You probably remember the first time you heard about ChatGPT. The AI tool’s lifelike responses seemed like magic—so much so that people were debating whether generative AI tools like it were actually conscious.

Such a debate was honestly a bit silly, and it didn’t last long. But the idea that these large-language models were sentient proved how much AI can emotionally influence people.

Fast-forward to today and that response is much less starry-eyed. You’ve no doubt run across AI-created content and art on the Internet that is, frankly, terrible (not to mention glaringly obvious). That’s prompted outlets like The Wall Street Journal to tell us “The AI revolution is already losing steam” and compare the industry to the “biggest crashes of the first dot-com bubble.”

The fact that the tech press has oscillated from optimism to pessimism shows that AI has entered a more mature phase: that of adoption.

Now that talk of an AI-created utopia, where no one has to work at all (or a dystopia, depending on your outlook!) has died down, companies are looking at how much AI to incorporate in their operations to make them run more efficiently. And that is where the biggest profits (and dividends!) are there for us contrarians to bank.

This is the approach we’ve taken in my CEF Insider advisory: focusing on high-yielding closed-end funds (CEFs) that take a pragmatic approach to AI gains. A 9.1%-yielding CEF called the Virtus Artificial Intelligence & Technology Opportunities Fund (AIO) is a good example.

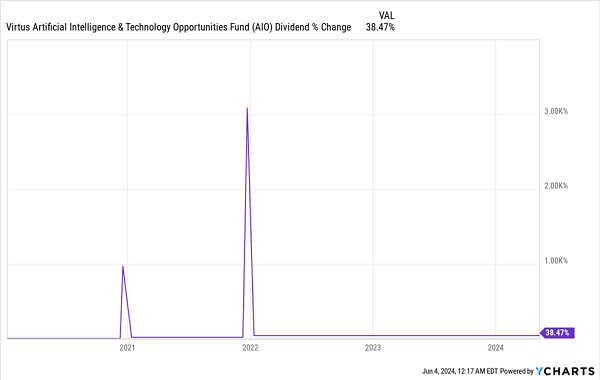

AIO’s High, and Rising, Income Stream

As you can see above, AIO has raised its dividend since its IPO in 2019 and has given investors two generous special payouts, as well. That’s helped secure the fund’s total returns, which have tracked those of the tech sector over the industry’s broad recovery during the past 12 months.

As you can see above, AIO has raised its dividend since its IPO in 2019 and has given investors two generous special payouts, as well. That’s helped secure the fund’s total returns, which have tracked those of the tech sector over the industry’s broad recovery during the past 12 months.

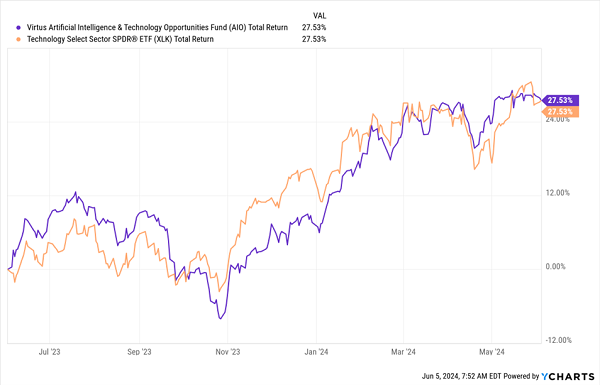

AIO Books Tech Profits and Income

This chart shows how AIO (in purple) is giving investors essentially the same total return as the broader sector, shown above by the performance of the Technology Select Sector SPDR ETF (XLK), in orange. The key difference? The tech ETF yields just 0.7%, while AIO’s 9.1% payout beats it by more than 10X.

This chart shows how AIO (in purple) is giving investors essentially the same total return as the broader sector, shown above by the performance of the Technology Select Sector SPDR ETF (XLK), in orange. The key difference? The tech ETF yields just 0.7%, while AIO’s 9.1% payout beats it by more than 10X.

In other words, AIO’s investors have gotten the same returns as tech investors more generally over the last 12 months, but a huge slice of those gains have come in cash, thanks to the fund’s huge dividend.

Thanks to AIO’s strategy of methodically selling its shares and distributing the resulting gains as dividends, the fund gives investors the strong profits of tech investing and the reliable, growing income stream of dividend stocks. AIO isn’t the only CEF to do this, but its focus on the more “mundane” part of AI is why it stands out.

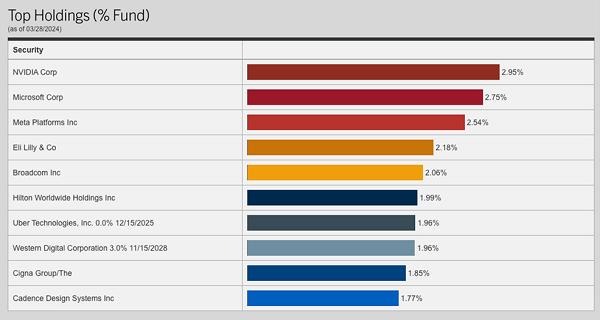

That approach shows up in the fund’s top 10 holdings:

Source: Virtus Investment Management

Source: Virtus Investment Management

Obviously, NVIDIA (NVDA) and Microsoft (MSFT) make sense as top holdings in an AI fund, but what about Eli Lilly & Co. (LLY) and Hilton Worldwide Holdings (HLT)? Simply put, Lilly is one of the world’s largest makers of diabetes drugs, and AI is being used aggressively in diabetes research.

Hilton is here because AI is increasingly being used in the hospitality industry to streamline operations and improve efficiency. In other words, AIO hasn’t only invested in tech, but it also strategically buys other companies that’ll benefit from using AI.

Now that the AI hype cycle is maturing into actual productivity improvements, these moves are paying off.

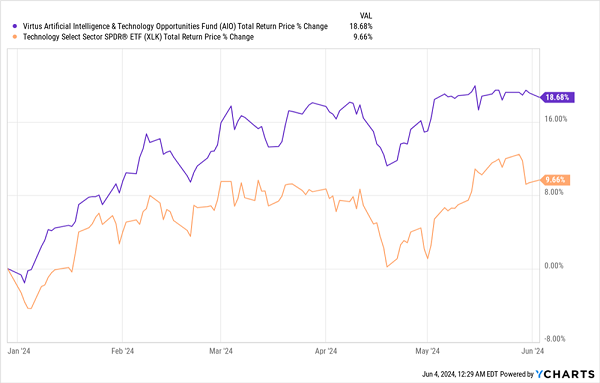

A second ago, we saw how AIO matched the tech sector over the last 12 months. But in 2024, as the hype cycle has waned and the focus has turned to productivity gains, AIO has clobbered tech. It’s not even close.

AIO’s Prudent AI Bet Wins Out Over Hype

The fact that this fund trades at a 7% discount to net asset value (NAV, or the value of the stocks it holds) shows that this approach is, for now, still undervalued—despite clear evidence that this is the way to go.

The fact that this fund trades at a 7% discount to net asset value (NAV, or the value of the stocks it holds) shows that this approach is, for now, still undervalued—despite clear evidence that this is the way to go.

But wait a minute, you might be thinking. If AI can be used to improve medical research and hotels, can’t it be used to improve other things just as much?

Indeed, that is very much happening and is the subject of many conversations at many firms. Consider, for example, that 199 companies mentioned AI in their first-quarter earnings calls this year. That is also why the best way to profit from the AI revolution is to invest in firms likely to make material gains from this time-saving technology.

Of course, that’s a boring conclusion to come to! But this “boring” approach is what will work as we move further into the AI era. And CEFs like AIO, which have ignored the hype cycle and focused on those gains, are the ones we want to buy into.

— Michael Foster

An 10.5% dividend… paid monthly? Yes, but you’ll want to move quickly. [sponsor]

One of my top buy-and-hold income plays for this market is the brainchild of one of the smartest investment minds on the planet… It dishes an incredible 10.5% yield… paid like clockwork every single month! And my research suggests that it’s poised for big price gains in the months ahead… no matter which way the broader market swings. I’m so excited about this fund that I’ve made it a core holding in my “Monthly Payer Portfolio” – an easy-to-buy collection of stocks and funds that could hand you $3,300+ in payouts every single month! Don’t delay! Details are ready for you HERE.

Source: Contrarian Outlook