-287 which is in Phase 2b, and SER-301 which is in Phase 1b to treat ulcerative colitis.

Further, it has license Agreement with NHSc Rx License GmbH for the therapeutic products based on the microbiome technology, which includes VOWST product candidate, which is developed for the treatment of CDI and recurrent CDI; and collaboration license agreement with Société des Produits Nestlé S.A. (Nestlé) for the development and commercialization of certain product candidates for the treatment and management of CDI and inflammatory bowel disease including UC and Crohn’s disease.

The company was formerly known as Seres Health, Inc. and changed its name to Seres Therapeutics, Inc. in May 2015.

Website: https://www.serestherapeutics.com

Latest 10-k report: https://ir.serestherapeutics.com/static-files/6a4765f2-25b4-424d-beb6-d2cb856ca372

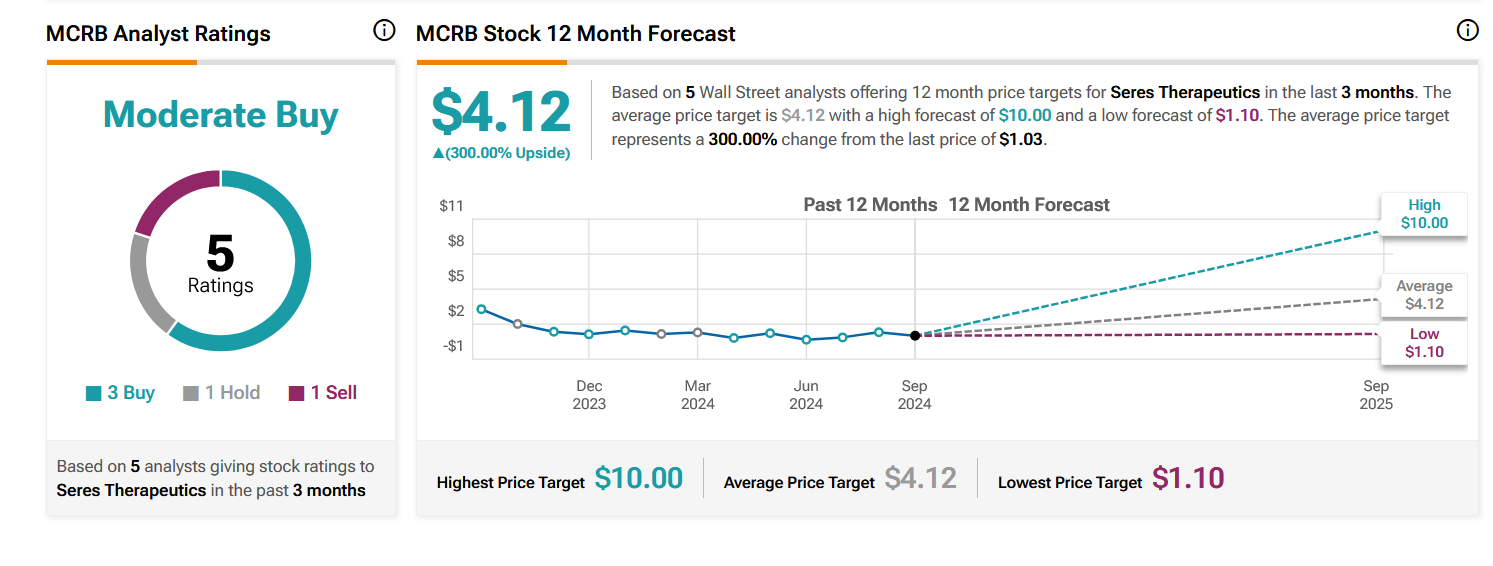

Analyst Consensus: As per TipRanks Analytics, based on 5 Wall Street analysts offering 12-month price targets for MCRB in the last 3 months, the stock has an average price target of $4.12, which is nearly 300% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company has received Fast Track designation from the FDA for SER-155 to reduce the risk of infection and GvHD in patients undergoing allo-HSCT, and for SER-287 for the induction and maintenance of clinical remission in adults with mild-to moderate UC.

- Rumors of acquisition by Nestle.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern: The daily chart shows that the stock is currently forming a symmetrical triangle pattern, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for MCRB is above the price of $1.15.

Target Prices: Our first target is $1.80. If it closes above that level, the second target price is $2.20.

Stop Loss: To limit risk, place a stop loss at $0.80. Note that the stop loss is on a closing basis.

Our target potential upside is 57% to 91%.

For a risk of $0.35, our first target reward is $0.65, and the second target reward is $1.05. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

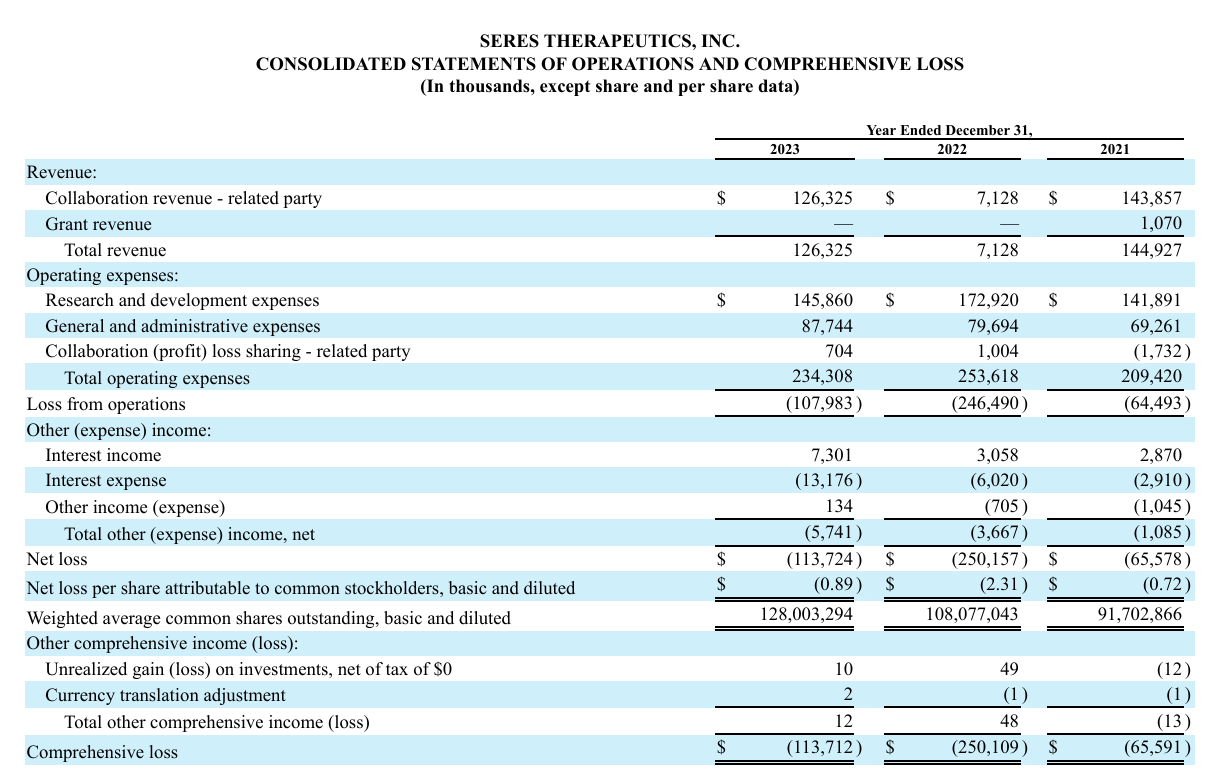

- The company has a history of net losses. MCRB’s net loss was $113.7 million for the year ended December 31, 2023, and $250.2 million for the year ended December 31, 2022. As of December 31, 2023, the company had an accumulated deficit of $978.2 million.

- The company requires additional funding for the continuation of the commercialization of VOWST, the SER-155 Phase 1b study, and research, development, and initiation of clinical trials of its product candidates. Any sale of additional equity or convertible securities would dilute all of the stockholders and may decrease the stock price.

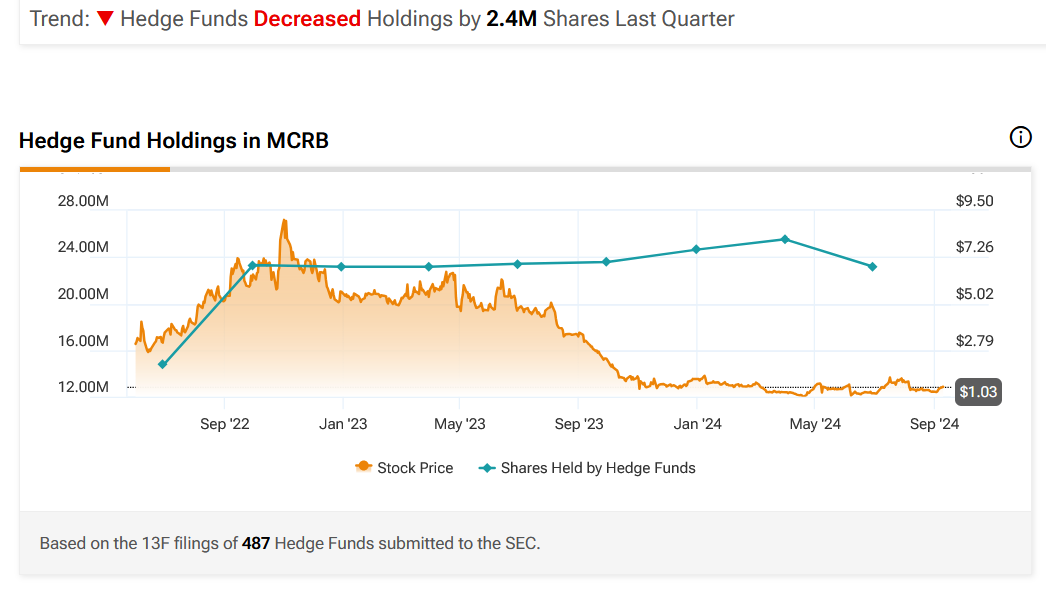

- Hedge Funds Decreased Holdings by 2.4M Shares Last Quarter.

- The company’s business currently depends heavily on its ability to successfully commercialize VOWST in the United States in its approved indication with its collaborator, Nestlé.

- On September 28, 2016, a purported stockholder filed a putative class action lawsuit in the U.S. District Court for the District of Massachusetts against MCRB entitled Mariusz Mazurek v. Seres Therapeutics, Inc., et.al. alleging false and misleading statements and omissions about the clinical trials for the company’s then product candidate SER-109 in its public disclosures between June 25, 2015, and July 29, 2016. Although the above suit was dismissed, the company may be subject to similar or other litigation in the future, which may harm its business.

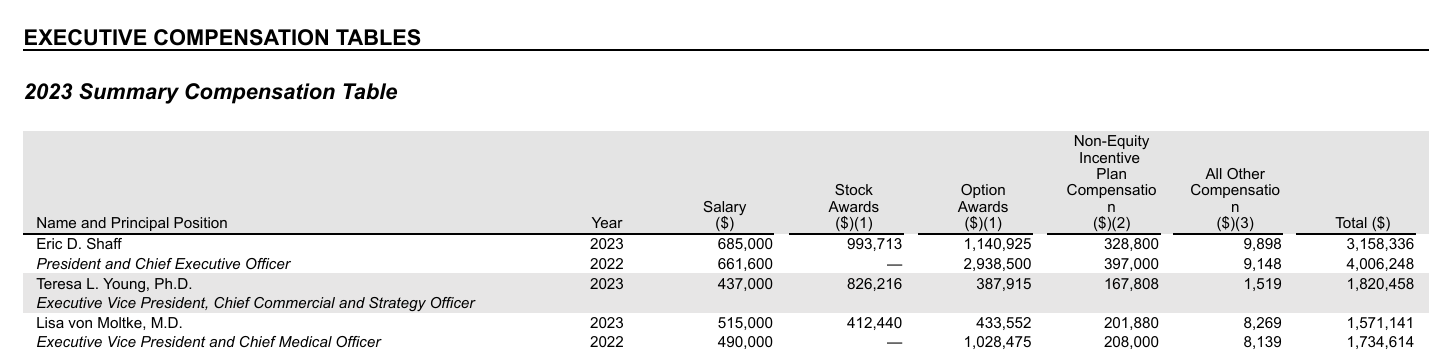

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Trades of the Day