My public Dividend Growth Portfolio is a real-life demonstration of investing for growing income from stocks. The concept of using stocks for rising income is fundamentally different from investing in fixed-income assets like bonds.

The portfolio has been in operation since 2008. I reinvest the dividends each month, so – on top of the dividend increases declared by the companies I own – the dividend stream has also been compounding for more than 15 years.

In January, I moved coverage of the portfolio to our new Investor Group service Dividends & Income Select. The service is designed for investors interested in building growing income streams through dividend-paying stocks. At the end of this article, I will show you how you can access the service, for free, for two weeks.

Dividend-growth investing comes in many flavors, but in its basic version, it focuses on building a stock portfolio whose main purpose is to generate a growing stream of dividend income.

That stream can become so sizable over time that you can live off it in retirement.

There are sound, reliable reasons that the dividend stream becomes so large. The two most important reasons are:

- The companies you own raise their dividends every year. Did you know that there are 699 companies traded in the U.S. that have raised their dividends for at least five years in a row? An amazing 148 of them have increase streaks of 25 or more years in a row. The longest streak is 69 years.

- If you reinvest the dividends, they compound, which means that they grow even faster than they would based on the increases alone.

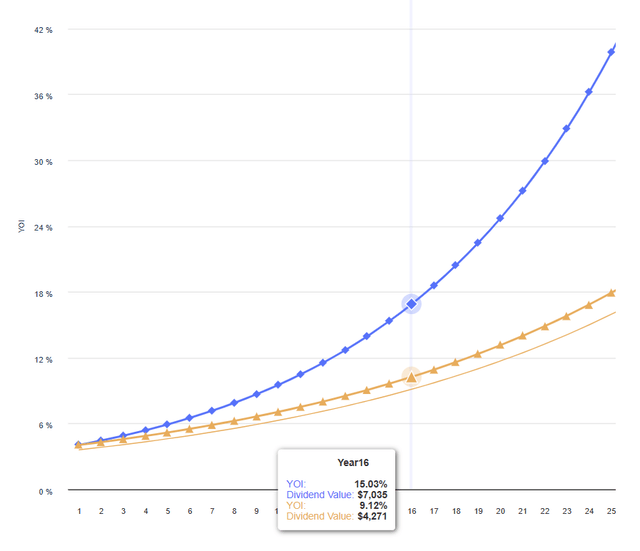

The following chart’s blue line shows the approximate growth of my income stream with the compounding from reinvestment accounted for. This graph is generated by a calculator that takes both dividend increases and reinvestments into account. (The orange line accounts only for the dividend increases by themselves.)

The vertical line shows about where I will be when my portfolio hits its 16thbirthday in June. I started the portfolio with $46,783 and have never added a dime more to it.

Source: Miller/Howard Investments

In real life, of course, a DG income stream is not as smooth as the mathematically-perfect blue line in the chart, but the general principles hold. This chart shows the actual dividends I have collected since I kicked off the portfolio.

You can see that the annual bars are becoming taller faster, mimicking the curvature in the blue line on the earlier chart. In other words, each year the increase in income is more than the prior year’s increase.

In our Dividends & Income Select service, you can see not only what is in the portfolio, but also how I manage it, including the dividend reinvestments.

Creating and managing such a portfolio is not hard. You do not even have to follow the market. Dividends are independent from the market, because they are declared and paid by the companies themselves and credited directly to your account. Reinvesting them is easy, provided you know what to buy.

I would like to invite you to a two-week free trial of Dividends & Income Select. Use this link to get to our product-description page. There you will find a complete presentation of the service and a sign-up button for the free trial.

When you see the full description of our service, you will find that it includes much more than my portfolio:

- Two more real portfolios (not play-money models) run by Mike Nadel. Mike’s portfolios are (1) a new from-scratch Income Builder Portfolio, and (2) his grandkids’ college fund, Growth and Income Portfolio.

- Dividend Growth Ideas, including graded lists of highly-rated stocks from me, and deep-dive reviews of high-yield stocks from Jason Fieber. We already have coverage of more than 50 stocks, and new ones are being added frequently.

- Real option trades for instant income executed and described by Greg Patrick.

The free trial lasts for two weeks, and if you cancel at any time during the trial, you will never be charged anything. The free trial is 100% risk-free.If you don’t like what you see, just cancel.

Again, use this link to gain complete access to Dividends & Income Select for free, for two weeks, with no obligation.

-Dave Van Knapp