Leidos Holdings (LDOS) , a Zacks Rank #1 (Strong Buy), provides services and solutions in the defense, intelligence, civil, and health markets. Renewed strength in the aerospace sector provides a durable backing for this industry leader. Leidos shares have begun to display relative strength, recently surging to 52-week highs. Increasing volume has attracted investor attention as buying pressure accumulates in this top-ranked stock.

Leidos is part of the Zacks Aerospace – Defense industry group, which currently ranks in the top 36% out of more than 250 Zacks Ranked Industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months.

Quantitative research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

Leidos Holdings offers national security solutions and systems for air, land, sea, space, and cyberspace for the U.S. Intelligence Community, the Department of Defense, the National Aeronautics and Space Administration, as well as other government agencies and military services. The company is a technology leader in areas such as cybersecurity, data analytics, and logistics.

In addition, Leidos Holdings provides IT solutions in cloud computing, mobility, data center management, and help desk operations. The company boasts a wide array of customers including foreign governments and their agencies, which are primarily located in the United Kingdom, the Middle East, and Australia.

Increased contract wins for Leidos from the Pentagon and other U.S. allies have been a primary growth driver for the company. In the first quarter of this year, Leidos recorded net bookings worth $3.7 billion. This led to an impressive backlog of $36.57 billion, a solid increase relative to the $35.09 billion from the year-ago period.

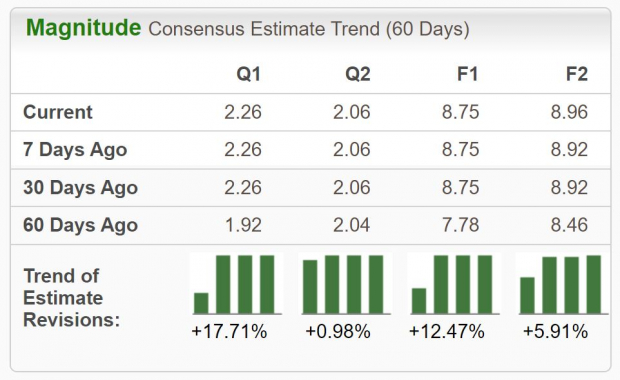

Earnings Trends and Future Estimates

The diversified defense provider has put together an impressive earnings history, surpassing earnings estimates in each of the last four quarters. Back in April, the company reported first-quarter earnings of $2.29/share, a 38.8% surprise over the $1.65/share consensus estimate. Leidos Holdings has delivered a trailing four-quarter average earnings surprise of 23.4%.

LDOS stock received a boost as analysts covering the company have been increasing their 2024 earnings estimates lately. For the full year, earnings estimates have risen 12.47% in the past 60 days. The Zacks Consensus EPS Estimate now stands at $8.75/share, reflecting a potential growth rate of 19.9% relative to the prior year. Revenues are projected to climb 4.4% to $16.12 billion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Let’s Get Technical

This market leader has seen its stock advance more than 35% in 2024 alone. Only stocks that are in extremely powerful uptrends are able to experience this type of outperformance. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of 52-week highs, widely outperforming the major indices. With positive fundamental and technical indicators, LDOS stock is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Leidos Holdings has recently witnessed positive revisions. As long as this trend remains intact (and LDOS continues to deliver earnings beats), the stock will likely continue its bullish run this year.

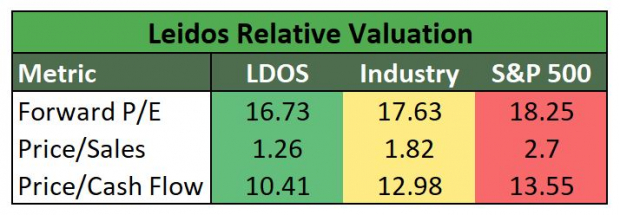

Despite the impressive performance, the stock remains relatively undervalued based on traditional valuation metrics:

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Leidos is ranked favorably by our Zacks Style Scores, with a best-in-class ‘A’ rating in our Momentum category and a second-best ‘B’ rating in our Growth category. This indicates that LDOS stock is likely to continue its strong momentum based on a favorable combination of earnings and sales growth.

Backed by a top industry group and impressive history of earnings beats, it’s not difficult to see why this company is a compelling investment. Robust fundamentals combined with an appealing technical trend certainly justify adding shares to the mix. The future looks bright for this highly-ranked, leading stock.

— Bryan Hayes

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks