As inflation calms down, these dividend stocks are going to fire up. I’m talking about five stocks with payouts popping between 33% and 100% per year.

And these are safe, profitable businesses powered by good ol’ fashioned cash flow. I know, what a concept. These stocks should never be cheap, but they are, thanks to the recent stock market panic in September and October.

This five-pack highlights the power of a phenomenon called the “dividend magnet.” This is where payout growth pulls a stock’s price higher regardless of whatever the broader economy is doing.

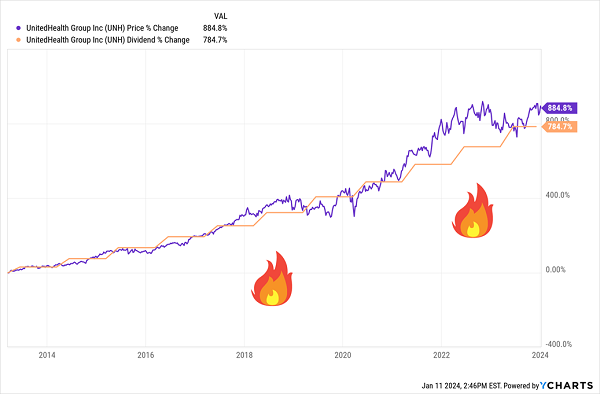

Dow component UnitedHealth Group (UNH) is a perfect example of the dividend magnet. It’s not just UNH’s high level of outperformance over its publicly traded life—the stock has more than quadrupled the S&P 500 since 2013—it’s how UnitedHealth’s stock price and dividend move in tandem. UNH shares almost seem to take their cue from dividend hikes (or vice versa); it’s a virtuous cycle of price returns and fatter yields.

This Magnet Has an Irresistible Pull

My Hidden Yields research service uses UNH as an ATM. We buy pullbacks and sell rips. The result? Annualized gains up to 21.1%:

My Hidden Yields research service uses UNH as an ATM. We buy pullbacks and sell rips. The result? Annualized gains up to 21.1%:

UNH isn’t the only potential ATM on the board today. Today we’ll discuss five scorching dividends that are growing between 33% and 100% per year. That’s no typo. These are the types of stocks we want to “front run” and consider buying before they announce their next dividend hikes:

UNH isn’t the only potential ATM on the board today. Today we’ll discuss five scorching dividends that are growing between 33% and 100% per year. That’s no typo. These are the types of stocks we want to “front run” and consider buying before they announce their next dividend hikes:

Old Dominion Freight Line (ODFL)

Dividend Yield: 0.4%

2023 Increase(s): 33%

Projected Q1 Dividend Announcement: Early February

Old Dominion Freight Line (ODFL) is a less-than-truckload (LTL) freight shipping specialist whose trucks you’ve probably seen while traveling America’s interstates.

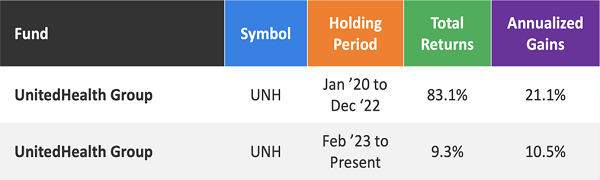

Transportation might be a cyclical business, but ODFL has been a pinnacle of stability, delivering 30% annual profit growth on average over the past seven years. And while the stock hasn’t gone up in a straight line, it has crushed the broader market in that time.

Notice Anything Else That Has Been Heading Higher?

ODFL has been rapidly raising its dividend of late, from 15 cents per share in 2020 to 40 cents today—that’s 167% in just three years!

ODFL has been rapidly raising its dividend of late, from 15 cents per share in 2020 to 40 cents today—that’s 167% in just three years!

Old Dominion’s rapid dividend improvement in recent years make its next likely announcement, to come in late January or early February, worth watching. We could get a lesser raise given that ODFL is expected to have a down year—the top and bottom lines are both expected to recede for full-year 2023. But the transportation stock pays a paltry 13% of earnings to fund its dividend, so the company has all sorts of headroom to keep income investors satisfied.

Microchip Technology (MCHP)

Dividend Yield: 1.9%

2023 Increase(s): 33% (across four hikes)

Projected Q1 Dividend Announcement: Early February

Microchip Technology (MCHP) is not your average technology stock.

The business is typical. Microchip Technology makes microcontroller, mixed-signal, analog and Flash-IP integrated circuits for the automotive, aerospace, communications, industrial and other markets. Its products can be found in airline cabin management systems, smart home locks, electric meters, heart-rate monitors and more.

That’s the allure of chipmakers in general—rather than betting on a certain technology or a certain company’s products taking off, you bet on the components that hundreds of companies need across a host of technologies.

And it’s a good bet to make—technology is more and more integrated with every facet of our everyday lives. That’s why MCHP has grown by leaps and bounds—fiscal 2023 revenues were 110% better than they were in fiscal 2018, and profits were nearly 8x higher.

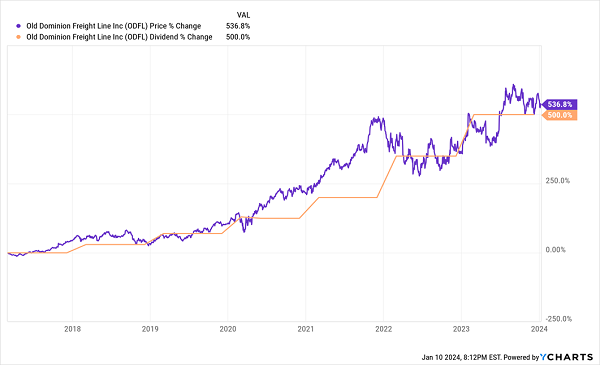

That kind of growth is little different from technology firms. But where MCHP differs as a technology stock is its dedication to growing dividends.

Starting in 2021, MCHP Got Serious About Giving Back

Not only has Microchip Technology been pumping more and more cash into its payout each year—it has been doing it each and every quarter for years. So if you don’t jump in before its next probable hike in February, don’t worry. You probably have just three months before the next one.

Not only has Microchip Technology been pumping more and more cash into its payout each year—it has been doing it each and every quarter for years. So if you don’t jump in before its next probable hike in February, don’t worry. You probably have just three months before the next one.

Constellation Energy (CEG)

Dividend Yield: 1.0%

2023 Increase(s): 100%

Projected Q1 Dividend Announcement: Mid-February

Constellation Energy (CEG) generates and sells carbon-free energy to homes, businesses, and public-sector customers across the continental United States. Specifically, it has 32,355 megawatts of generating capacity consisting of nuclear, wind, solar, natural gas and hydroelectric assets.

CEG has shot up like a rocket since being spun off from Exelon (EXC) in early 2022—a move that allowed the public utility to both focus on its core business while taking advantage of the growth in green energy.

Constellation is coming off yet another beat-and-raise quarter that saw continued strength in its commercial business. CEG has the kind of balance-sheet strength you want to see from a utility, but it also boasts a trait you rarely see from the sector:

A low payout ratio.

CEG pays out less than 20% of its earnings as dividends—a ratio that should make dividend investors bookmark Constellation’s investor relations page so they can check in on it every mid-February, when Constellation appears to be making its annual dividend-hike announcements. It might be asking a bit too much for another dividend doubler like in 2023, but it’s hard not to expect more rapid expansion of the payout.

Public Storage (PSA)

Dividend Yield: 4.0%

2023 Increase(s): 50%

Projected Q1 Dividend Announcement: Mid-February

Self-storage giant Public Storage (PSA) was long the poster child for dividend stagnation—something of a head-scratcher given the relatively recession-resistant business that is self-storage.

But after a long stretch of operational flatness, funds from operations (FFO) have exploded over the past couple of years, and last February, PSA decided to share the wealth, ramping up its payout by 50%, to $3 per share, after keeping it level at $2 since 2017.

The question becomes: What’s next?

Again, PSA was content to keep the payout level for years—it’s possible Public Storage prefers to move its payout in big chunks, and that last year was not the start of a healthy dividend habit.

For what it’s worth, Public Storage would have good reason to remain conservative with its dividend. The real estate investment trust (REIT) faces myriad headwinds as we enter 2024, including a pullback in consumer spending and a glut of supply, which is weighing on occupancy and margins.

We should find out one way or another sometime in mid-February.

Public Storage: Decent Dividends, But You Can’t Set Your Watch By Them

RLJ Lodging Trust (RLJ)

RLJ Lodging Trust (RLJ)

Dividend Yield: 3.1%

2023 Increase(s): 100% (across two hikes)

Projected Q1 Dividend Announcement: Late February

Another REIT you should watch, this time in late February, is RLJ Lodging Trust (RLJ), a hotel REIT that focuses on “premium-branded, rooms-oriented, high-margin, focused-service and compact full-service hotels.”

There are quite a few buzzwords in here, but basically, RLJ’s properties typically hold hotels with specific, limited amenities and essentials, as well as hotels that are smaller in size but offer a wide variety of services (restaurants, bars, spas, etc.) And those “premium” brands include Courtyard by Marriott, Residence Inn by Marriott, AC Hotels, Moxy Hotels, Hilton Garden Inn, Embassy Suites, Hyatt Place and Wyndham.

RLJ’s recovery from COVID has been slower than many of its peers, and its stock has actually been in decline for most of the past two years. Operationally, though, things are improving—albeit slowly. The company is repositioning some of its hotels, but only at a clip of two or three properties every year.

Still, it has been enough to lift the dividend back from the near-dead. RLJ slashed its payout from 33 cents per share to a mere penny at COVID’s onset in 2020, and it only started raising it again in 2022. Since July 2022, RLJ has announced a dividend hike every two quarters (from a penny per share to 5 cents, to 8 cents, to its current 10 cents), so the announcement of its next payout increase would come in late February or early March, if past is any precedent.

— Brett Owens

A Simple, Safe Way to Lock In 15% Yearly Returns … For Life! [sponsor]

While its dividend is on the mend, RLJ might not be the growth-and-dividend-growth dynamo we’re looking for. Nothing in RLJ’s portfolio sets the REIT apart, and it has shown for years.

But that’s OK! Even if RLJ itself isn’t ripe for the picking, we can still look to it as an example of the right strategy—a simple but potent two-step recipe for success that has proven itself to investors again, and again, and again:

- Step 1: Buy aggressive dividend growers that are actually expanding their businesses, too.

- Step 2: That’s it! There is no Step 2! Just keep targeting elite dividend growers!

If you invest your money with corporate managers who both effectively deploy capital for growth and know how to reward shareholders, you will clobber the market on a regular basis—and better still, as the years roll on, more and more of those returns will come from cold, hard cash.

You can put this income-printing strategy to work today with a simple-to-manage, easy-to-understand group of just 5 specific tickers that are quietly handing investors a steady 15%, 17%, 21% or more every year—and growing income streams!

Better still, they’re trading at far more attractive prices—a value proposition that will further boost our price returns over time.

Your next move is simple: Buy now and set yourself up for annual returns of at least 15%. That’s far better than the market’s historical average, and it’s a level of return that would double your nest egg every five years!

You can get the full breakdown on each of these standout names within seconds. Click here to get my complete research: names, tickers and a full breakdown of their operations—everything you need to buy with confidence.

Source: Contrarian Outlook